Forex News and Events

Article 50 - The long goodbye?

Fears are increasing that the UK's separation from the EU may take quite a bit longer than anticipated. Indeed, insiders now claim that the UK is not ready for the negotiating stage of the exit and as a result Theresa May may postpone invoking the formal procedure, which was until now largely expected to happen in January 2017. As it currently stands, formal exit proceedings may only begin at the end of next year and last until Q4 2019.

Throughout the history of the EU, it has not been unknown for democratic decisions to be unobserved as was the case with the Lisbon Treaty in France in 2005, or in Greece last year with the OXO vote. It seems that there is a good vote and a bad vote. At the moment the only thing that is certain, is uncertainty. Currency-wise, we will soon see markets beginning to price in a likelihood of a Bremain, pushing the GBP/USD higher.

Summer Doldrums

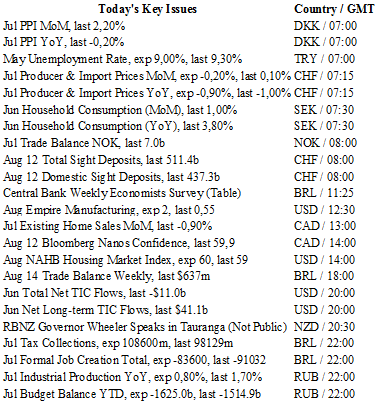

Traders should brace themselves for a week of extremely unexciting, directionless trading. Alongside the general seasonality affecting markets, the lack of key data and ultra-loose monetary policy will make this week snooze-worthy. Global central banks action, punctuated by the BoE, has depressed volatility and removed the fear of uncertainty. The fact is best represented by the VIX shrinking to 11.83 - well below historical norms, while Bloomberg’s US Economic Policy uncertainty composites index surged to levels not seen since 2011. Bernanke’s “put” is clearly entrenched and gone global. Despite risk to outlook building, we don’t see any catalyst derailing the current risk-on environment, especially not this week ahead of Yellen speech in Jackson Hole (Aug 26th). Government bond yields continue to trend lower, especially in DM, which has only intensified the search for yields. Against this backdrop, USD should continue to trade lower against higher yielding EM currencies and range bound against G10. Investors have disregarded shaky fundamentals; diving head first into risky currencies likes BRL, PLN, ZAR and TRY. The highlight of this dull week should be US CPI, FOMC minutes and Fed member Lockhart’s speech as indicators for board members voting skew. From the UK, investors will get an additional view of economic activity post-Brexit with the release of CPI, the employment report and retail sales. With data pointing towards further monetary and fiscal easing, evidence that the consumer will bear the brunt of Brexit fears will only increase expectations for stimulus and send the GBP lower.

GBP/USD - Monitoring Downtrend Channel.

The Risk Today

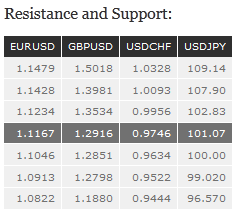

EUR/USD is increasing towards hourly resistance at 1.1234 (02/08/2016 low). A break of this resistance is needed to confirm deeper buying pressures. The road remains nonetheless wide-open towards hourly support that can be found at 1.1046 (05/08/2016 low). In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD still lies within a downtrend channel. The pair is trading below 1.3000 and the bearish momentum remains lively. Hourly resistance can be located at 1.3097 (08/08/2016 high). Expected to head towards support implied by the lower bound of the downtrend channel around 1.2900/20. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment,

USD/JPY keeps on trading between hourly resistance at 102.83 (02/08/2016 high) and hourly support at 100.68 (02/08/2016 low). A failure to go above 102.83 supports a continued medium-term bearish momentum. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is trading mixed at the moment. The pair continues to trade between hourly support at 0.9634 (02/08/2016 low) and strong resistance given at 9956 (30/05/2016 high). Buying pressures seem weak and should indicate that a reversal towards 0.9634 is likely. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.