Are you going to grab a couple beers with your buddies today? Well when you do, keep in mind that Boston Beer Company Inc (NYSE:SAM), the brewer of American classic Sam Adams beer, isn’t as strong as it used to be.

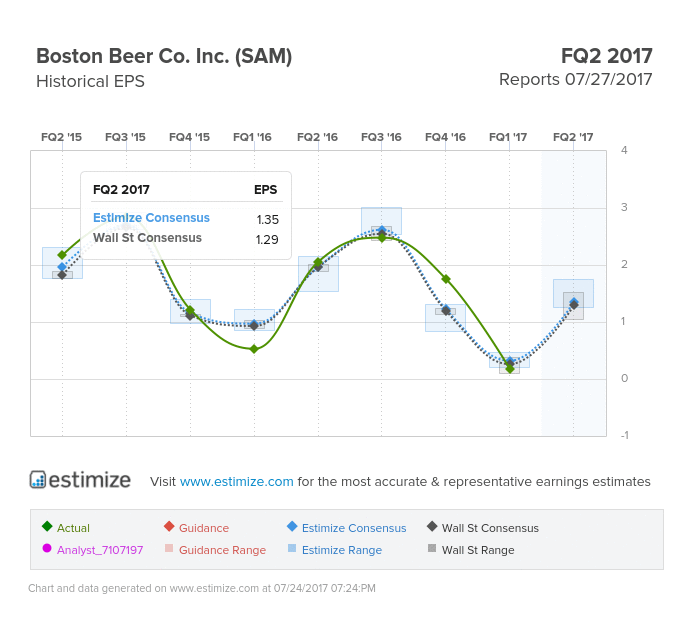

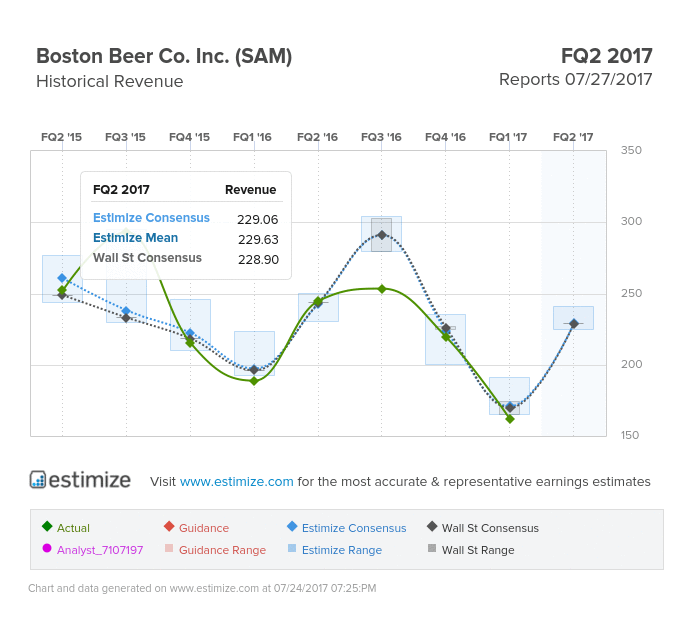

Our Estimize consensus comes in at $1.36 per share, edging out Wall Street’s $1.29 by just above 5%. Meanwhile, revenue estimates are nearly identical with Estimize projecting $229.06M and Wall Street coming in at $228.90M. However, these numbers don’t paint the whole picture: EPS is expected to decrease 37% over the same quarter last year. Revenue is falling as well, with a still-less-than-stellar 7% decrease anticipated. Furthermore, Boston Beer has only beaten Estimize EPS and Revenue in half of all quarters in the last 5 years.

It’s been a busy day for the beer company as Goldman Sachs downgraded its rating to sell from neutral. The stock has responded so far today by falling over 4%. This is largely because overall beer consumption is down in the coveted 21-35 year old demographic. However, while total alcohol sales have remained fairly stable, the young people are switching to wine and liquor. In addition, there is some speculation that an increase in marijuana usage among this age group is contributing to sluggish beer sales.

Enjoy your cold one this weekend, but keep in mind beer companies no longer represent the rock-solid investment of generations past.