Bristol-Myers Squibb Company (NYSE:BMY) announced that a phase III study, CheckMate-238, evaluating Opdivo 3 mg/kg versus Yervoy 10 mg/kg met its primary endpoint at a planned interim analysis. The study evaluated patients with stage IIIb/c or stage IV melanoma who are at high risk of recurrence following complete surgical resection.

The trial randomized 906 patients to receive either Opdivo 3 mg/kg intravenously every two weeks or Yervoy 10 mg/kg IV every three weeks for four doses and then every 12 weeks until documented disease progression or unacceptable toxicity, up to maximum treatment duration of one year. The results from the study showed superior recurrence-free survival (RFS) in patients receiving Opdivo compared to Yervoy.

The data from the study will be presented at an upcoming medical conference.

We note that Opdivo became the first PD-1 inhibitor to be approved for a hematological malignancy – classic Hodgkin lymphoma in both the U.S. (May 2016) and the EU (Nov 2016). In Nov 2016, Opdivo gained the FDA approval for the treatment of patients with recurrent or metastatic squamous cell carcinoma of the head and neck with disease progression on or after platinum-based therapy.

Label expansion into additional indications would give the product access to a higher patient population and increase the commercial potential of the drug.

The company entered into a collaboration agreement with Seattle Genetics, Inc. (NASDAQ:SGEN) . Per the deal, Bristol-Myers will evaluate the combination of Opdivo and Seattle Genetics’ antibody drug conjugate (ADC) Adcetris in a phase III trial as a potential treatment option for patients with relapsed/refractory or transplant-ineligible advanced classical Hodgkin lymphoma (HL). The trial will being in mid-2017.

However, the company suffered a setback in Jan 2017 when it decided not to pursue the accelerated regulatory pathway for the regimen of Opdivo plus Yervoy in first-line lung cancer in the U.S. based on a review of available data.

Opdivo is facing competitive challenges in the U.S. With the FDA approving Merck’s (NYSE:MRK) Keytruda, for the first-line treatment of metastatic nonsquamous NSCLC, the company is expected to suffer further loss of market share.

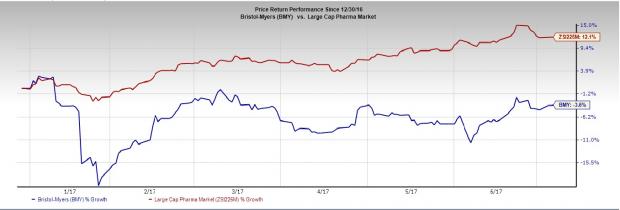

While Bristol-Myers’ share price has decreased 3.6% in the year-to-date, the Zacks classified Large Cap Pharmaceuticals industry gained 12.1%.

Zacks Rank& Key Pick

Bristol-Myers currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in healthcare sector is Bayer (DE:BAYGN) AG (OTC:BAYRY) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bayer’s earnings per share estimates have inched up from $8.85 to $8.93 for 2017 and from $9.53 to $9.61 for 2018, over the last 30 days. The company has delivered positive earnings surprises in three of the four trailing quarters with an average beat of 10.25%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2%, respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Bayer AG (BAYRY): Free Stock Analysis Report

Seattle Genetics, Inc. (SGEN): Free Stock Analysis Report

Original post

Zacks Investment Research