Gold is money. Gold is a reserve currency for most central banks. Central banks continue to add gold to their reserves and the pace of their buying is clearly peppy.

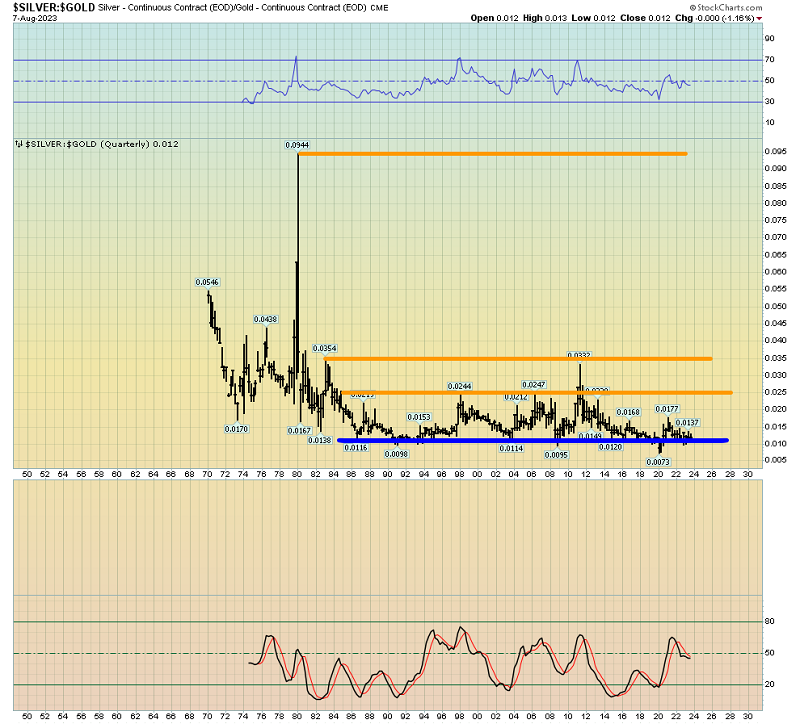

Silver should also be money, and technically it is, but it’s no longer a main central bank reserve asset.

This is one of the main reasons that the silver versus gold ratio hasn’t taken out the 1980 highs. The other reason is of course a lack of inflation.

August 22 is the next BRICS meet, and it will likely mark a significant low for the price of both gold and silver versus American fiat money.

While I’ve urged all gold bugs to be sceptical about an imminent launch of a BRICS gold-backed currency, a major expansion of the BRICS members is highly likely to happen at this meeting. There are also likely to be strongly worded statements of concern about the ongoing actions of the US government that are de facto bullying.

That means de-dollarization is set for fresh impetus.

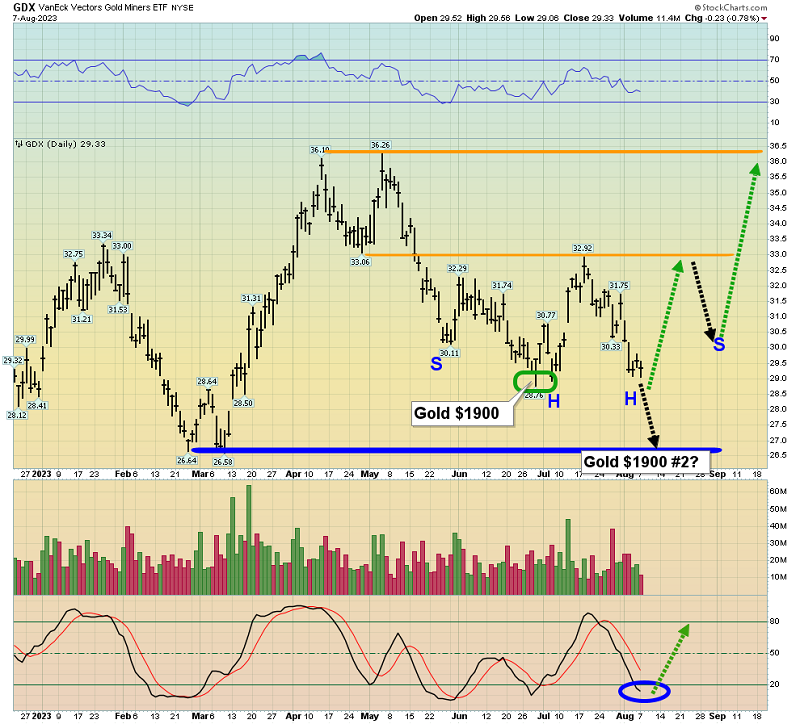

Could gold make a key low before August 22? In the crude oil chart, note the double-headed inverse H&S base pattern that’s now in play.

The August 10 US CPI report (this Thursday) could be the catalyst that sends gold shooting higher from the current right shoulder low but…

If the CPI report is a dud for gold, it’s highly likely that gold mimics oil and puts in a second head of its inverse H&S pattern. That second head would almost certainly coincide with the BRICS meeting on August 22. From there, a massive rally to $1980 and then to $2080 would be the next order of gold bug business and celebration.

All gold bug eyes should be on the US CPI, the BRICS meet, and the 4.33% high for the US government's ten-year bond yields.

Note that when the ten-year yield was last at 4.33%, gold was near $1600. Now gold is $1930 with yields at almost that same high. This is a tremendous display of strength for the world’s mightiest metal and ultimate currency.

The 2021-2025 war cycle? While US citizens have built a real economic empire, I’ve argued that the US government looks more like a mafia than an empire. The government brags endlessly about itself and its “mightiness”, yet it’s failed to win any recent war except its illegal bully war against the tiny forces of Panama.

The government’s current scheme is to financially ruin the citizens of Russia so they will engage in civil war. This has already turned into yet another debt-oriented fiasco for America, and Ukraine is a de facto wasteland.

With the Ukraine failure becoming obvious to even the silliest US citizens, the government mafia needs a new war, and fast, to keep the citizens in war worship mode. Maybe Niger fits the bill; most US citizens don’t know anything about it, and it’s a softer target than Russia.

The bottom line: Whatever nation is chosen for US government “Madmaxification” next is unknown, but it’s obvious that one will be chosen…so it’s critical for all citizens to embrace gold whenever there’s a significant price sale for it, and one is underway right now.

What about the miners (NYSE:GDX)? There are some basic “rules of the gold bull era road” for mining stock investors to follow. First and foremost is to hold enough fiat to remain emotionally stable and weather gold stock dips like this one.

The US Dollar rally from the big 100 number buy zone continues, but it’s likely to fail as the BRICS meet and the 4.33% ten-year yield become resistant. Regardless, it’s prudent to hold significant fiat cash as long as what an investor buys is priced in that fiat.

A second investor rule is this: when placing actual buys for gold stocks, it’s mostly gold bullion price action that matters. Note that as gold arrived at my $1900 buy zone in late June, GDX was trading at about $29-$30. I suggested then that investors should focus on buying gold bullion ETFs and physical gold rather than the miners there. Now GDX is back at its $29-$30 lows, yet gold is $1930, well above the $1893 low of late June.

A second arrival of gold in the $1900 buy zone around this week’s CPI report and/or August 22 BRICS meet could see GDX hold its ground, but it’s much more likely that it trades near the $26.50 low.

If gold does trade at $1900 again, this time I will be an eager mine stock buyer, and I would expect a significant rally from $26.50 for GDX and most individual miners should have very big rallies too. If the ten-year yield is capped at around 4.33% again, and it likely will be, Oct 31 Halloween candy handouts could include some very sweet $2080 gold.