Brent crude oil has reached $84.94, and the recent upward trend is primarily supported by recent US energy inventory statistics, which showed a significant decrease of 4.87 million barrels against an anticipated decline of 0.8 million barrels.

This marks the longest stretch of inventory reductions since last September, underscoring a robust demand for oil.

Fueling the market optimism further, recent comments from Federal Reserve representatives suggest an imminent rate cut, with a 98% market expectation for this to occur in September. Lower interest rates typically stimulate economic activity, thereby boosting demand for oil.

Geopolitical tensions also play a role in the current price dynamics. Reports of renewed attacks by Hussite forces on vessels in the Red Sea have raised concerns about potential disruptions in oil supplies, prompting the market to add a risk premium to oil prices.

Brent Technical Analysis

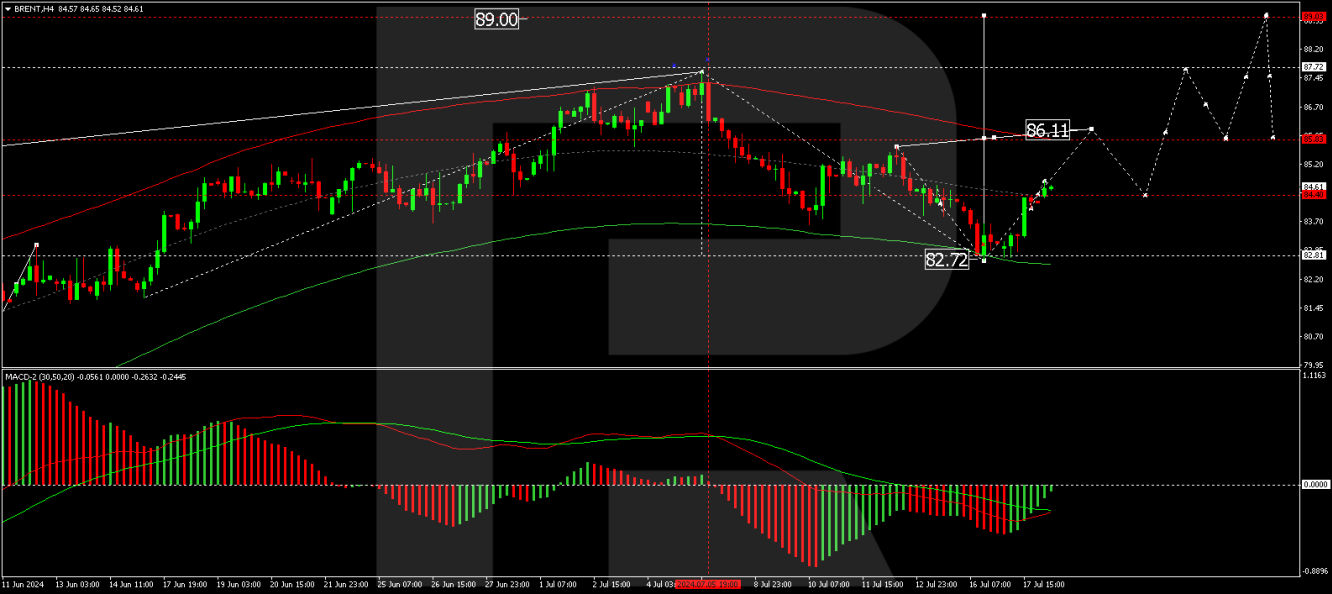

The market has shown a growth wave, reaching 84.42. A consolidation range has been established around this level.

If the market breaks above this range, we anticipate a move towards 86.10, which is the immediate target.

After reaching this target, a retest of 84.42 could occur, potentially setting the stage for further growth towards 87.70 and possibly extending to 90.00.

The MACD indicator supports this bullish outlook, indicating an upward trajectory from below the zero mark.

The market has found support at 84.42 and is progressing through a growth phase with an expected target of 86.10.

We anticipate this target will be reached shortly, followed by a correction phase returning to 84.42. This view is supported by the Stochastic oscillator, which is nearing the 80 level, suggesting a potential pullback after the target is met.

Investors and traders should closely monitor these levels and the broader market context, including geopolitical developments and further signals from the Federal Reserve, as these factors will likely influence Brent's price movements in the near term.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.