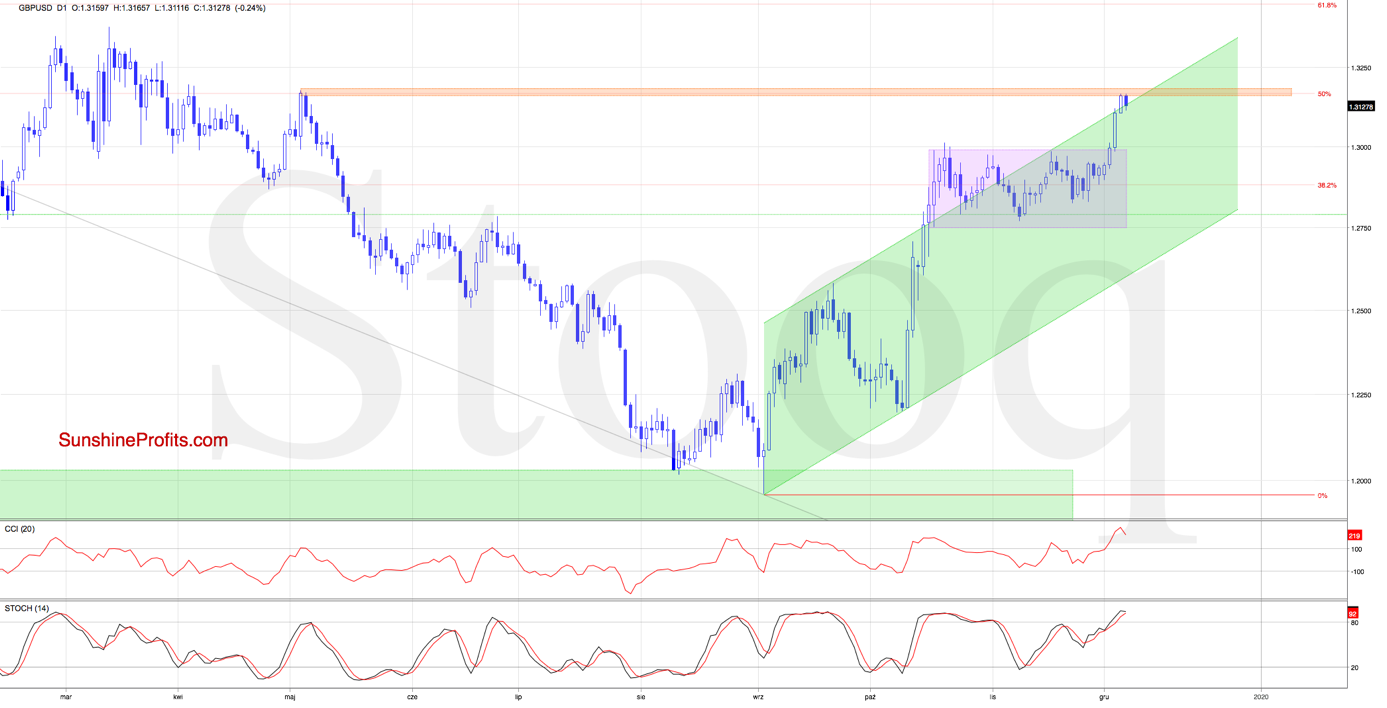

For many weeks running, GBP/USD has been trading sideways in the pink consolidation. After moving higher recently, just what are the chances of the breakout sticking?

GBP/USD recently broke above the pink multi-week consolidation, and the bulls didn’t really look back. The pair extended gains and reached the orange resistance area created by the May peaks, and the 50% Fibonacci retracement.

This move took the exchange rate also slightly above the upper border of the rising green trend channel. Before jumping to conclusions, let’s take a look also at the position of the daily indicators. Both the CCI and the Stochastic Oscillator are very close to generating their sell signals.

Coupled with the above-mentioned resistance zone and the current position of the daily indicators, it seems that a reversal and lower values of GBP/USD may be just around the corner.

Should we see an invalidation of the breakout, we’ll consider opening short positions.