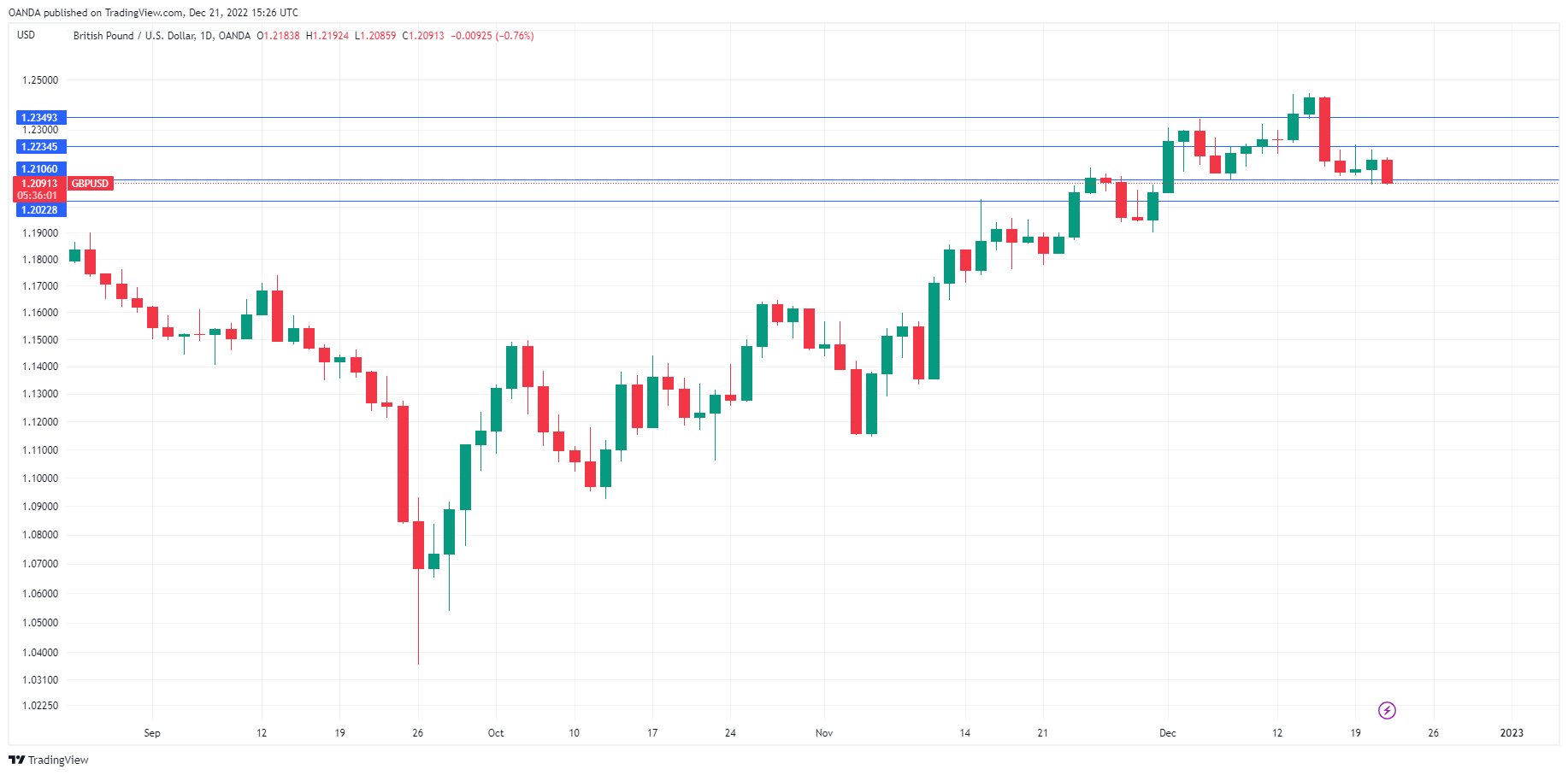

GBP/USD is sharply lower on Wednesday. In the North American session, the pound is trading at 1.2093, down 0.74%.

Retail Sales Outperform

There was an unexpected surprise from the UK CBI Realized Sales today. December sales volumes showed a strong rebound, rising 11 points. This easily beat the November reading of -19 and the consensus of -21. However, retailers expect the rebound to be short-lived and are predicting a decline in January, with a forecast of -17.

The UK releases Final GDP for Q3 on Tuesday. The consensus stands at -0.2%, after an identical release from GDP in the second quarter. Two consecutive quarters of negative growth would technically mean that the UK economy is in recession, but it’s clear that there is a recession even without this definition. The Office for Budget Responsibility (OBR) is projecting that the UK is in a recession that will last more than one year and cause a massive 7% drop in household incomes over the next two years.

Households have been hit by a double punch of high inflation and rising interest rates, and wages have failed to keep pace with inflation. Tens of thousands of ambulance workers went on strike today in England and Wales, and more public sector workers are expected to follow suit this winter. This sets up the specter of a wage-price spiral, which would complicate the Bank of England’s struggle to curb inflation, which remains in double digits.

We’ll also get a look on Tuesday at UK Revised Business Investment for Q3. A weak release of -0.5% is expected, after an identical reading in the second quarter.

GBP/USD Technical

- GBP/USD is testing support at 1.2106. Next, there is support at 1.2023

- There is resistance at 1.2234 and 1.2349