Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Chart

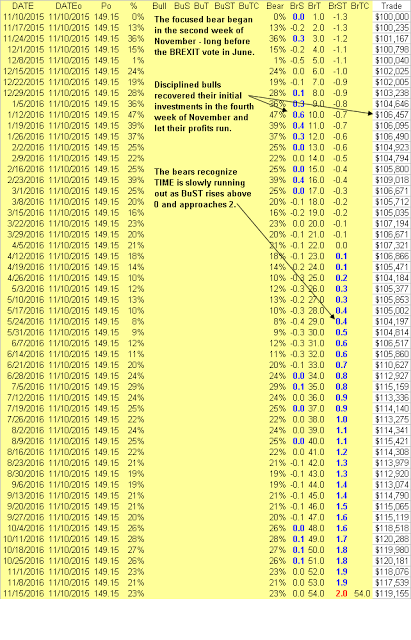

The pound's focused bear opportunity has produced 23% annualized return for the bears since the second week of November 2015 (see FXB Matrix). This opp recorded an impressive 47% gain in the second week of January. Disciplined bears that booked profits and reduced risk in November 2015 and January 2016 are letting their profits run while watching TIME.

Smart money, a small minority listening to the message of TIME, knows it's running out as BrST rises above 0 and approaches 2. BrST = 2.0, an extreme bearish concentration suggesting TIME is up, has them preparing for a reversal while the majority remains blindly bearish.

FXB (NYSE:FXB) Matrix

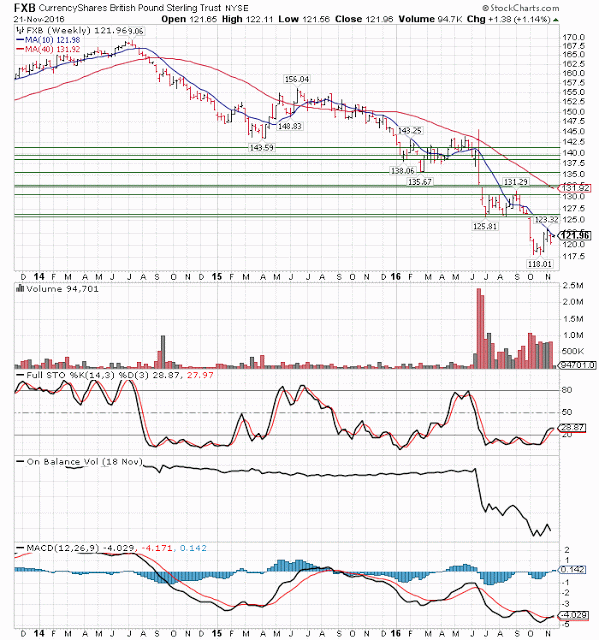

A weekly close below support at 118.01 supports the down impulse, while a close above the October gap from 125.73 to 126.43 could reverse it. A reversal favors testing of higher resistance.

On balance volume, a crude measure of trend energy, suggests distribution. Distribution favors the bears.

While doom and gloom about a falling pound rules the headlines, its exactly what Britain needs to boost its exports and failing economy longer term. Politicians have be 'trained' to view a strong pound as good and weak as bad. Few remember that Britain, the first nation to remove itself from the gold standard during the Great Depression, was also the first to recover. Don't expect the financial headlines to consider the lessons from history. Britain, despite all the doom and gloom, made the right move to leave the EU - also known as the sinking ship.