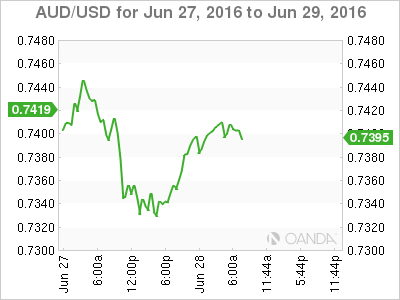

The Australian dollar has posted gains on Tuesday, reversing directions after losses in the Monday session. AUD/USD is trading at the 0.74 line.

On the release front, the US will release two key indicators – Final GDP and CB Consumer Confidence. There is one minor Australian event on the schedule, HIA New Home Sales.

With the aftershocks of the Brexit vote continuing to reverberate in Britain and Europe, political leaders must now pick up the pieces and deal with the radical new landscape, which was unthinkable just a few months ago – that of a European Union without Britain.

The historic decision raises many questions and has resulted in political and financial instability in Europe and the UK, and wiped out a staggering $3 trillion from global stock markets. The British pound has tumbled about 11 percent since the vote, and other currencies and gold have also recorded sharp volatility.

Chancellor of the Exchequer George Osborne and Bank of England Governor Mark Charney have sought to reassure the markets and the public that the situation is under control, but is it? The political picture is fluid, with Prime Minister Cameron resigning, the Labor Party in turmoil, and general elections likely later in the year.

On the financial front, the pound and the markets have taken a beating, and London’s position as a world financial center has been shaken. The uncertainty is not going to disappear anytime soon, so traders should be prepared for further volatility in the currency markets.

British Prime Minister Cameron will meet his EU colleagues in Brussels for a 2-day summit, and already there are signs that this divorce between Britain and the EU could be rancorous and messy. Cameron said on Monday that his successor would be the one to initiate the exit mechanism, and other British politicians have said there is no rush to leave.

However, European lawmakers, furious with the decision, have called on Britain to leave as soon as possible. Britain may have voted “Leave”, but clearly the timing and the type of exit plan remain unclear. The future framework of political and economic relations between the UK and the continent will have to be negotiated, and we will see plenty of uncertainty and perhaps fireworks in the coming months.

Overshadowed by Brexit, the US wrapped up last week with soft manufacturing and consumer confidence numbers. Core Durable Goods Orders came in at -0.3%, marking the third decline in the past four months. This figure was well short of the forecast of +0.1%. There was no relief from Durable Goods Orders, which posted a sharp drop of 2.2%, compared to forecast of a 0.5% decline.

The UoM Consumer Sentiment report also missed expectations, with a reading of 93.5 points. The markets had expected a reading of 94.2 points. Next up is Final GDP later on Tuesday, and the strength of the release could have major implications regarding a rate move during the second half of 2016.

AUD/USD Fundamentals

Tuesday (June 28)

- 8:30 US Final GDP. Estimate 1.0%

- 19:00 US S&P/CS Composite-20 HPI. Estimate 5.5%

- 10:00 US CB Consumer Confidence. Estimate 93.2

- 10:00 US Richmond Manufacturing Index. Estimate 2 points

- 19:00 FOMC Member Jerome Powell Speaks

- 21:00 Australian HIA New Home Sales

*Key releases are highlighted in bold

*All release times are EDT

AUD/USD for Tuesday, June 28, 2016

AUD/USD June 28 at 6:40 EDT

Open: 0.7355 Low: 0.7346 High: 0.7415 Close: 0.7405

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7160 | 0.7251 | 0.7339 | 0.7472 | 0.7612 | 0.7739 |

- AUD/USD posted slight gains in the Asian session and has been flat in the European session

- There is resistance at 0.7472

- 0.7339 is providing support

- Current range: 0.7339 to 0.7472

Further levels in both directions:

- Below: 0.7339, 0.7251 and 0.7160

- Above: 0.7472, 0.7612, 0.7739 and 0.7835

OANDA’s Open Positions Ratio

AUD/USD ratio is showing slight gains in long positions on Tuesday, reversing the movement seen on Monday. Long positions have a majority (57%), indicative of trader bias towards AUD/USD continuing to move to higher levels.