Bristol-Myers Squibb Company (NYSE:BMY) announced new data from a cohort of the phase II CheckMate -142 study on Opdivo.

CheckMate-142 study is an ongoing study evaluating Opdivo (nivolumab) and Yervoy (ipilimumab) for previously treated patients with DNA mismatch repair deficient (dMMR) or microsatellite instability-high (MSI-H) metastatic colorectal cancer. Results from the study showed that the primary endpoint of objective response rate per investigator assessment was 55%, with a median follow-up of 13.4 months. The overall survival rate at one year was 85%, and median OS was not yet reached. The results showed that Opdivo plus Yervoy provide durable clinical benefit in patients with dMMR or MSI-H metastatic colorectal cancer.

The data showed statistically significant and clinically meaningful improvements in key patient reported outcomes, including symptoms, functioning and quality of life.

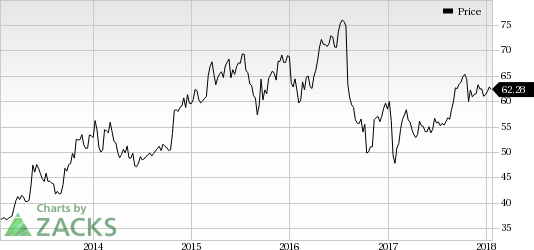

Bristol-Myers’ shares have rallied 24.5% in the past one year compared with the industry gain of 23.9%.

We note that Opdivo is already approved for a number of indications. These include classical Hodgkin lymphoma, recurrent or metastatic squamous cell carcinoma of the head and neck (SCCHN) with disease progression on or after platinum-based therapy. Additionally, it is approved as a monotherapy for the treatment of SCCHN in adults progressing on or after platinum-based therapy.

Opdivo is also approved for intravenous use for patients with hepatocellular carcinoma, who have been previously treated with Nexavar. The drug received approval for liver and colorectal cancers as well.

Meanwhile, the company continues to evaluate Opdivo alone or in combination therapies with Yervoy and other anti-cancer agents. Label expansion of the drug into additional indications would give the product an access to a higher patient population and increase the its commercial potential significantly.

However, Opdivo is facing competitive challenges in the United States. With the FDA approving Merck’s (NYSE:MRK) Keytruda, for the first-line treatment of metastatic non-squamous non-small cell lung cancer (NSCLC), the company is expected to suffer further loss of market share.

Zacks Rank & Stocks to Consider

Bristol-Myers carries a Zacks Rank #3 (Hold).

A few better-ranked stocks from the health care space are Exelixis, Inc. (NASDAQ:EXEL) and XOMA Corporation (NASDAQ:XOMA) . While XOMA sports a Zacks Rank #1 (Strong Buy), Exelixis carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Exelixis’ earnings per share estimates have moved up from 72 cents to 73 cents for 2018 in the last 60 days. The company delivered a positive earnings surprise in all the last four quarters, with an average of 572.92%. Share price of the company surged 53.1% in 2017.

XOMA’s loss per share estimates have narrowed from 99 cents to 42 cents for 2018 in the last 60 days. The company posted a positive earnings surprise in one of the last four quarters, with an average beat of 47.92%. Share price of the company skyrocketed 656.3% in 2017.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

XOMA Corporation (XOMA): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Original post

Zacks Investment Research