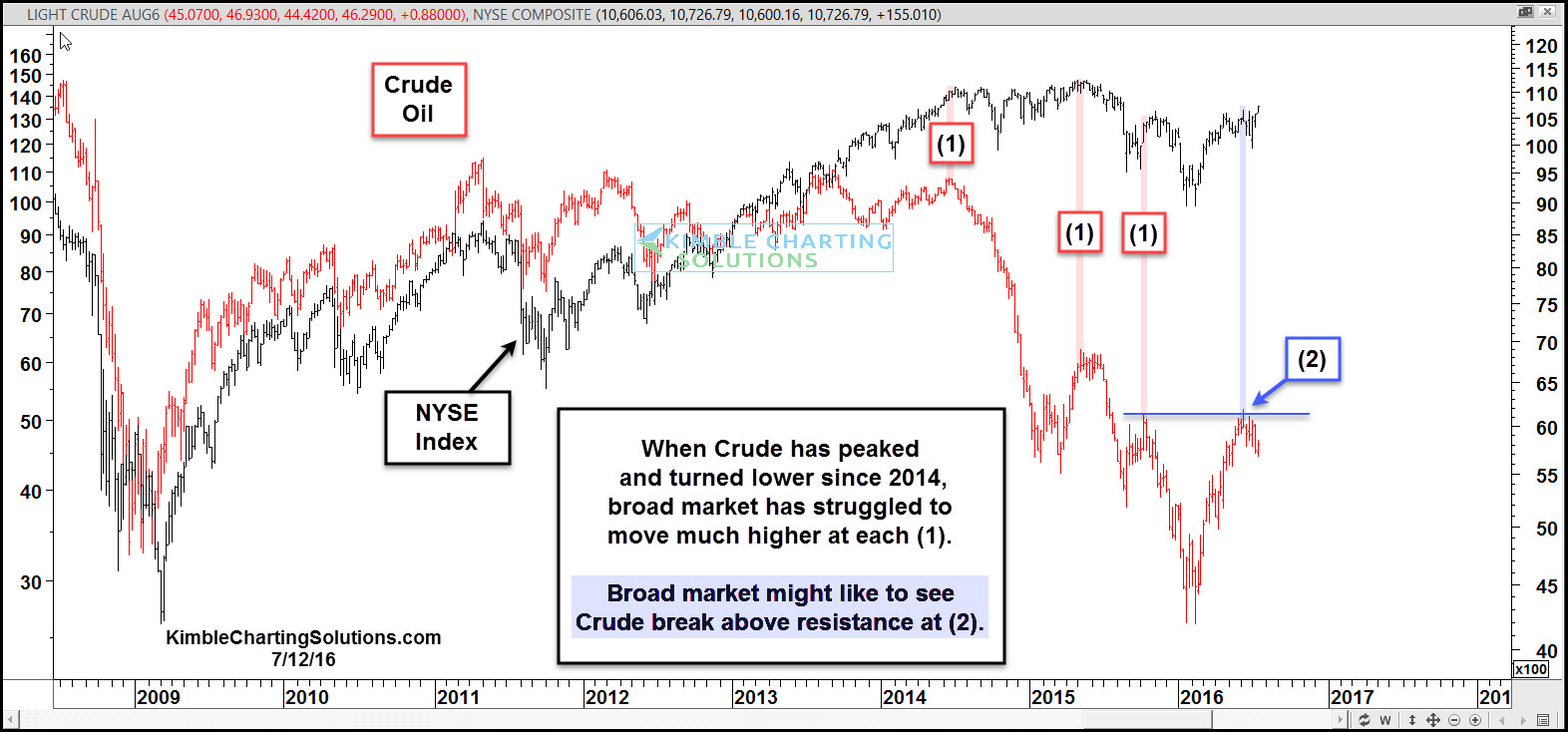

Both crude oil and the broader market have been fairly correlated over the past couple of years. The chart below shows crude and NYSE Index price patterns since 2008.

Notice that while both bottomed at around the same time during the financial crisis, they diverged when crude peaked in 2014 as the NYSE -- from a gain perspective -- struggled to stay abreast of oil.

Still, when crude peaked at (1) above, it wasn’t long before the NYSE index resumed its pacing, hitting a high before turning a little softer.

A big test to that correlation is at hand right now at (2), as crude tests last-year's highs.

So goes crude, so goes the broad markets? Will this correlation continue?

If history is any guide, the risk-on trade might want -- or need -- crude to breakout at (2). If it does take out last year's highs, history suggests that the broad market will appreciate the price action.