Insufficient support for any version of Brexit

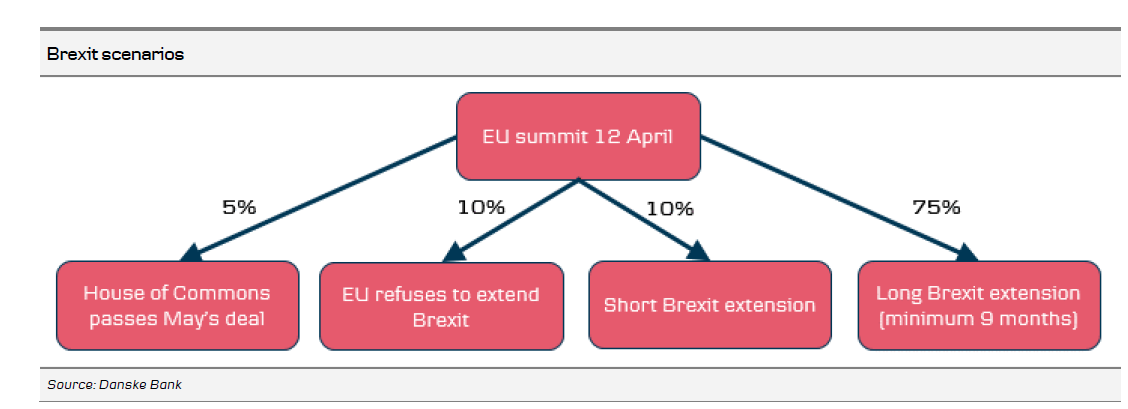

This week is going to be another dramatic week in Brexit land. While PM Theresa May has sent a letter to Donald Tusk asking for an extension to 30 June, we do not think the mood in Brussels is for another short extension. Our base case is the EU will grant the UK a year-long extension with the flexibility to leave earlier if/when the Withdrawal Agreement is passed (75% probability). We assign a 10% probability of a short extension.

While the EU leaders are sick and tired of dealing with Brexit, we think the probability of a no deal Brexit is low but not negligible (10%) . Brexit is also about what is going to be written in the history books. The problem remains, however, that the EU leaders have to take the decision unanimously, and so far the UK has not really come up with a good explanation to why they should be granted an extension at all. Also not all countries are exposed to Brexit to the same extent as the northern European countries, either economically or politically. The EU leaders meet on Wednesday 10 April and the meeting starts at 18:00 CEST.

A big surprise last week was PM Theresa May's intervention, where she finally put country above party by reaching out to Labour leader Jeremy Corbyn in an attempt to strike a cross-party deal . While it may seem puzzling for people living in the Nordic countries that she has not done this before, the political system in the UK is very different from the Nordic system, as there is no tradition of cross-party solutions. Still, May revealed she did not want to be the Prime Minister taking the UK out without a deal with all its many possible negative consequences. The negotiations between May and Corbyn are ongoing but a breakthrough does not look imminent. Even if they reach an agreement, they still need to persuade the backbenchers to vote in favour, which may be easier said than done, as the compromise may involve a permanent customs union. We think the probability of the Withdrawal Agreement passing before 10 April is just 5%.

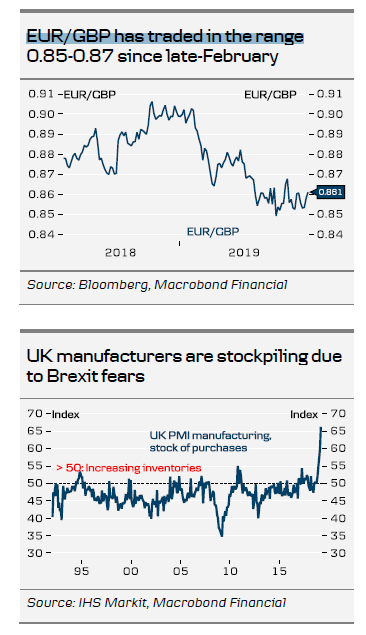

EUR/GBP has traded in the 0.85-0.87 range for some time now and we expect it will continue to do so until we get some clarification over the coming days. Our base case with a long extension would probably be slightly GBP-positive and we could see EUR/GBP trade in the 0.84-0.86 range. In the event of a no deal Brexit, we still expect EUR/GBP to move towards parity. We continue to expect EUR/GBP to move down to 0.83 if the Withdrawal Agreement passes.

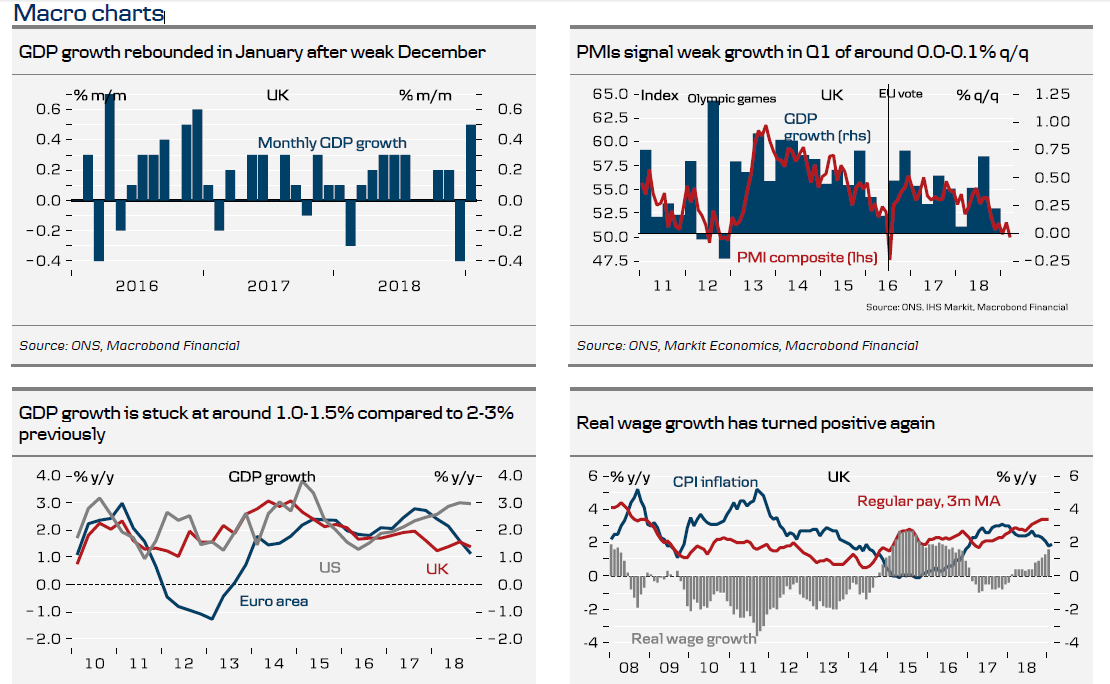

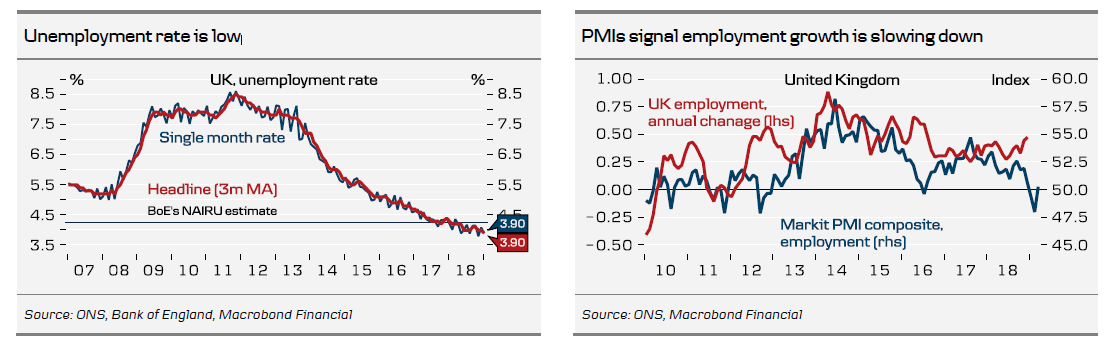

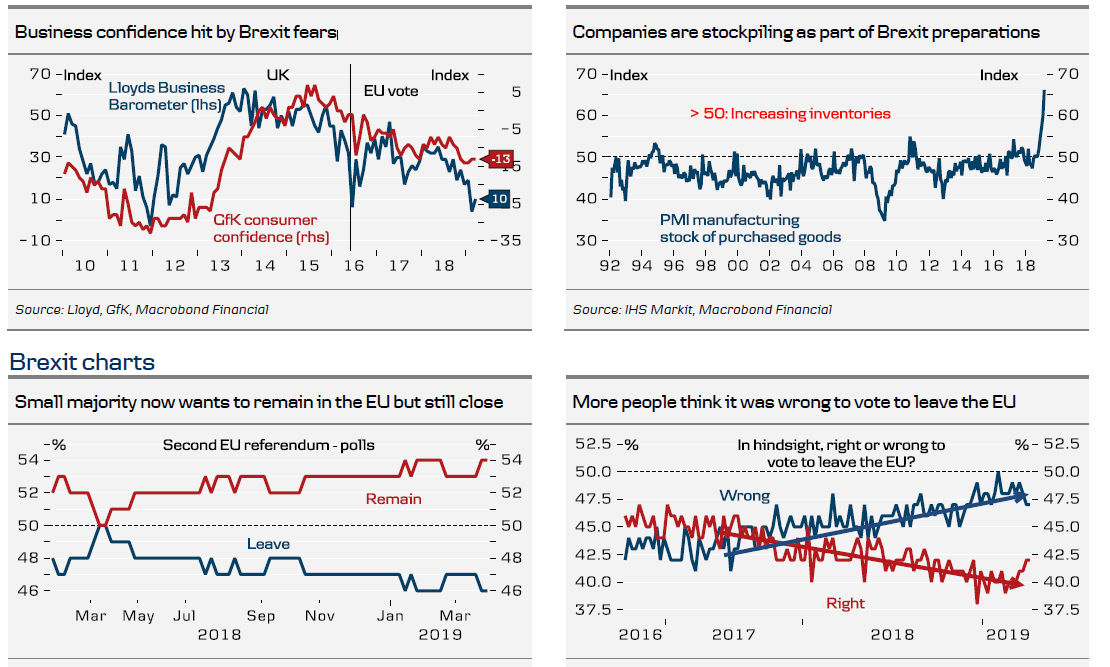

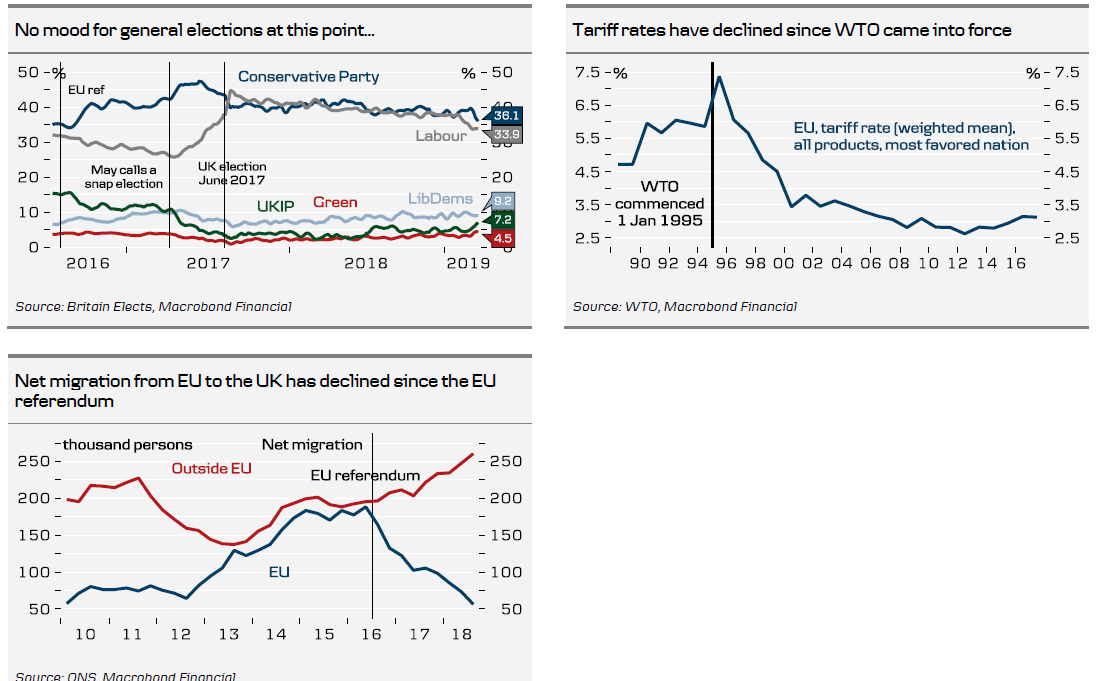

Looking at economic activity in the UK, the PMIs indicate growth around 0.0-0.1% q/q in Q1 . PMI Services dropped below the 50 threshold and is now indicating negative service sector growth. PMI Manufacturing is very high, as manufacturers have been stockpiling ahead of Brexit. This shows up as positive growth but is actually negative, as it is borne out of fear. Both consumer and business confidence indicators remain subdued.