Brent crude oil prices have continued their downward trajectory, reaching 81.14 USD per barrel as of Wednesday. This marks the fifth consecutive session of decline, primarily influenced by significant reductions in US oil inventories.

The latest data from the API indicates a decrease of 3.9 million barrels, surpassing the forecasted reduction of 2.5 million barrels and marking the fourth consecutive week without a correction.

Concurrently, developments in the Middle East are also impacting oil prices. There is emerging optimism regarding ceasefire negotiations between Israel and Hamas, which has helped alleviate some geopolitical pressures on oil prices.

Additionally, concerns about potential disruptions in oil supplies due to forest fires in Canada influence market dynamics, albeit helping to stabilize prices momentarily.

The strength of the US dollar continues to make commodities less attractive, as a stronger dollar typically reduces the purchasing power of other currencies in the commodities market.

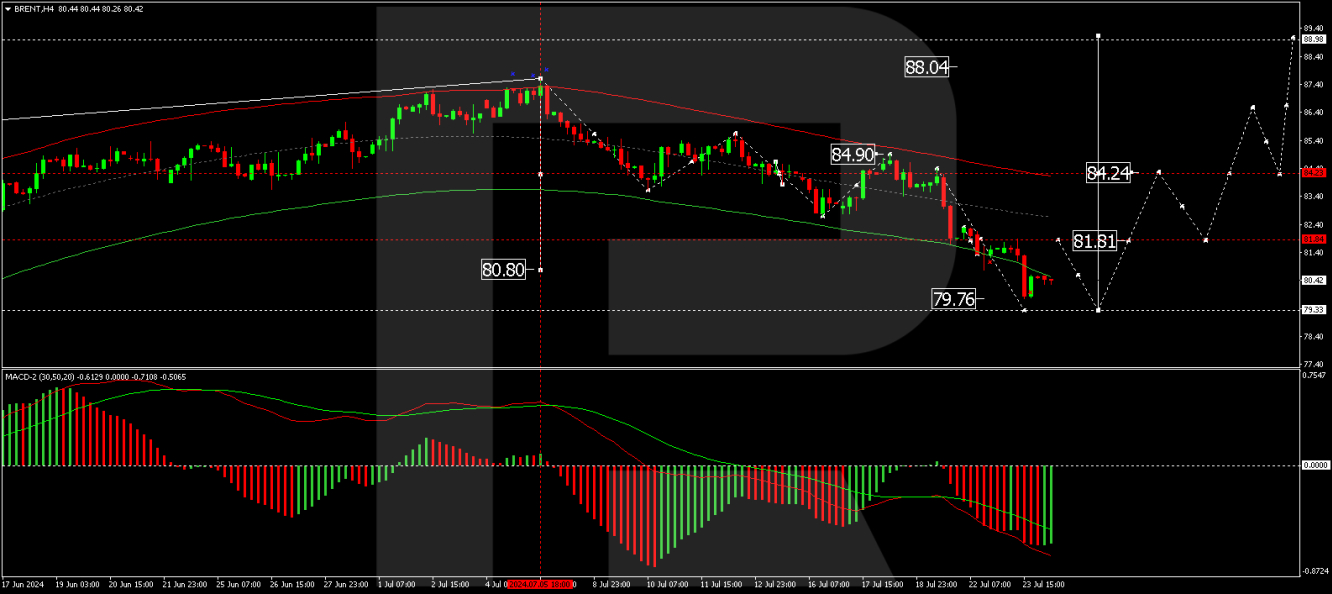

Technical Analysis of Brent

Brent oil is forming a consolidation range around the 80.80 USD level with an extension down to 79.76 USD. A further decline to 79.33 USD may occur. If the price exits this range on the upside, we might see the initiation of a growth wave targeting 84.24 USD.

The MACD indicator supports this scenario, showing potential for new growth as it prepares at the lows.

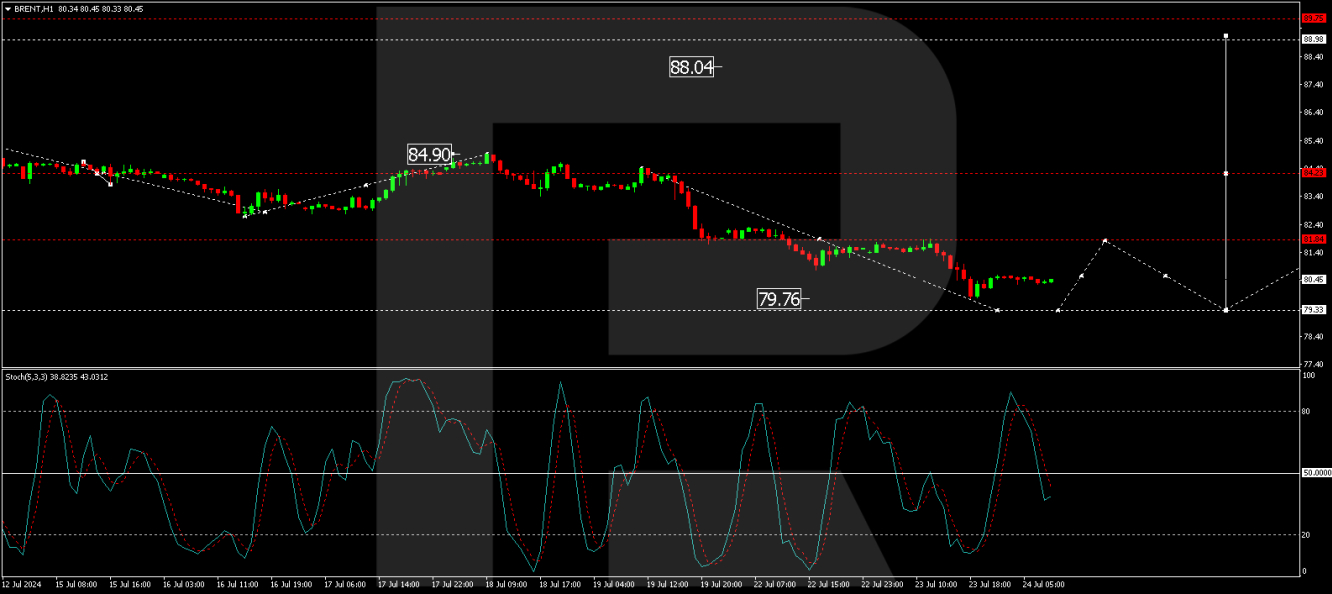

The market has established a consolidation range around the 81.84 USD level. The target level of 79.76 USD has been reached with a downward exit.

We anticipate a new consolidation range forming at these lows, potentially followed by another decline to 79.33 USD. If the price exits the range upward, a rebound to 81.44 USD could occur.

The stochastic oscillator, currently below the 50 level and heading towards 20, supports this potential downward movement.

Investors and market analysts must closely monitor these developments, as any significant changes in US monetary policy or geopolitical events could further influence oil prices.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.