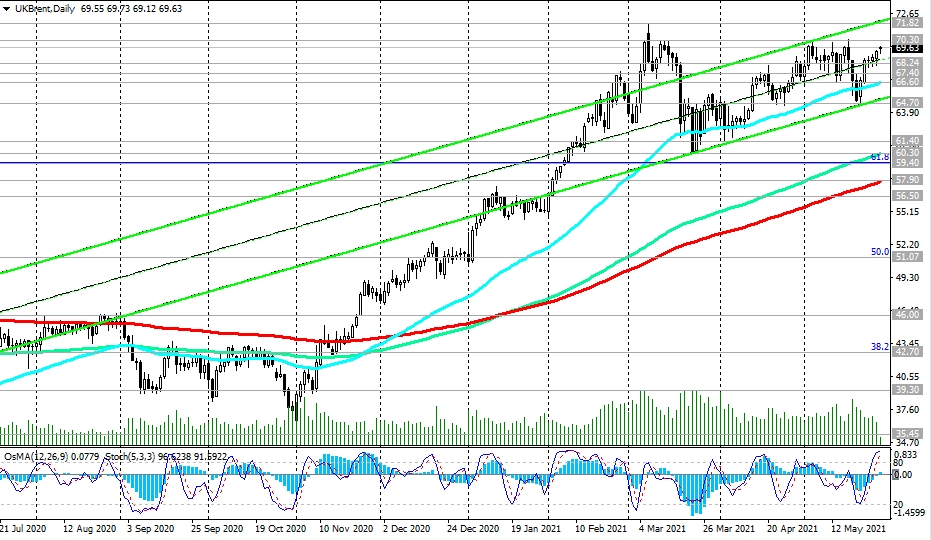

The price of Brent remains in the bull market zone, above the long-term support levels of 56.50, 57.90, 59.40 (Fibonacci level 61.8%) and short-term levels of 68.24, 67.40. A breakdown of the local resistance level of 70.30 will cause further price growth towards the local resistance levels of 71.82, 75.50.

In an alternative scenario and in case of a breakdown of the support level 66.60, the decline may continue to levels 64.70, 61.40 (local minimums), 59.40.

The breakout of the support levels 57.90, 56.50 will strengthen the negative dynamics and the likelihood of a return to the downtrend. The first signal for the implementation of this scenario will be a breakdown of the short-term important support level 68.24.

Support levels: 68.24, 67.40, 66.60, 64.70, 61.40, 60.30, 59.40, 57.90, 56.50

Resistance levels: 70.30, 71.82, 75.50, 86.60

Trading recommendations

Sell Stop 68.20. Stop-Loss 70.35. Take-Profit 67.40, 66.60, 64.70, 61.40, 60.30, 59.40, 57.90, 56.50

Buy Stop 70.35. Stop-Loss 68.20. Take-Profit 71.00, 71.82, 75.50, 86.60