The NBER does not define a recession as two consecutive quarters of contracting GDP. That is the mainstream definition that largely survives as a coping mechanism to deny what might otherwise be quite apparent. That was certainly true in 2008, as only Q1 GDP declined and it wasn’t until Q4 2008 that this mythical “technical” definition was met. The NBER only made it worse by waiting until December that year to declare what was by then obvious to everyone, already one year in length.

The organization actually employs a Business Cycle Dating Committee whose job it is to decide both cycle peaks and troughs. The Committee, according to the NBER, considers a broad range of data that includes GDP, but relies primarily on four sources or accounts. The first two are broad monthly figures, real personal income less transfer payments and employment, while the second two are basically manufacturing, industrial production and inflation-adjusted total sales aggregated for the whole supply chain.

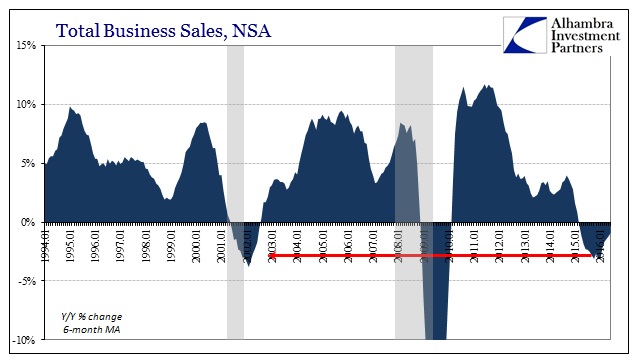

Updated figures for Industrial Production continue to show contraction, even if only slightly. The decline now stretches about a year, which suggests something more significant than simple and expected variation. And we already know that total sales across the whole of the “goods economy”, from manufacturing to wholesale to retail, are declining, with particularly acute weakness again in retail sales and the lingering, heightened inventory imbalance. The NBER committee takes into account “inflation” here, but with total business sales already a negative number just in nominal terms the specific level of “real” decline isn’t really the issue.

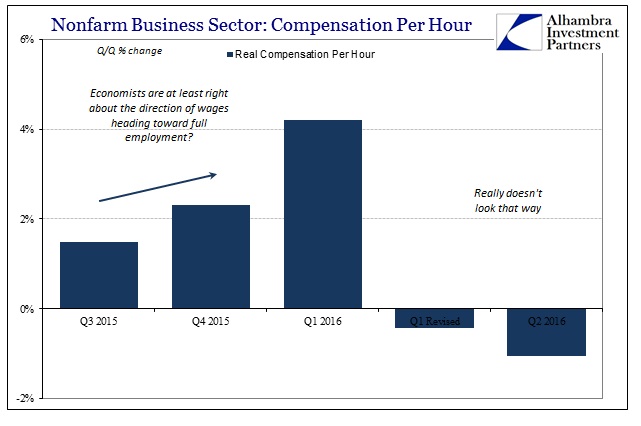

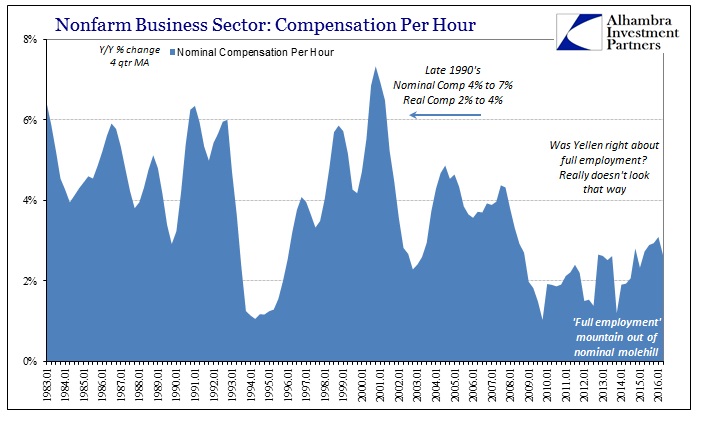

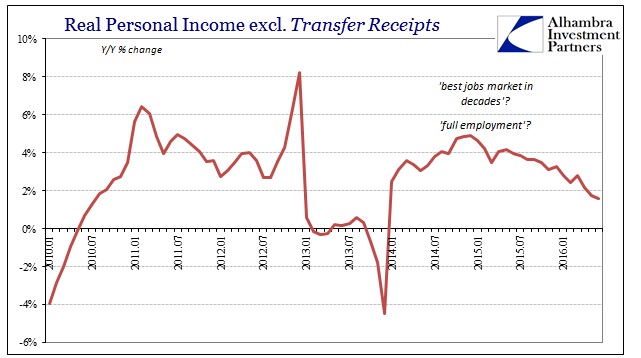

That leaves the monthly labor and income estimates. We already know all-too-well that the Establishment Survey refuses to acknowledge anything but variable strength, while the unemployment rate denotes conditions where inflation should be moving far above the Fed’s 2% target rather than sticking at less than 1%. As noted last week, despite the headline labor numbers there is no evidence that “full employment” is having any effect particularly on wage gains; they remain contrarily subdued and especially so in 2016.

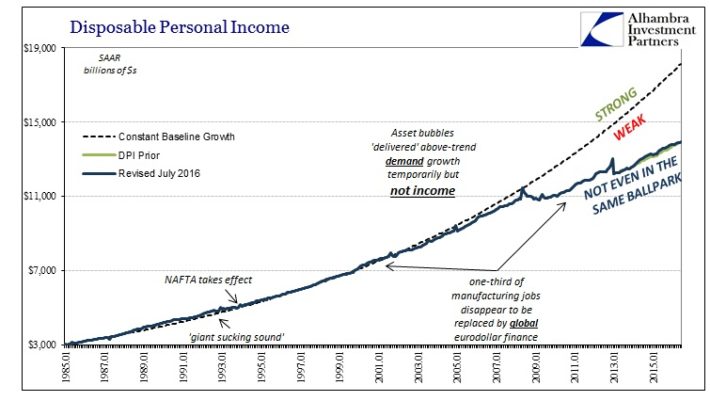

Unfortunately for the growth case, Real Personal Income less Transfer Payments also contradicts the unemployment rate and Establishment Survey. While gaining somewhat in 2014, rather than continuing to accelerate it has instead done the opposite despite a much lower calculated and applied inflation rate since the end of that year.

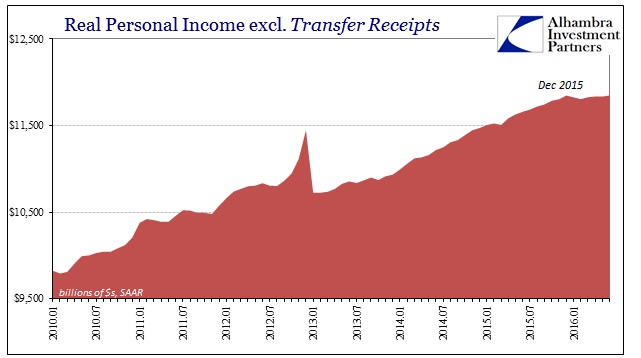

While there isn’t a contraction here, the concerning part is this year, which becomes apparent when viewed in the seasonally-adjusted format (SAAR).

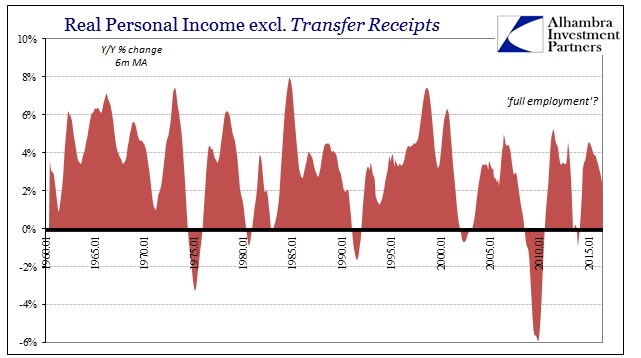

What was a steady growth trend, albeit, as usual, weaker than in past “cycles”, suddenly stopped at the end of last year – an inflection point that isn’t in any way surprising. It did not turn recessionary and immediately drop into contraction, but that isn’t my point with all this. I am not trying to define a recession in 2016, rather I am looking for a consistent and comprehensive view of the economy as it actually is. Using the NBER’s criteria, what we find is highly compelling weakness in three of them stacked against the fourth.

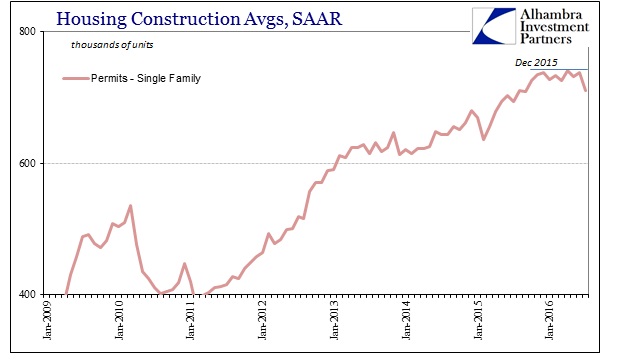

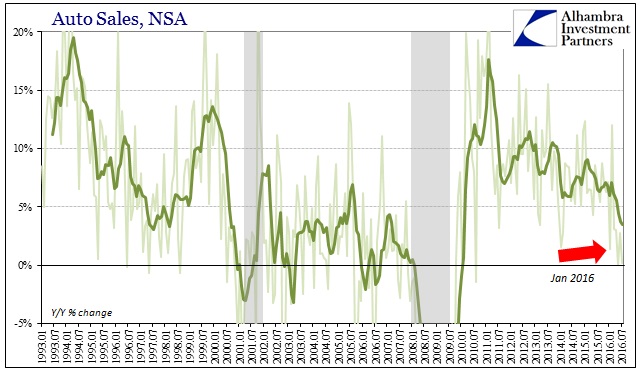

The timing of this seemingly durable change in Real Personal Income less Transfer Payments is something we have seen elsewhere. Earlier today, the Commerce Department reported that permits to build new single family homes had contracted year-over-year in July, continuing a noticeable flattening and deceleration that likewise began at the end of last year. That is also about the same time as when auto sales fell off toward what is hoped at this point nothing more than a “plateau.”

It is very likely much more than coincidence that the two largest consumer purchases become noticeably weaker at the same time one of the more meaningful income measures suddenly and prominently does, too. The consistency among these three different items raises the probability that this is a “real” trend.

Given the NBER’s recession framework, then, we can reasonably surmise that the contraction in the manufacturing or goods economy rather than being written off as just “12% of GDP” or an isolated, “unexpected” aberration is starting to have a significant impact on the whole darn thing; though not yet as an orthodox cycle peak. It isn’t full-scale contraction across the whole economy, but it isn’t all that far, either. The relatively easy slope of the decline in the “manufacturing recession”, spaced out between one and two years or more (in various indications), likely accounts for the lack of full recession – to this point. If it ever gets that far, it may be found to have been the gentlest, most confusing cycle peak in history; a product of the fact the last recession wasn’t really a recession even though the NBER declared it one.

Right now, the search for cyclicality is almost irrelevant, though after too much longer that may change. In other words, what we find is growing weakness in 2016 more than 2015 that is increasingly corroborated even among the data points the NBER’s Business Cycle Dating Committee emphasizes. The economy is pointing downward, spring rebound aside, with alarms ringing in a wider and broader variety of important economic accounts. From this view, it is no wonder the FOMC overreacted to the May payroll report; that’s all that is left as it is more and more isolated.