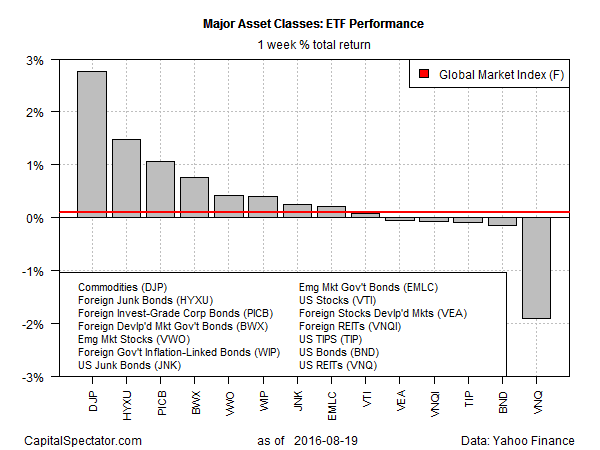

Commodities rebounded sharply last week, posting the strongest gain among the major asset classes, based on a set of representative exchange-traded products. The rise marks the second weekly increase for broadly defined commodities.

The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) popped 2.8% for the five trading days through Aug. 19. The increase delivered the biggest weekly gain since late-June.

Meantime, US real estate investment trusts (REITs) suffered the biggest loss among the major asset classes for the second week in a row. The Vanguard REIT (NYSE:VNQ) shed 1.9%, the third consecutive weekly loss.

Overall, the winners trumped the losers last week for an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F continued to advance last week, ticking up by 0.1% (red line in chart below).

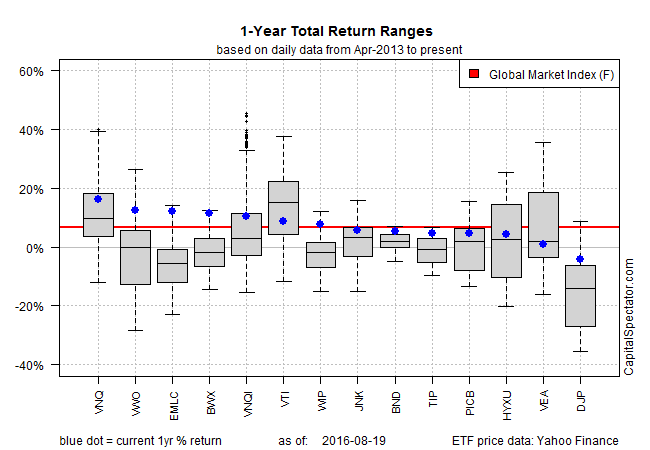

Despite the recent wave of selling for US REITs, this slice of securitized real estate continues to hold the top spot for the trailing one-year window. VNQ is up 15.2% as of last Friday vs. the year-earlier price on a total-return basis.

But in contrast with recent history, the first-place premium is slipping and the number-two performer for the past year—SPDR Barclays International Treasuries (NYSE:BWX)—is in close pursuit with an 11.7% total return (in unhedged US-dollar terms).

Commodities are still in last place for the one-year performance column, although the recent gains have pared the loss considerably. DJP is in the red by a comparatively mild 3.6% for the trailing 12-month return—a big improvement vs. the double-digit losses that have prevailed in previous months.

Speaking of improving results, GMI.F continues to edge higher for the trailing one-year return. As of last Friday, the benchmark has gained a respectable 6.7% over the past 12 months. In short, a passive strategy that holds everything and shuns trading is generating competitive results once again.