British American Tobacco PLC (NYSE:BTI) was upgraded by stock analysts at Morgan Stanley from an "equal weight" rating to an "overweight" rating in a note issued to investors on Wednesday, StockTargetPrices.com reports.

Other equities research analysts have also issued research reports about the company. Societe Generale lowered British American Tobacco PLC from a "buy" rating to a "hold" rating in a research note on Friday, July 29th. Cowen and Company assumed coverage on British American Tobacco PLC in a research note on Thursday, August 25th. They issued a "market perform" rating for the company.

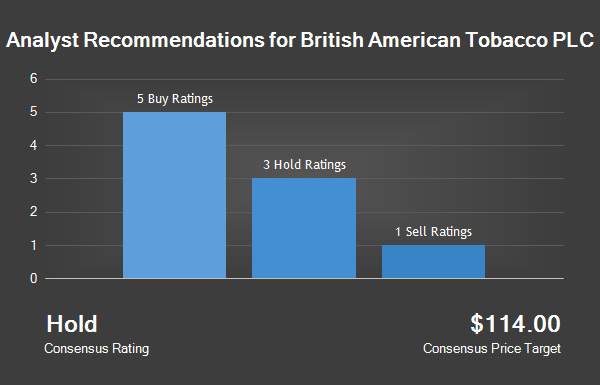

Finally, Investec upgraded British American Tobacco PLC from a "hold" rating to a "buy" rating in a research note on Thursday, September 8th. One analyst has rated the stock with a sell rating, three have issued a hold rating and six have issued a buy rating to the company's stock. The stock currently has a consensus rating of "Buy" and a consensus price target of $114.00.

British American Tobacco PLC (NYSEMKT:BTI) traded down 0.52% during trading on Wednesday, hitting $112.56. 2,103,080 shares of the stock traded hands. The stock has a market cap of $104.57 billion, a P/E ratio of 19.97 and a beta of 0.95. The stock has a 50 day moving average price of $121.33 and a 200-day moving average price of $123.56. British American Tobacco PLC has a 52-week low of $99.81 and a 52-week high of $131.34.

Several hedge funds and other institutional investors have recently modified their holdings of the company. National Planning Corp increased its stake in shares of British American Tobacco PLC by 6.1% in the first quarter. National Planning Corp now owns 2,588 shares of the company's stock valued at $315,000 after buying an additional 149 shares during the period.

Avalon Advisors LLC increased its stake in shares of British American Tobacco PLC by 0.3% in the first quarter. Avalon Advisors LLC now owns 14,312 shares of the company's stock valued at $1,673,000 after buying an additional 47 shares during the period.

Clark Capital Management Group Inc. increased its stake in shares of British American Tobacco PLC by 12.7% in the first quarter. Clark Capital Management Group Inc. now owns 19,305 shares of the company's stock valued at $2,257,000 after buying an additional 2,177 shares during the period.

Euclid Advisors LLC bought a new stake in shares of British American Tobacco PLC during the first quarter valued at about $4,150,000. Finally, Sensato Investors LLC bought a new stake in shares of British American Tobacco PLC during the first quarter valued at about $4,855,000.

About British American Tobacco PLC

British American Tobacco p.l.c. is a tobacco company. The Company is engaged in manufacturing and marketing cigarettes and other tobacco products. Its segments include Asia-Pacific, Americas, Western Europe, and Eastern Europe, Middle East and Africa (EEMEA). The Company's brands include Dunhill, Kent, Lucky Strike, Pall Mall and Rothmans.