Investing.com’s stocks of the week

Market Brief

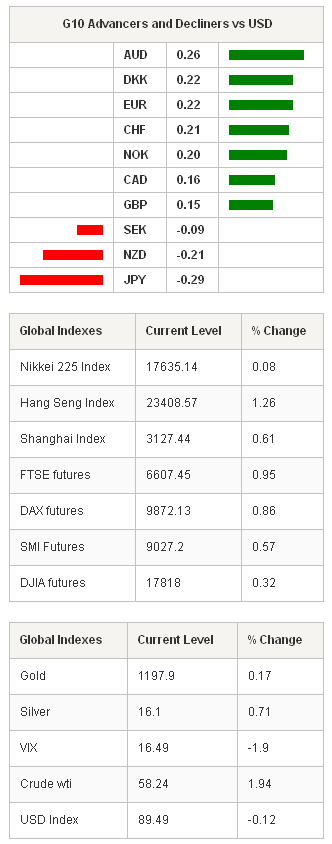

Forex price action was subdued in the Asian session as equity markets rallied and USD was broadly sold-off. However, prior to the negative USD sentiment the EURUSD touch a new two-year low at 1.2220 on divergent monetary policy expectations. Gains on Wall Street Friday, pushed Asia higher today. The Nikkei rose 0.08%, while the Hang Seng increased 1.26% and Shanghai climbed 0.61%. News that the Chinese cabinet unveiled rules to lower the regulatory hurdle for foreign banks in order to open the domestic financial sectors also helped raise sentiment. In oil news, Saudi Arabia stated on Sunday they would not cut production even if non-OPEC nations did so.

This was one of the strongest signals that Saudi Arabia is dedicated use the price slump to push out competitors. Brent crude was stable about the $60 handle and is expected to remain there for rest of 2014. USDJPY was range-bound for most of the session yet was interrupted by a rogue spike (low participation and low liquidity environment) as European markets opened. With Tokyo holidays tomorrow and Christmas later in the week many Japanese speculative traders are stepping away from the markets. In addition, Tokyo businesses are officials closed to for the year on Friday limiting current real money trading.

EURUSD traded lower but was able to recover on short-covering to 1.2268. We would suspect the EURUSD to remain under pressure into the new year as traders are getting comfortable with the ECB engaging in sovereign bond buying at their January 22nd 2015 meeting. ECB VP Constancio stated that he is expecting negative inflation in the coming months after oils price plunge which will put the economy at risk, therefore supporting QE. While the ECB Coene, in La Libre Belgique, was quoted as supporting government bond purchases.

The EURs weakness will also be a result of traders further pricing in the Fed’s tightening cycle and lingering concerns over political developments from Greece. After the SNB surprising move into negative rates EURCHF was unchanged between 1.2028 and 1.2037. USDNZD was slightly higher, shrugging off weak consumer confidence data and picking up carry driven bids around the 1.2900 handle. Tomorrow’s New Zealand trade report should read NZ$500m deficit and NZ$750m y/y.

For algorithmic trade details & more great trade ideas,

Currency Tech

EURUSD

R 2: 1.2485

R 1: 1.2351

CURRENT: 1.2314

S 1: 1.2248

S 2: 1.2175

GBPUSD

R 2: 1.5826

R 1: 1.5786

CURRENT: 1.5664

S 1: 1.5541

S 2: 1.5423

USDJPY

R 2: 121.85

R 1: 120.20

CURRENT: 119.21

S 1: 117.55

S 2: 115.46

USDCHF

R 2: 0.9972

R 1: 0.9850

CURRENT: 0.9800

S 1: 0.9723

S 2: 0.9554