Despite several highly-publicized "failures" of late (financial market flash crashes, unexpected triumphs like Brexit and Trump in political prediction markets), the interaction of buyers and sellers is still the best way to "predict" the future we have.

Unlike pundits and politicians who often have conflicting incentives (building their brand, speaking to their diehard base, promoting books), traders are motivated by one thing: making money. And they only profit if they can correctly anticipate future developments.

That's why, when the social-media outrage over United Airlines (NYSE:UAL) forcefully removing a passenger from a flight erupted yesterday, the first thing I checked was the price chart of UAL stock. While social justice warriors on Facebook (NASDAQ:FB) engaged in a game of one-upmanship, UAL traders were relatively nonplussed and the stock closed higher by nearly 1% on the day.

By no means am I excusing the violent actions of the police involved, but at least from the market's perspective, there was little reason to fear a mass boycott or legal action having a material impact on the massive airline's earnings. Of course, the probability of such an event is constantly evolving (note that UAL was trading down by 3% pre-market). They're far from perfect, but markets still provide the best aggregate prediction model that our species has invented to date.

This brings us to a topic we've been following closely since the US election: the so-called "Trump Trade". Two weeks ago, we asked "Are we at a tipping point for the Trump Trade?." Based on research by Goldman Sachs (NYSE:GS), that tipping point may have come closer to two months ago.

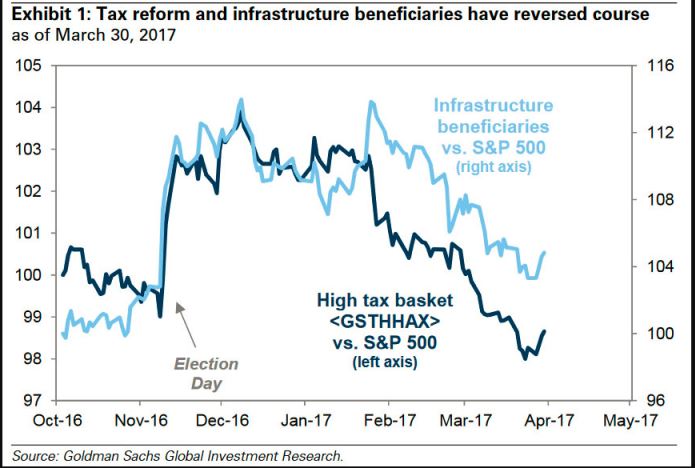

The GS research team assembled proprietary stock indices based on companies expected to benefit from the two pillars of The Donald's fiscal policy: a "phenomenal" tax reform (read cuts) and a massive infrastructure spending bill. As the chart shows, both of these indices have been trending lower since at least early February:

Source: Goldman Sachs Global Investment Research

Marginal Performance

Looking at the chart, we can see that companies with high tax brackets have actually reversed course against the broader market and are now underperforming the overall market since the US election. Companies poised to benefit from infrastructure spending have also been seeing their relative outperformance fade and are only up marginally more than the market since November 8.

Like the UAL fiasco, the market's evaluation of the future is constantly changing, but for now, it's clear that traders are growing increasingly skeptical about the scale and timeframe of the president's fiscal bonanza.