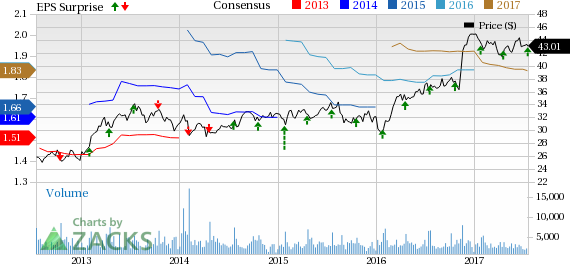

Brown & Brown, Inc. (NYSE:BRO) reported second-quarter 2017 earnings of 49 cents per share that beat the Zacks Consensus Estimate by 4.3%. However, earnings remained flat year over year.

The quarter witnessed improved revenues, partially offset by a rise in expenses. Nonetheless, the company saw an increase in its commissions and fees.

Including change in estimated acquisition earn-out payables of 3 cents per share, net income came in at 46 cents per share, down 2.1% from the year-ago quarter.

Behind the Headlines

Total revenue amounted to $466.3 million, beating the Zacks Consensus Estimate of $465 million by approximately 0.3%. Also, the top line improved 4.4% year over year riding on higher commissions and fees. Organic revenue growth was 1.6% in the reported quarter.

Commissions and fees rose 4.3% year over year to $464.7 million.

Investment income fell 20% year over year to $0.4 million.

Total expenses increased 6.2% to $358.3 million, owing to a rise in employee compensation and benefits, other operating expenses, depreciation, interest as well as change in estimated acquisition earn-out payables.

Net income before interest, income taxes, depreciation, amortization and change in estimated acquisition earn-out payables (EBITDAC) margin decreased 120 basis points to 32.3%.

Financial Update

Brown & Brown exited the second quarter with cash and cash equivalents of $600.3 million, up 16.4% from the 2016-end level.

Long-term debt of $965.4 million as of Jun 30, 2017 was down 5.2% from $1.0184 billion at the end of 2016.

Dividend Update

In the second quarter, this Zacks Rank #4 (Sell) company’s board of directors announced a quarterly dividend of 14 cents per share.

On Jul 13, 2017, the company’s board approved a quarterly cash dividend of 13.5 cents per share. The dividend will be paid on Aug 16 to shareholders on record as of Aug 9, 2017.

Stocks to Consider

Some better-ranked stocks from the insurance industry are Everest Re Group, Ltd. (NYSE:RE) , Reinsurance Group of America, Incorporated (NYSE:RGA) and Cigna Corporation (NYSE:CI) . Each stock holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Everest Re Group offers reinsurance and insurance products. The company is set to release first-quarter results on Jul 24.

Reinsurance Group is primarily engaged in life reinsurance and international life and disability insurance on a direct and reinsurance basis. The company is set to release second-quarter results on Jul 27.

Cigna provides insurance plus related products and services in the United States and internationally. The company is slated to release second-quarter results on Aug 4.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA): Free Stock Analysis Report

Cigna Corporation (CI): Free Stock Analysis Report

Everest Re Group, Ltd. (RE): Free Stock Analysis Report

Original post