Investing.com’s stocks of the week

Brookfield Infrastructure Partners LP (NYSE:BIP) operates cash flow-generative assets in the fields of transportation, energy, utilities and communications. The company went public in January 2008, just in time for the Financial Crisis. By March 2009, the stock was down over 67% from its IPO price to as low as $4.77.

Over 10 years later today, BIP is hovering above $44 and is close to its all-time high of $46.88 reached in late-2017. Brookfield Partners would have delivered a pretty decent 826% return to anybody, who had the courage and the luck to buy the 2009 bottom. Add the dividends to the calculation and the result gets even better.

The last decade brought many growth stories similar to this one. No wonder buy-and-hold strategies are so popular among investors nowadays. The problem is that this strategy usually gets the most attention after a huge price increase. Unfortunately, “today’s investor does not profit from yesterday’s growth.”

Buying at the wrong time of the market cycle can significantly alter your returns, even if you are in for the very long term. So instead of buying in the 11th year of Brookfield Partners’ rally, let’s first see if the bulls can indeed be trusted.

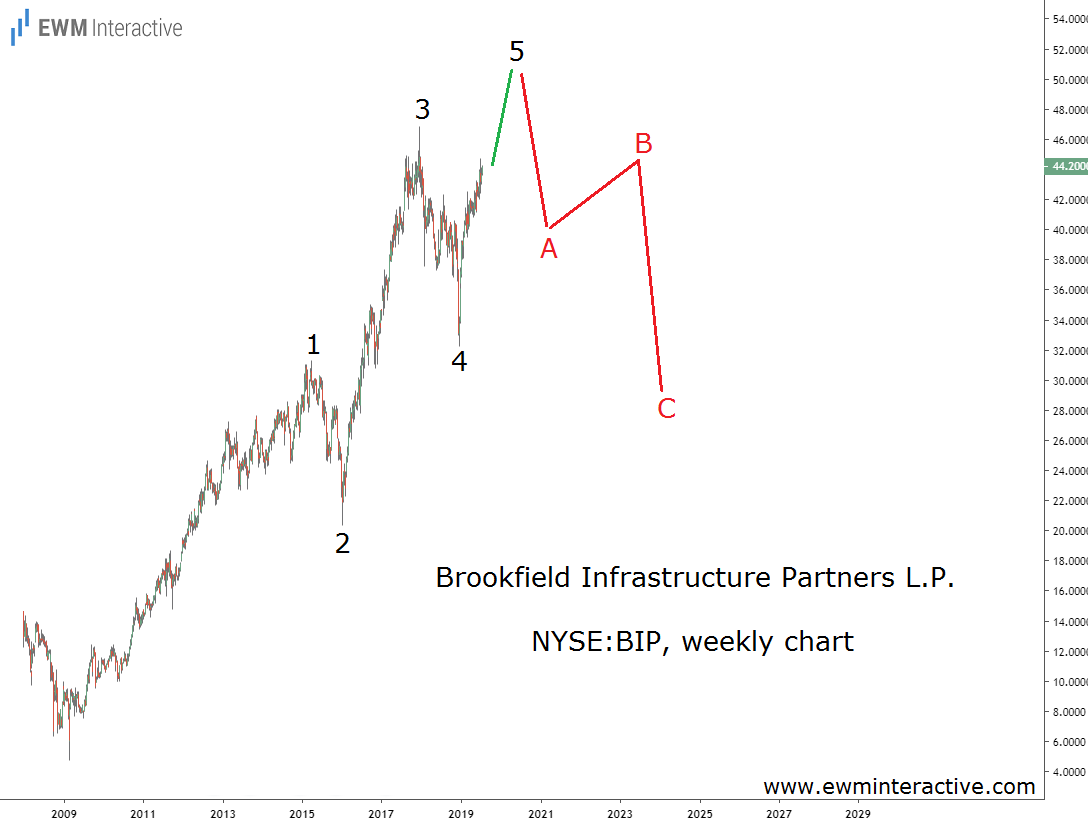

The weekly chart above puts BIP’s entire surge since 2009 into Elliott Wave context. In our opinion, there is no reason for optimism. It seems the stock is currently drawing the final fifth wave of a larger five-wave impulse, labeled 1-2-3-4-5.

As Brookfield Partners Stock Rises, Risks Rise, Too

Fifth waves usually exceed the end of the third wave, so it makes sense to expect a new high near $50 a share soon. On the other hand, the theory states that every impulse is followed by a three-wave correction in the opposite direction.

This means that instead of throwing a party to celebrate the new record, investors should be very careful. If this count is correct, the anticipated three-wave retracement can drag BIP stock back to the support area of wave 4 near $32. Maybe lower. Even if it is just on paper, a 40% loss still hurts. To avoid the pain, we think investors should stay away from Brookfield Partners stock for now.