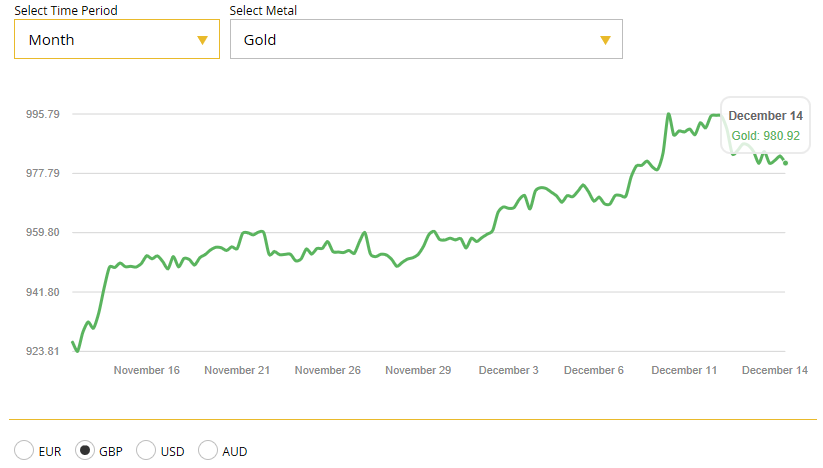

Gold Gain In Euros and Pounds – Nears £1,000/oz & €1,100/oz

Gold was lower today in dollars, but saw slight gains in pounds and euros. It was supported by increasing concerns about the likelihood of a ‘hard’ Brexit, global economic growth and uncertainty around the Fed’s interest rate policies in 2019.

Gold has consolidated on last week’s 2% gains in dollar terms. It is essentially flat in dollars, but has seen gains in euros and pounds today and this week.

Gold is down 0.3 percent for the week in dollars, but has seen gains in not just pounds and euros, but also Australian dollars, New Zealand dollars and other fiat currencies.

Concerns about trade wars have abated in the short term, but the risk has not gone away completely and will support gold.

Other risks will also support gold. These include the fallout from a ‘hard’ or ‘no deal’ Brexit on UK and EU economic growth and indeed increasing concerns of another global financial crisis. This has been warned of by ex Fed Chair Yellen and indeed the IMF this week.

Silver fell 0.6% today to $14.65 per ounce, but is up about 0.4 percent for the week and is building on last week’s 3% gain.

The Fed is expected to hike interest rates next week, which could lead to short term weakness for gold. However, with the Fed likely to pause interest rate hikes in 2019, gold will be supported and should indeed see gains in the medium term and in 2019.

The risk of a recession in the U.S. in the next two years has risen to 40 percent, according to a poll of economists by Reuters. There is also a significant shift in expectations toward fewer Fed interest rate rises next year due to concerns regarding U.S. and global economic growth.

Among other precious metals, spot palladium was down 0.5 percent at $1,254.50 per ounce, having hit an all-time high of $1,269.25 yesterday. Palladium is on track to mark it’s third week of gains with prices up another 2 percent this week.

Gold will be a valuable portfolio diversification in what looks set to be a volatile 2019.

As the business and economic cycle turns, risk assets such as bonds and stocks look increasingly vulnerable. Many property markets globally also appear vulnerable and gold will hedge investors exposures.