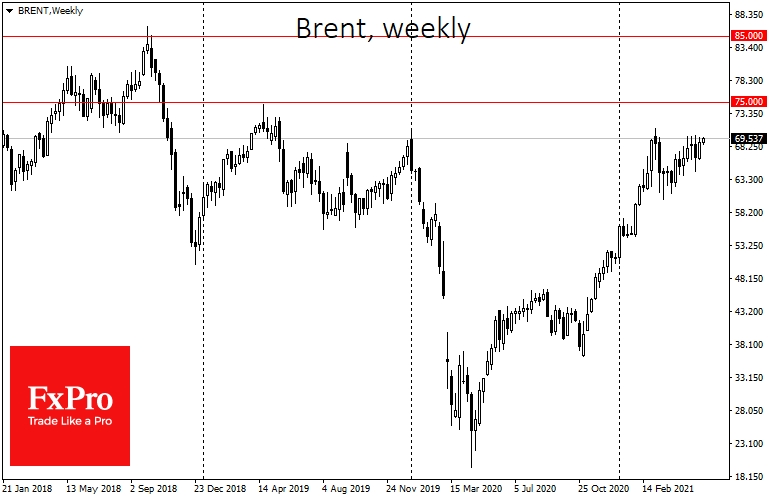

The oil market maintains upward momentum despite apparent caution by players around the two-year highs. Brent is trading at $69.50, the area of this year's peaks. Two years ago, in 2019, it failed to stay above $70 for long. So, this area acts as an important breaking point whose impact goes beyond the pandemic.

This week the bulls will likely try to storm this psychologically important level and the significant resistance of recent years. And in our view, the chances of a sustained rally above $70/bbl. Brent is now much higher.

In recent years, the dynamics of oil are more a story of trying to find a supply balance at the global level. The expanded OPEC+ since 2014 has agreed to cut its production and revenues for the sake of price stability. America, in contrast, has used the situation to build up its share of the energy market until 2020. However, that seems to have changed.

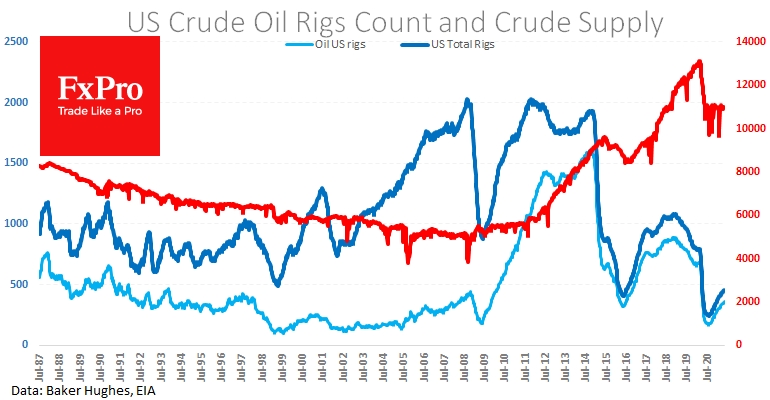

Last year has dramatically turned the mood around. Before 2020, we saw a real shale boom in the industry: production was financed by debt, and the favorites were the fast-growing companies, despite their negative profit. Now investors see this industry as a cash cow, preferring companies with higher dividends and stable business.

Oil and gas production is becoming a tedious business, like coal mining or nuclear power, after the hype of previous years. Weekly data shows an increase in drilling activity in the US oil and gas sector.

However, new rigs are only enough to maintain production at 11m BPD since last September, after the peak in March 2020 above 13m b/d. Even two-year highs in prices and extremely favorable financial conditions on the markets do not inspire active expansion.

Without the US as a contender for market share, the main balancing force is the OPEC cartel, whose overall policy is well within the new "standards" of boring oil producers: high dividends and slow-growing supply.

If the production boom is behind us, we should expect a price boom along with a demand boom.

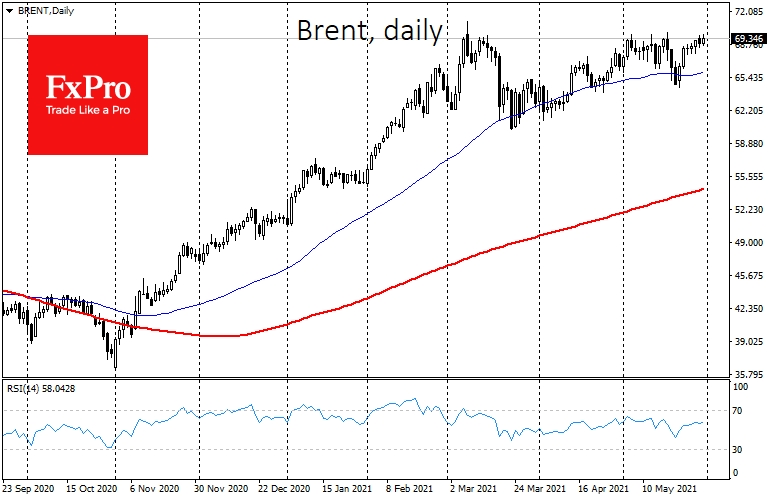

Technically, the market is close to a breakout. Brent's pullback from $70 has become less deep over the past three months, which has taken away the overheated market and allowed the bulls to gain liquidity for a new assault.

Above the $70 levels in Brent, there are no meaningful resistance levels until $75, the peak of 2019, so such a rise could be easy and quick. But that would require a significant news trigger. This could be the OPEC council meetings tomorrow or Friday's monthly US jobs report.

The FxPro Analyst Team