As anticipated Monday, we’ve already spilled plenty of digital ink on this week’s Brexit developments, but the hits just keep coming!

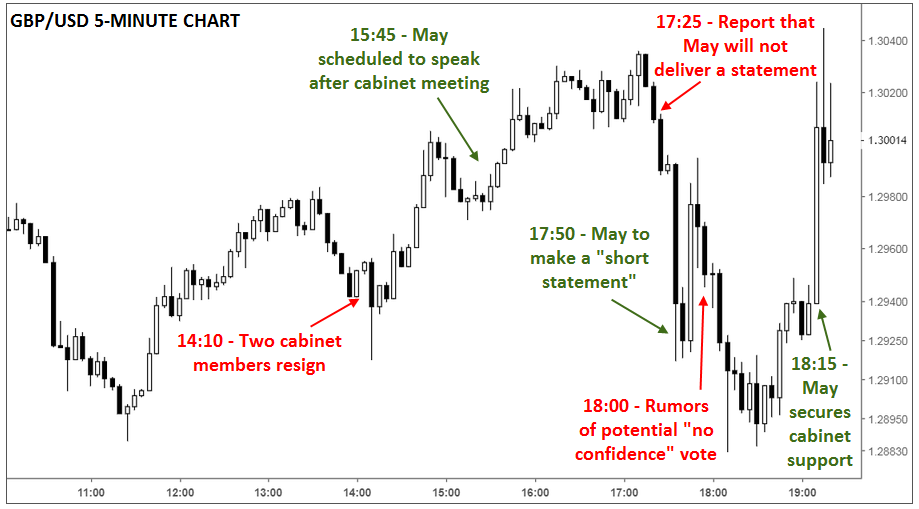

The following is a brief (approximate) timeline of the headlines out of Wednesday’s roller-coaster of a cabinet meeting at 10 Downing Street [market comments in brackets]:

- 14:10 GMT: Cabinet members Mordaunt and McVey to resign [GBP/USD dropped to the low-1.2900s on fears of a mass exodus]

- 15:45 GMT: PM May scheduled to speak outside 10 Downing Street at 17:00 GMT [this was cheered by the market, as it suggested that the cabinet had agreed to bring the proposed deal to Parliament]

- 16:45 GMT: Cabinet meeting overrunning – not expected to finish until 18:00 or 19:00GMT [no major reaction in markets as hopes of an agreement remained intact]

- 17:25 GMT: Reuters reports May will not deliver a Brexit statement [GBP/USD falls sharply off its daily highs, shedding 100 pips in less than 30 minutes]

- 17:50 GMT: May to make a “short statement” after the cabinet meeting [GBP/USD spikes 75 pips in 10 minutes]

- 18:00 GMT: Rumors hit that letters of no confidence in May are being submitted [GBP/USD drops another 100 pips to below 1.2890]

- 18:15 GMT: May apparently secures cabinet support for her Brexit deal [GBP/USD explodes up to 1.3040, a fresh daily high]

Needless to say, any price-based analysis will be old news by the time this is published, but speaking generally, May’s difficulty getting the agreement through her cabinet may be an ominous sign for approval by the broader Parliament. Based on the latest headlines, it seems like disaster has been averted (or at least postponed), but there are still plenty of hurdles to clear.

Source: TradingView, FOREX.com

Cheers