Forex News and Events

Traders should be mindful of the tightness of the vote and the non-linear scenarios (by Peter Rosenstreich)

After what seemed to be an endless wait the UK referendum on EU membership is finally here. And we are giddy with anticipation. The financial market rarely finds itself in such a monumental binary event. While we still believe the vote outcome is a coin toss, markets are indicating that the “remain” camp has the upper hand.

GBP/USD has reached a 1.4844, 6-month high, while oddsmakers are indicating a 76% probability of a “remain” vote. Even GBP short-term volatility has fallen significantly from the highs, making the decision to put on protection at any cost, look nonsensical. We expect market volatility to continue to contract and price action to consolidate until 20:00bst.

This could be considered as the witching hour as afterwards rumors, hearsay, and news will cause excessive volatility generating illiquid condition and price dislocation. We advise clients to trade extremely carefully. One of the earlier constituencies to declare a result should be Sunderland, which is viewed as bellwether.

Should Sunderland result in a close result or plain majority vote to “remain”, then it is assumed that a “remain” vote will triumph. By 05:00bst, 80% of authorities are expected to have made declarations providing a clearer view of the outcome.

However, this is all too neat-and-tidy in our minds. We need to imagine other narratives since we do not see this as a linear process, despite our attempts to make it orderly. There could be controversy in the polling process, just remember the Florida “hanging chads” in the 2000 presidential election.

Also, there are plenty of historical precedents that indicate that a referendum is not legally bidding. US congress rejected TARP, during the financial crisis, only to pass it with 90% a few days later. Similarly, the Greek and Ukraine referendums democratically passed by the people were completely ignored. We cannot rule this type of narrative out, so as you trade, the tightness of the vote and nonlinear aspect needs to be considered.

With this in mind our initial trade on a “Brexit” result is nothing revolutionary, but selling GBP and EUR and buying traditional safe haven trades USD, JPY and CHF (reverse trades in case of a “remain” outcome). Second tier trades should be focused on selling currencies with significant exposure to trade with both nations as we anticipate a contraction in growth due to immediate uncertainties.

This puts NOK, PLN and SEK at risk. In this current scenario, we doubt that counter factors such as safe-haven status and correlation to oil prices will protect SEK and NOK from an immediate sell-off.

Finally, we are focused on global risk sensitivity, high beta currencies where MXN, TRY and ZAR look to be the most vulnerable to a risk-off result. As for rates, with Germany below zero investors will favor US treasuries, chasing higher nominal yields at the long end of the US curves, flattening the yield curves and providing feedback into USD higher.

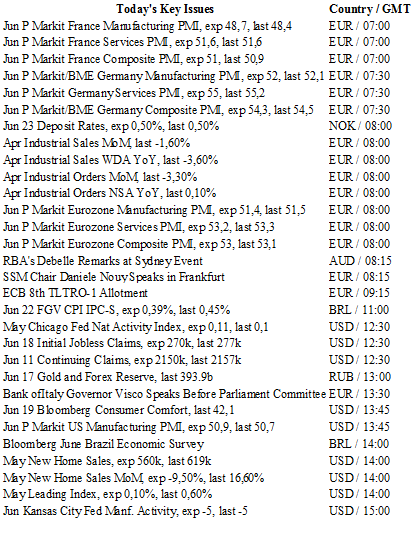

Norway: Deposit rates kept on hold at 0.5% (by Yann Quelenn)

With today being D-Day and all eyes on Brexit, Norway’s rates decision was not exactly heavily anticipated. Financial markets had already priced in the fact that Norges Bank would keep its rate unchanged at 0.5%.

Indeed, under global uncertainties on the European Union, we believe that Norges Bank is waiting for the Brexit results before adjusting its monetary policy. The Brexit vote is really a toss-up and consequences may still be hard to assess for both outcomes.

However, we believe that a reaction of the Norwegian Central Bank after the Brexit referendum results is definitely possible and that this will also take into account the fact that the rebound in oil prices has faded but also that a barrel of Brent remains around $50.

The fact that the oil price is stalling at this level has reduced the demand for NOK. Yet, we still expect that global demand for the black commodity should match the ongoing supply and consequently that global demand should continue to increase. We therefore think that policymakers will lower interest rates to anticipate the increasing demand for NOK in the medium-term.

Moreover, it seems clear to us that the general environment of low and negative interest rates is pushing policymakers to adjust as the result could mean massive inflows of money which would strongly appreciate the currency.

The price stability threat is also of serious concern in Norway. Inflation is still very strong. The latest May inflation figures came in earlier this month above expectations at 3.3% - still above the central bank’s inflation target of 2.5%. Norway, like many countries, is on hold but ready to react.

Crude Oil - Strong Selling Pressures Area.

The Risk Today

Yann Quelenn

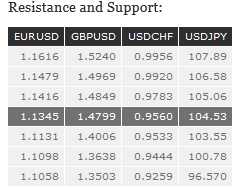

EUR/USD is trading higher. Hourly resistance can be found at 1.1416 (09/06/2016 high). Hourly support is located at 1.1237 (22/06/2016 low). Expected to further monitor symmetrical triangle. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD has reached resistance at 1.4849 (30/12/2015 high) before falling back. Yet, it confirms that buying pressures are important. Hourly support is located at 1.4731 (intraday low). Strong support is located at 1.4013 (16/06/2016 lower. Expected to further increase. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is still consolidating after the recent strengthening move. Yet, selling pressures seem still significant. As a result, the technical structure continues to favour a second leg lower. Monitor the test of the hourly support at 103.55 (16/06/2016 low). An hourly resistance stands at 105.06 (21/06/2016 high). The medium term momentum is clearly oriented downwards. Expected to continue weakening. We favour a long-term bearish bias. Support is now given at 103.56 (28/08/2014 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now very unlikely. Expected to monitor support at 103.56.

USD/CHF's volatility is weakening. The pair keeps on declining within the downtrend channel. Hourly support is given at 0.9533 (intraday low). Expected to show growing selling pressures. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.