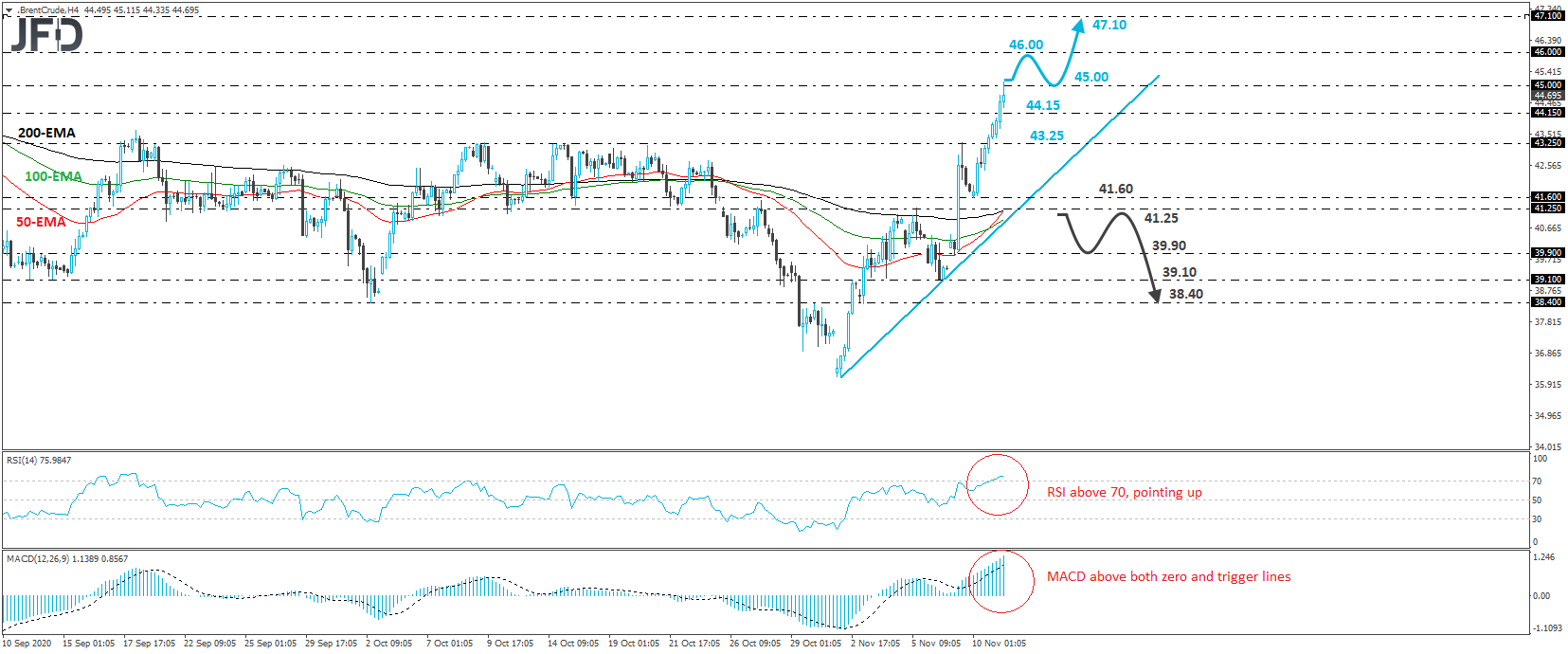

Brent oil traded higher on Wednesday, breaking above the 44.15 barrier, marked by the high of Sept. 4, and hitting resistance slightly above the psychological number of 45.00. Overall, the black liquid has been trading in a rally mode since Monday, while staying above the upside support line drawn from the low of Nov. 2. In our view, this paints a positive near-term picture.

If the bulls are willing to stay in the driver’s seat and manage to push the price above the 45.00 barrier, we could see them targeting the 46.00 area soon, a zone that stopped the price from climbing higher between Aug. 25 and 31. That said, if that territory fails to act as a decent resistance this time and breaks, the rally may get extended towards the 47.10 area, which is marked as a resistance by an intraday swing high formed on Mar. 6.

Turning our gaze to our short-term oscillators, we see that the RSI runs above 70 and points up, while the MACD lies above both its zero and trigger lines, pointing north as well. Both indicators detect strong upside speed and corroborate our view for further advances. Having said that though, due to the overextended nature of the recent rally, we would stay cautious over a possible setback before the next leg north.

Nonetheless, even if we see a corrective setback, we will abandon the bullish case only if we see a drop below 41.25, defined as a support by the inside swing high of Nov. 5. Brent would already be below the aforementioned upside line and the bears may be tempted to push the action towards Monday’s low, at 39.90. If they don’t stop there, the next possible zones to consider as supports are the 39.10 and the 38.40 areas, marked by the lows of November 6th and 3rd respectively.