This month's Fed meeting was supposed to be the highlight of the quarter until the repercussions of the Ukraine War sent commodity and energy prices to new record highs. The new record high of $10845 in copper was followed by almost a new high in gold of $2070 vs $2075 from 2 years ago.

The bullish equities narrative stating Russia/Ukraine's willingness to negotiate regardless of the outcome remains eclipsed by the bearish narrative of prolonged war, tightened sanctions on Russia, and the impact of Russia's economic/financial blockade on the rest of the world economy.

COVID's damaging impact on the global supply-chain was in fact Broken-Supply-Chain Part II after the Trump-Xi trading war introduced Broken-Supply-Chain Part I. Blocking the world of Russia's oil, gas, wheat and industrial metals is sending the world economy into the horror scenario Broken-Supply-Chain Part III + 40-year high inflation + Ultra Low Policy Rates + Record Deficits in Developed countries.

In oil, news of further obstacles to an Iran nuclear deal has revived US Crude oil off its $101 support. Each passing day shows Putin digging deeper into the Ukraine with chances of compromise increasingly thin.

There are 2 ways to break oil: 1) demand destruction due to recession; or 2) sudden explosion of production. The 1st option is a far likelier possibility than the 2nd option, albeit not in the near-term.

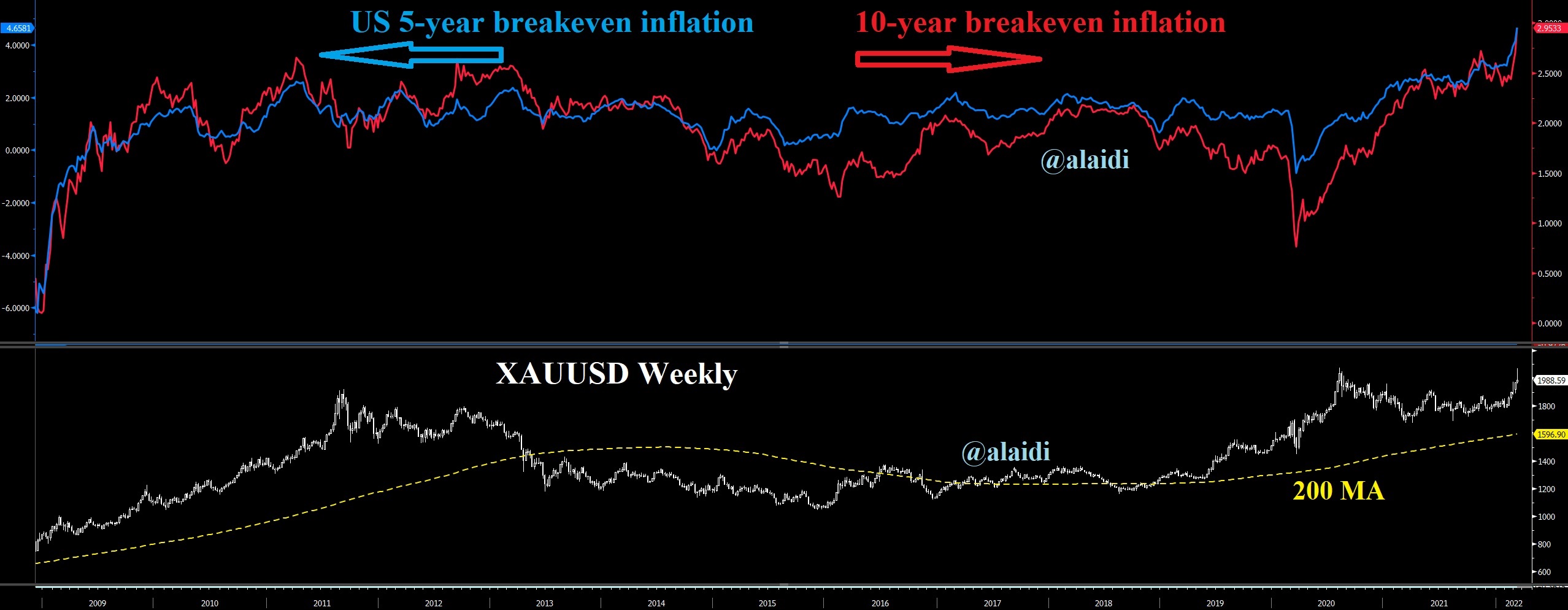

As for gold, it needs some sort of a break. Whether such pause extends ahead of next week's FOMC decision or after, we're not sure. One factor remaining favorable for gold is that breakeven inflation levels are surging for both 5 and 10 year terms (see chart above), a positive for precious metals, especially as the Fed is "forced" to remain behind the curve.

Three weeks ago, I laid out the case for $2200 gold to our WhatsApp Broadcast Group, describing it as a "medium term target." It seems that Q2 is a more probable timing for now, before I update the next target depending on momentum/price metrics on the day.