Brown-Forman Corporation BF.B, the leading producer and distributor of premium alcoholic beverages, is set to report fourth-quarter fiscal 2017 results on June 7 before market opens. Investors are keen to know whether the company will post a positive earnings surprise in the to-be-reported quarter, after missing the same in the preceding quarter. In the trailing four quarters, Brown-Forman outpaced the Zacks Consensus Estimate by an average of 2.3%.

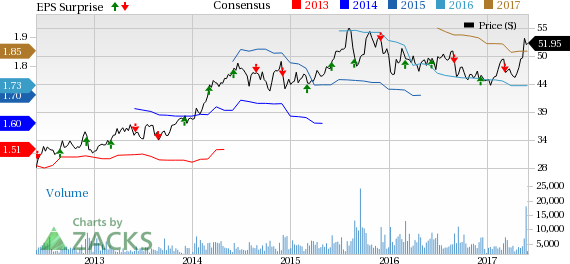

Brown Forman (NYSE:BFb) Corporation Price, Consensus and EPS Surprise

The Zacks Consensus Estimate of 40 cents for the fourth quarter and $1.73 for fiscal 2017 has remained stable over the past 30 days. Analysts polled by Zacks expect revenues of $736.4 million for the upcoming release. Let’s now have a look at how things are shaping up prior to this announcement.

Factors Influencing the Quarter

Brown-Forman gains strength from its strong portfolio of premium American whiskey brands, along with its Jack Daniel's trademark. The company expects to grow on the back of strong demand for its authentic American whiskey brands worldwide, consumer interest in flavored whiskey and a growing trend in premium spirits. Its consistent focus on pricing, product innovation and expansion solidify its market position.

However, the company has been battling currency woes for a while now, along with tough economic conditions in emerging markets and soft travel network. These have been hurting its top line which missed the Zacks Consensus Estimate in five of the past seven quarters. Further, the company anticipates these obstacles along with an uncertain geopolitical environment to linger in fiscal 2017.

Management had earlier projected 3–4% growth in underlying sales and earnings per share in the range of $1.71–$1.76.

Also a look at Brown-Forman’s share price movement in the past three month shows that the stock has underperformed the Zacks categorized Beverages–Alcoholic industry. While shares of the company increased 6.7% in the said time frame, the industry registered growth of 8.6%.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Brown-Forman is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Brown-Forman has an Earnings ESP of 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 40 cents.Although, the company has a Zacks Rank #3, which increases the predictive power of ESP, we need to have a positive ESP in order to be confident about earnings surprise.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

MGP Ingredients, Inc. (NASDAQ:MGPI) has an Earnings ESP of +2.44% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cott Corporation (NYSE:COT) has an Earnings ESP of +6.67% and a Zacks Rank #3.

Amplify Snack Brands, Inc. (NYSE:BETR) has an Earnings ESP of +12.50% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Brown Forman Corporation (BF.B): Free Stock Analysis Report

Cott Corporation (COT): Free Stock Analysis Report

Amplify Snack Brands, inc. (BETR): Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI): Free Stock Analysis Report

Original post

Zacks Investment Research