Beecher Carlson Insurance Services, LLC, a subsidiary of Brown & Brown, Inc. (NYSE:BRO) , has purchased certain assets of Donald P. Pipino Company. The transaction will not only enable the insurance broker to enhance its service portfolio but also provide a wide range of resources and extended service plus consulting capabilities to its clients.

Established in 1952, Pipino Company offers its clients a broad range of property and casualty insurance products and services. The firm’s primary focus is to cater risk management solutions to clients in the commercial real estate industry, which includes malls and shopping centers. The acquired portion of Pipino Company’s operations has revenues of about $11 million. Post completion of the buyout, the team at Pipino Company will continue with its operations from its current locations.

From the standpoint of Pipino Company, this takeover is expected to prove beneficial in the near term as the combination of these firms will help building a formidable client-focused insurance risk management firm in the industry. Both companies share a common objective — creating risk management products and services that will have a positive impact on the respective clients’ total cost of risk and insurance. The transaction will aid the teams at both companies to gain from each other’s exceptional leadership along with individual areas of expertise. Therefore, the Pipino Company is hopeful of maintaining and developing the next level of insurance risk management innovations with this integration, achieving greater success in the process.

Mirroring the acquirer’s culture of providing clients with high-quality consulting services on risk identification, quantification, financing alternatives and program implementation and execution, the buyout is expected to upgrade the insurance broker’s capabilities as a whole.

Additionally, the latest consolidation will lend a vital support to ramping up the company’s inorganic growth profile and boosting its margin expansion. Moreover, the company is anticipated to gain traction from this takeover in terms of reinforcing its product and service offerings.

The above-mentioned inorganic ploys braced the company to fuel growth and broaden its scope of operations. Also, these strategic attempts facilitated Brown & Brown’s increase in commissions and fees, which in turn, contributed to revenue growth. The year 2018 marked the insurance broker’s most important phase for pursuing acquisitions with the transaction of Hays Companies being the most significant buyout. Per the company’s projection, this particular purchase is estimated to deliver revenues in the range of $210-$220 million.

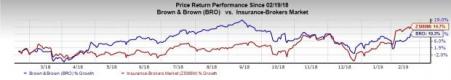

Shares of this Zacks Rank #4 (Sell) insurance broker have gained 10.3% in a year’s time, underperforming its industry’s increase 14.7%. Nonetheless, we expect the company’s sustained operational performance, higher commissions and fees plus a solid capital position to push up the stock higher in the near term.

Stocks to Consider

Investors interested in better-ranked stocks from the insurance industry can consider Arch Capital Group Ltd. (NASDAQ:ACGL) , Cincinnati Financial Corporation (NASDAQ:CINF) and Torchmark Corporation (NYSE:TMK) .

Arch Capital Group provides property, casualty and mortgage insurance and reinsurance products worldwide. The company delivered positive surprises in all of the last four reported quarters, the average being 14.72%. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cincinnati Financial provides property and casualty insurance products in the United States. The company pulled off positive surprises in three of the trailing four reported quarters, the average positive surprise being 18.08%. The company sports a Zacks Rank of 1.

Torchmark provides various life and health insurance products, and annuities in the United States, Canada and New Zealand. The company came up with positive surprises in three of the preceding four reported quarters, the average beat being 2%. The company holds a Zacks Rank #2 (Buy).

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Torchmark Corporation (TMK): Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL): Free Stock Analysis Report

Cincinnati Financial Corporation (CINF): Free Stock Analysis Report

Original post

Zacks Investment Research