Sometimes, the most boring, under-the-radar businesses prove to be the best long-term investments, and Broadridge Financial Solutions Inc (NYSE:BR) could be one of them.

In fact, Broadridge was called “the most important firm on Wall Street that you’ve never heard of” by Dick Grasso, the former CEO and chairman of the New York Stock Exchange.

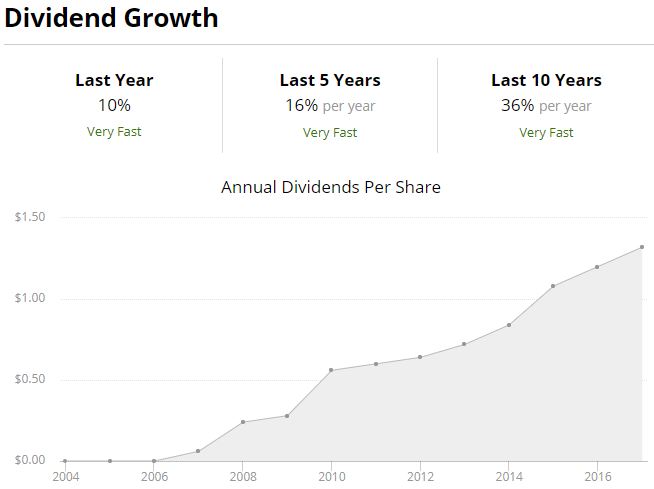

Paying higher dividends every year since 2007 and recording double-digit annualized dividend growth, Broadridge is a dividend achiever that boasts an impressive track record.

Let’s take a closer look at this high quality dividend growth stock to see if the company’s future remains bright and if today could be a reasonable time to consider adding to the stock to a diversified dividend portfolio.

Business Overview

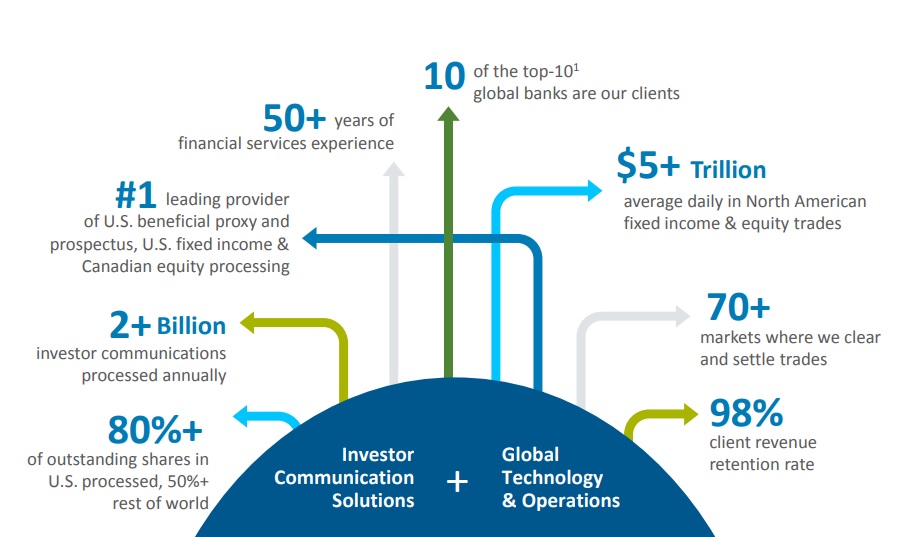

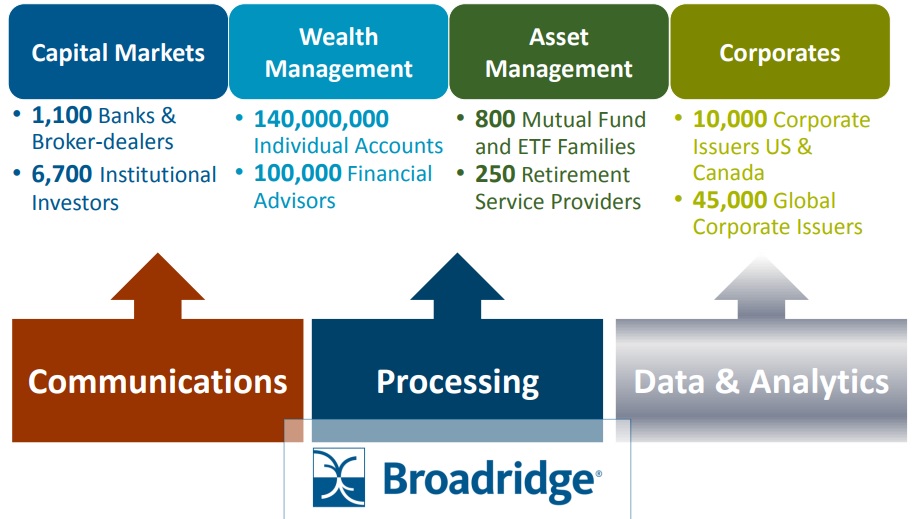

Broadridge Financial serves banks, brokerage firms, mutual funds, clearing firms, bond issuers, hedge funds, and financial advisors by handling many of their administrative but mission-critical tasks such as shareholder record keeping, investor communications, billing, tax reporting, clearing and settling trades, and more.

The company has been in business for more than 50 years, but it operated as a division of Automatic Data Processing (ADP) until spinning out as an independent company in 2007.

Broadridge operates in two segments.

Investor Communication Solutions accounts for 80% of total sales. The majority of this segment processes and distributes proxy materials to investors in equity securities and mutual funds and helps with vote processing.

Many public companies have thousands or even millions of shareholders, but the company does not know who they all are because that data is held across many different brokers.

It would be impractical for companies to work with all of the brokers through which their shares are held beneficially, so they turn to Broadridge to ensure that proxy materials are distributed to all beneficial owners and that their votes are accurately reported.

The SEC requires public companies to reimburse brokers for the expense of distributing stockholder communications to beneficial owners, so Broadridge bills the public company for its proxy services using fees established by the NYSE, takes its cut, and submits to the broker its portion of the fees.

Broadridge Financial dominates this market, processing over 80% of the outstanding shares in the U.S. last year (up from 70% in 2007).

The company also processed over two billion investor communications through either paper or electronic channels and offers dozens of other services – prospectus fulfillment services; electronic delivery solutions for documents including trade confirmations, tax documents, and account statements; marketing communications; tax services; and much more.

The Global Technology and Operations segment accounts for the remaining 20% of Broadridge Financial’s sales and provides systems that support real-time processing of securities transactions.

Its services automate the transaction lifecycle of trading operations, from order capture and execution through trade confirmation, settlement, custody, and accounting. Essentially, Broadridge allows brokers to avoid building out costly infrastructure to support the basic back-end processes of electronic trading.

Broadridge Financial processes over $5 trillion in equity and fixed income trades per day of U.S. and Canadian securities, including 60% of U.S. fixed income trades and providing services to 18 of the 23 primary dealers of fixed income securities in the U.S.

Source: Broadridge Financial

Across both of its segments, Broadridge has made numerous bolt-on acquisitions over the years to expand its suite of services into adjacent markets, the latest being Spence Johnson, which is a leading provider of global institutional data and intelligence to the asset management industry.

While most investors associate Broadridge Financial with proxy services and securities processing, the company has over 150 additional products that are increasingly driving incremental growth.

Altogether, about 91% of Broadridge Financial’s total revenue is recurring, and the company regularly achieves a client revenue retention rate in excess of 98%. From a geographical perspective, over 80% of Broadridge’s income is generated in the U.S.

Business Analysis

With 91% of its sales recurring and a client retention rate of 98% (100% of Broadridge Financial’s associates have a bonus tied to customer satisfaction), Broadridge has one of the sturdiest business models you can find. Serving the financial services area comes with some extra regulatory risk, but the benefits the industry offers have far outweighed them so far.

Financial services firms demand accuracy, reliability, and security. All shareholders must have the opportunity to vote their proxy form. All trades must be fairly settled and accounted for. All account statements need to be correct for tax purposes. All data contains extremely sensitive personal information and must be kept private.

You get the point – these tasks are mundane, complex, and well outside of financial services firms’ core operations, but each is mission-critical.

Broadridge Financial has spent approximately $2 billion the last decade to broaden its product lineup and enhance technical offerings. The company continues to invest several hundred million dollars in technology each year and, in some cases, has spent over 50 years perfecting the features available in its products.

Broadridge Financial now has a dominant market share in a number of its products, represents a relatively small proportion of clients’ overall operating expenses, and, most importantly, has earned their trust. It’s not worth switching to another vendor for many of these reasons alone.

To reinforce the importance of Broadridge Financial’s services to the financial industry, consider its securities processing business. After the financial crisis, the Fed agreed that Broadridge Financial’s processing platform would serve as the industry’s “too big to fail” platform.

MF Global provides another example of Broadridge Financial’s importance. MF Global was not a client, but after the firm went under in 2011, its customer positions were moved to Broadridge Financial’s platform to unwind the transactions so that the industry could have the reliability of a known processor.

From a growth perspective, it is easy to assume Broadridge Financial’s prospects are more limited given the mature state of the proxy processing market and the company’s substantial market share.

While this is partially true, it is looking in the rearview mirror where Broadridge came from, not where it is going. In the last three years, the management had a target to grow recurring revenue (91% of total revenues) at a 7-10% annual rate while compounding earnings at a 9-11% annual clip.

The company has achieved annualized revenue and earnings growth of 14% and 11%, respectively, over that period.

Broadridge Financial recorded about $4.1 billion in revenue last fiscal year itself, representing a little over 17% of its $24 billion addressable market.

Roughly $16 billion of the opportunity is in Broadridge Financial’s Global Technology & Operations segment, where it generated over $800 million in sales last year. This large addressable market presents a long runway for growth propelled by key market trends of digitization, mutualization, and data & analytics.

The company has deployed $539 million on acquisitions so far, extending its reach into adjacent products and markets that can continue developing into sizeable revenue drivers over time.

As Broadridge Financial continues executing in these newer areas, higher-margin recurring fee revenue will become a larger part of overall mix and make Broadridge Financial less reliant on market-based activity.

This is already playing out when you look at the composition of Broadridge Financial’s incremental recurring revenue sales. The proportion of these closed sales that come from Broadridge’s Emerging and Acquired products increased by 25% in fiscal year 2017, for example.

Broadridge Financial’s strong brand and trust in the market provide a competitive advantage to allow it to more easily expand its wallet share with existing and new clients.

Data and analytics are newer areas that Broadridge Financial is leveraging to achieve higher-margin, long-term growth opportunities. Revenue from data and analytics, which is a potentially overlooked area by investors, could serve as a very nice tailwind for the business.

Broadridge Financial’s existing businesses provide the company with some very unique data assets – for example, Broadridge Financial has data on every beneficial equity position for over 140 million investors.

The company also acquired the fiduciary services and competitive intelligence unit of Thomson Reuters Lipper (now known as Broadridge Fund Information Services) in 2015. When combined with Broadridge Financial’s existing market intelligence and compliance solutions, the company can now provide a comprehensive view of fund flows across the globe, helping guide product development and marketing and distribution to fund boards of directors in support of their regulatory obligations.

The company is also improving its technology platform and now runs a back office trade processing utility for more than 30 clients in the financial services industry.

It is also investing in new product development areas like blockchain and tax reporting. For example, in 2016 Broadridge acquired the technology assets of Inveshare to develop blockchain applications for its proxy business and also recently completed a blockchain pilot for the bilateral repo market.

Finally, as more communications move digital, Broadridge Financial should enjoy higher margins and additional business opportunities.

From a profit growth perspective, digital communications are much less costly to implement than purchasing the materials and postage needed for direct mail campaigns.

Digital communication allows for a much greater collection of data as well, allowing Broadridge Financial to enhance its data analytics tools to help firms better prepare for and execute the proxy process and more effectively communicate with their shareholders outside the proxy process.

Opportunities can open up outside of financial services as well – take a look at Broadridge Financial’s new digital communications product Inlet, for example.

Despite Broadridge’s numerous competitive advantages and opportunities for long-term growth, there are several risks to be aware of.

Key Risks

Regulatory changes and technological shifts seem to pose the most risk to Broadridge Financial’s business.

First, the fees Broadridge Financial collects for its proxy services are predetermined by the NYSE and SEC. Should a change in rules occur, Broadridge’s business could be adversely impacted.

However, any changes generally take years to decide, and the SEC recently approved rule changes in January 2014, outlining the reimbursements broker-dealers and custodian banks receive for the work they perform in connection with forwarding proxy communications to their client accounts. Ultimately, the NYSE estimated that the new fee schedule would reduce issuers’ costs by 4%.

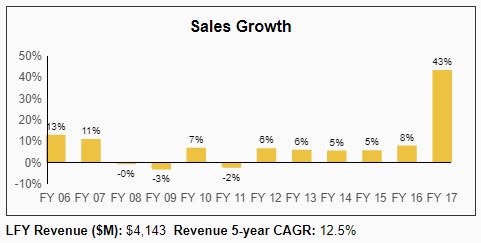

Fortunately, Broadridge Financial’s business has continued to perform just fine so far, growing sales by 5%, 8%, and 43%, respectively, over the last three years. Another fee ruling seems unlikely for for at least a few more years, if not much longer (prior to the 2014 change, the fee structure was untouched since 2002).

Beyond proxy fees, the SEC can propose other rules that could change different elements of Broadridge Financial’s business.

For example, in 2015 the SEC also proposed rules to require mutual funds to make new filings and to provide the option of mailing a notice of a fund report’s availability on a website instead of physically mailing a complete report to those investors that have not enrolled in e-delivery. However, the rule did not lead any changes to the report distribution method when passed.

Having said that, Broadridge not only has the experience of successfully implementing regulatory changes but is also investing heavily in digital offerings and platforms.

The company is well-equipped to launch products and solutions for almost any regulatory change. For example, it recently launched a trade reporting solution for the European Securities and Markets Authority’s (ESMA) forthcoming Securities Financing Transaction Regulation.

Technology trends are driving regulatory and business changes as well. In addition to the proxy distribution fee changes previously discussed, the SEC passed guidelines supporting the use by institutions of an Enhanced Broker Internet Platform (EBIP).

EBIPs would build on individual shareholders’ reliance on brokers’ websites as their primary source for information by also allowing shareholders to vote their positions on those sites. The goal is to utilize more technology in order to increase voter participation and streamline the proxy voting process.

As you might have guessed, Broadridge Financial is already leading the way with this transition with its Investor Mailbox EBIP solution, entitling the company to earn additional fees for the new customers going digital.

Looking at the bigger picture, it seems clear that digital technologies will reduce print communications, open up new content channels, and transform all types of investor communications – from proxy and regulatory documents to marketing materials and customer account statements. Over $20 billion is spent on paper and postage in financial services, so there is a long runway for this transformation to play out.

Broadridge Financial has invested in digital technologies for many years to protect and grow its business. As fewer bulky forms go through the mail, Broadridge Financial’s gross margins and free cash flow should continue improving since it no longer needs to deal with as many postal costs.

This profitable transition is already taking effect in some instances, with gross margins improving from 25.7% in 2007 to 32.1% in FY’16 while traditional distribution revenues declined over that same time period.

Broadridge’s R&D efforts are also taking advantage of digital technology to drive future growth. Inlet is a digital document distribution solution that allows for financial services companies to deliver documents to their customers through the online channels their customers already use, for example.

Inlet was developed in 2014 and started rolling out to the market in 2015. Over time, this product is expected to play an important role in the continued adoption of paperless delivery solutions, decreased delivery costs, and enhanced customer loyalty. If successful, Inlet could meaningfully expand Broadridge’s reach outside of the financial services vertical.

Beyond Inlet, the company is also investing in a number of digital technologies to make content more engaging and interactive. As a result of its efforts, Broadridge reported an increase in e-delivery from 19% in 2010 to 46% in 2016 with 24% cost savings since 2010.

Finally, many investors wonder about what impact, if any, the health of the stock market has on Broadridge Financial’s business.

Fortunately, Broadridge Financial has a low correlation with the stock market’s direction (sales fell just 3% in fiscal year 2009). Its sales volume is more related to overall transactions, processing needs, and trading volume.

Broadridge Financial’s Dividend Safety

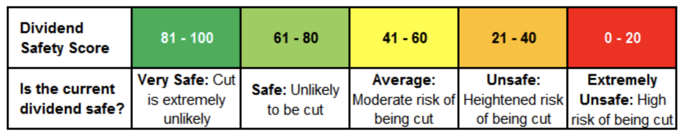

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

Our Dividend Safety Score answers the question, “Is the current dividend payment safe?” We look at some of the most important financial factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more.

Dividend Safety Scores range from 0 to 100, and conservative dividend investors should stick with firms that score at least 60. Since tracking the data, companies cutting their dividends had an average Dividend Safety Score below 20 at the time of their dividend reduction announcements.

We wrote a detailed analysis reviewing how Dividend Safety Scores are calculated, what their real-time track record has been, and how to use them for your portfolio here.

Broadridge Financial has a Dividend Safety Score of 83, a strong ranking that suggests Broadridge Financial’s dividend is safer than most other companies’. With rock solid client retention rates, almost all recurring revenue, and a very strong market position, Broadridge Financial’s high score doesn’t come as a big surprise.

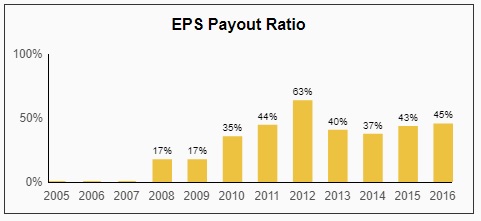

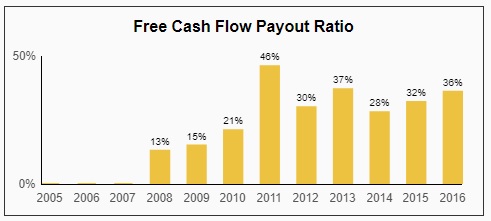

Over the trailing twelve months, Broadridge Financial’s dividend has consumed 50% of its earnings and 41% of its free cash flow. For a business as stable as Broadridge Financial’s, these payout ratios are excellent and provide plenty of room for continued dividend growth.

Going forward, Broadridge Financial expects to maintain an EPS payout ratio of at least 45%, which provides plenty of cushion to support the dividend.

For dividend companies with enough operating history, it’s always a prudent exercise to observe how their businesses performed during the financial crisis.

Broadridge Financial’s reported sales were down just 3% in fiscal year 2009, and earnings actually grew. Despite serving clients in the financial services industry, most of Broadridge Financial’s products are mission-critical and don’t depend on the market’s direction.

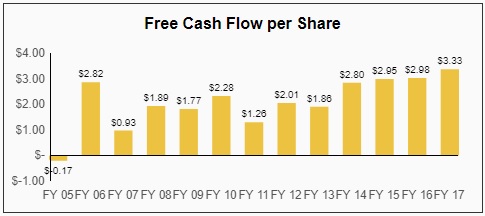

High quality companies are able to generate cash flow year in and year out. Rising cash flow is very important because it supports continued dividend growth without expanding the payout ratio.

Broadridge Financial’s business model has very low capital intensity (capital expenditures as a percentage of sales is typically below 2%), throwing off plenty of cash each year and recording solid growth over the last five years to pay a steadily-growing dividend:

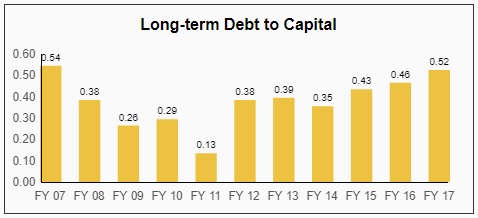

While payout ratios, industry cyclicality, free cash flow generation, and business performance during the recession provide a better sense of a dividend’s safety, the balance sheet is an extremely important indicator as well. Companies will also meet their debt obligations before paying dividends.

As seen below, Broadridge Financial’s long-term debt to capital ratio has remained fairly steady over the last decade, generally hovering between 30% and 40% which is quite reasonable.

However, it recently increased to more than 50% after its handful of acquisitions. Fortunately, none of the company’s long-term debt is due before September 2020, and Broadridge’s strong recurring cash flows suggest that the company’s increased debt won’t pose any challenges to the company’s operations or dividend payments.

Overall, Broadridge Financial’s dividend appears to be very safe. The company’s payout ratios are low, its business is very predictable and throws off tons of cash, and the balance sheet is healthy.

Broadridge Financial’s Dividend Growth

Broadridge Financial has delivered excellent dividend growth for shareholders since it started making payouts in 2007.

In fact, Broadridge Financial has increased its dividend each year since spinning off from ADP in 2007 (ten straight years) and most recently raised its dividend by 11%, marking the sixth consecutive double-digit increase.

Broadridge Financial’s dividend has grown at a 15% compound annual growth rate over the last five fiscal years and appears to have solid potential to continue growing at a low double-digit rate going forward thanks to the company’s relatively low payout ratio, solid business stability, and numerous opportunities for long-term earnings growth.

Valuation

Shares of BR trade at a forward P/E ratio of 23, which is a significant premium to the S&P 500’s forward P/E ratio of 17.9, as well as the tech sector’s 18.8 multiple.

Investors are clearly acknowledging Broadridge Financial’s resilient business model (91% recurring revenue; 98% client retention rate), very healthy free cash flow generation, and opportunities for continued earnings growth going forward.

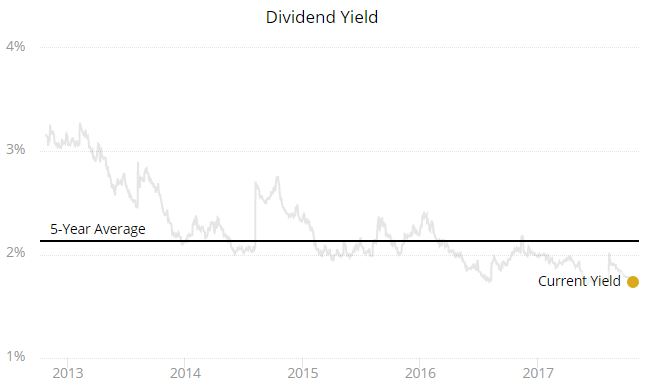

From a dividend yield perspective, BR’s 1.7% yield is meaningfully below its five-year average dividend yield of 2.1%.

From a P/E ratio and dividend yield perspective, shares of BR do not appear to be a bargain today.

However, should the company continue generating double-digit annual earnings growth over the coming years, Broadridge will quickly grow into its premium multiple and offer double-digit total return potential (1.7% dividend yield plus 9% to 11% annual earnings growth = 10.7% to 12.7% annual returns).

Conclusion

Broadridge Financial possesses many of the traits of an excellent business – low capital intensity, high returns on capital, a long runway for growth in adjacent products and markets, limited competition, high switching costs, dominant market share, and more.

While the company faces higher regulatory and technological risks than some other companies, its core competitive advantages and the generally favorable industry themes playing out (e.g. digitalization, data & analytics) seem to far outweigh any concerns.

Broadridge Financial’s current valuation doesn’t look cheap, but it rarely will given the extremely high quality and stability of the business (91% recurring revenue; 98% client retention rate). Broadridge Financial is a company worth watching for any type of meaningful pullback and a wonderful business to continue holding for existing shareholders.