Brent crude oil prices have declined to 71.65 US Dollar per barrel as the commodity market remains tense ahead of this week’s postponed OPEC+ meeting, now rescheduled for Thursday, 6 December.

The market is concerned about the direction of future global oil supply amid fears of oversaturation. The prevailing expectation is that OPEC+ might delay its planned increase in oil supply for the third time, reflecting persistent supply uncertainties.

Despite these pressures, there are optimistic signals from the oil sector, particularly China, where a resurgence in production activity is seen as a sign of gradual economic improvement in one of the world’s largest importers of raw materials. This development could bolster the energy sector.

The geopolitical landscape remains mixed, with traders closely monitoring tensions in the Middle East. Any escalation could heighten regional instability and affect the overall oil supply dynamics in these areas.

So far, the recent strengthening of the US dollar has not significantly impacted oil prices. However, future market dynamics could shift as global economic conditions evolve.

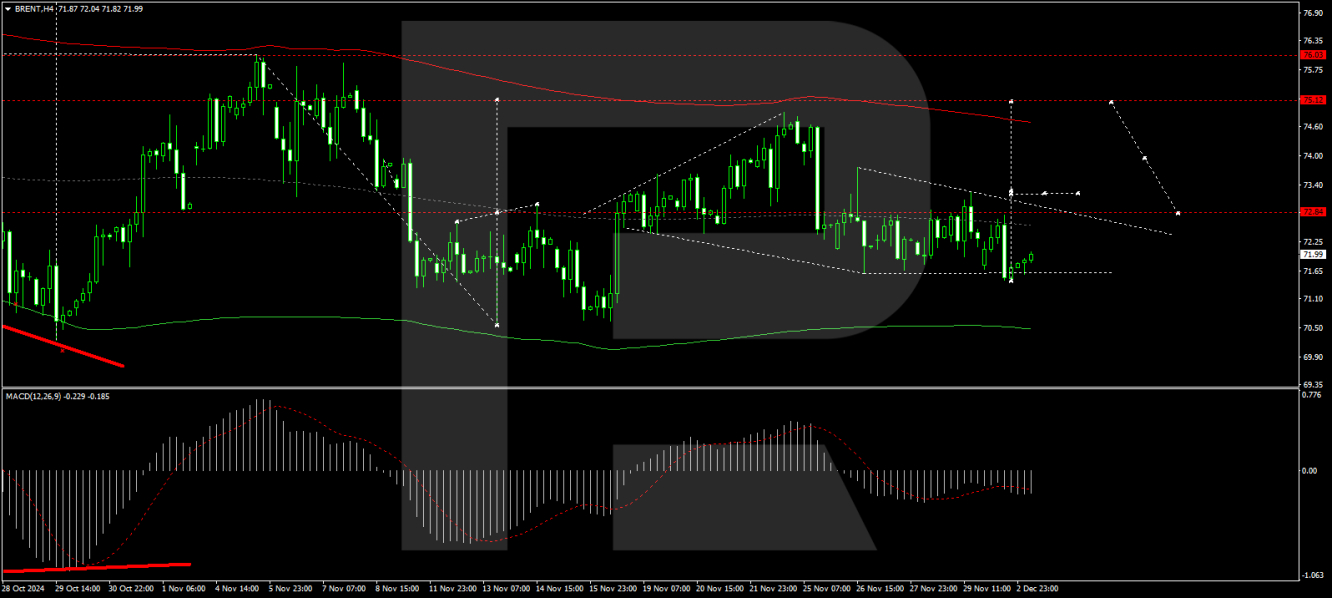

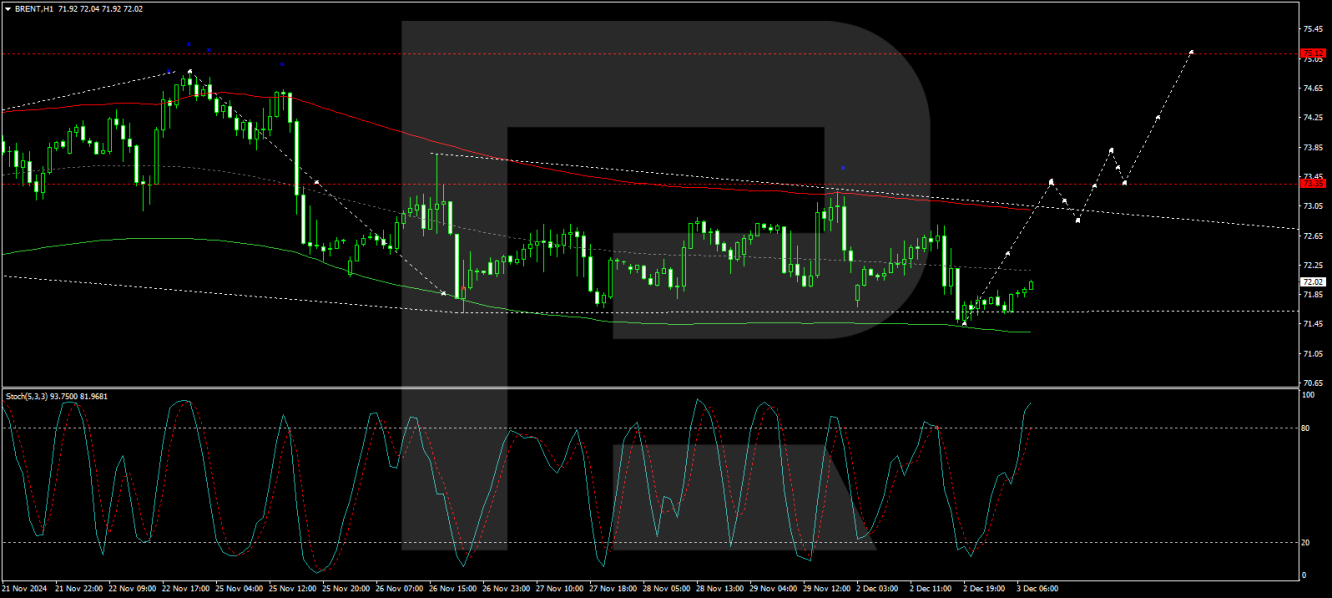

Technical analysis of Brent Oil

H4 chart: the market is navigating a broad consolidation range centred around the 73.33 level, with recent extensions downward to 71.55. An upward movement towards 73.33 is anticipated today. Should the price exit this range on the higher side, there may be potential for a growth wave targeting 75.15, potentially extending up to 80.00. The MACD indicator supports the bullish Brent outlook, with its signal line below zero but pointing upwards.

H1 chart: Brent has found support at 71.55, initiating a growth wave towards 73.33. Upon reaching this level, a compact consolidation range might form. A breakout above this range could lead to a rise towards 75.15. This potential growth trajectory is corroborated by the Stochastic oscillator, with its signal line currently above 50 and trending towards 80.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.