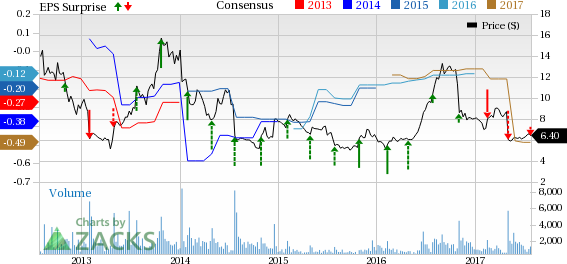

Brightcove Inc. (NASDAQ:BCOV) reported mixed second-quarter fiscal 2017 results wherein the bottom line missed the Zacks Consensus Estimate by a penny but the top line exceeded the same.

Adjusted loss (excluding all other one-time items but including stock-based compensation) of 20 cents per share was wider than the Zacks Consensus Estimate of a loss of 19 cents. On a year-on-year basis, this was also higher than the adjusted loss of 5 cents in the second-quarter 2016.

On a non-GAAP basis, Brightcove reported diluted net loss of 16 cents per share, compared with the loss of a penny in the year-ago period.

However, revenues increased 4.9% from the year-ago quarter to $38.8 million, which outpaced the Zacks Consensus Estimate of $37.2 million.

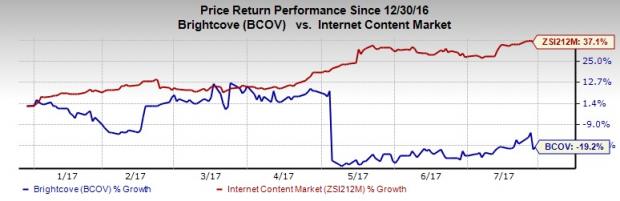

We note that Brightcove shares have fallen 19.2% so far this year, substantially outperforming the industry’s rally of 37.1%.

Quarter Details

The company’s Professional services and other revenue increased 71.5% year over year to $3.2 million in second-quarter 2017, attributable to several large over-the-top content (OTT) projects.

Subscription and support revenue of $35.5 million was up slightly compared with $35.1 million in the year-ago period.

Operational Details

Non-GAAP gross profit for second-quarter 2017 was $22.8 million, down from $24.1 million reported in the year-ago period.

The company’s non-GAAP operating loss was $5.5 million, compared with $302,000 reported year over year for second-quarter 2016.

Balance Sheet & Cash Flow

Brightcove exited the quarter with cash and cash equivalents of $28.4 million, compared with $29.2 million as of the previous quarter ended Mar 31, 2017.

Cash flow used in operations was $119,000 for second-quarter 2017, compared with cash flow from operations of $2 million in the year-ago quarter.

Guidance

The company provided guidance for third-quarter fiscal 2017.

Brightcove expects revenue to be in the range of $37.5–$38.5 million.

On a non-GAAP basis, the company anticipates to report diluted net loss in a range of 10–11 cents per share. This figure excludes stock-based compensation of approximately $1.7 million and amortization of acquired intangible assets of approximately $700,000.

Zacks Rank & Stocks to Consider

Currently, Brightcove carries a Zacks Rank #3 (Hold). Better-ranked stocks in the broader sector include Applied Optoelectronics, Inc. (NASDAQ:AAOI) , Kemet Corp. (NYSE:KEM) and IPG Photonics Corp. (NASDAQ:IPGP) . Applied Optoelectronics and Kemet both sport a Zacks Rank #1 (Strong Buy) while IPG Photonics carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank Stocks here.

In the trailing four quarters, Applied Optoelectronics, Kemet and IPG Photonics have yielded positive average earnings surprises of 118.33%, 72.92% and 6.12%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Brightcove Inc. (BCOV): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Kemet Corporation (KEM): Free Stock Analysis Report

IPG Photonics Corporation (IPGP): Free Stock Analysis Report

Original post

Zacks Investment Research