During the week Brent oil is trading within the range of 50.35 (Fibo correction 23.6%) and 49.00 with attempts to test its lower border. On Tueday the quotes grew in view of report on yet another reducion of US oil reserves by 4.62 mln barrels fixed in the weekly EIA report. Generally the market is dominated by negative factors. A monthly report by EIA on the prospects of oil industry development forecasts the growth of oil production in the USA.

Next year the average production volume may increase 10 mln barrels a day. Moreover, the market is destabilized by the conflict between the Gulf states and Qatar. Qatar is not in top-10 by oil production volumes but a conflict within OPEC may hinder the fulfillment of OPEC agreement. Today the quotes may make another correction attempt in case the reduction of oil reserves is confirmed by the weekly EIA report.

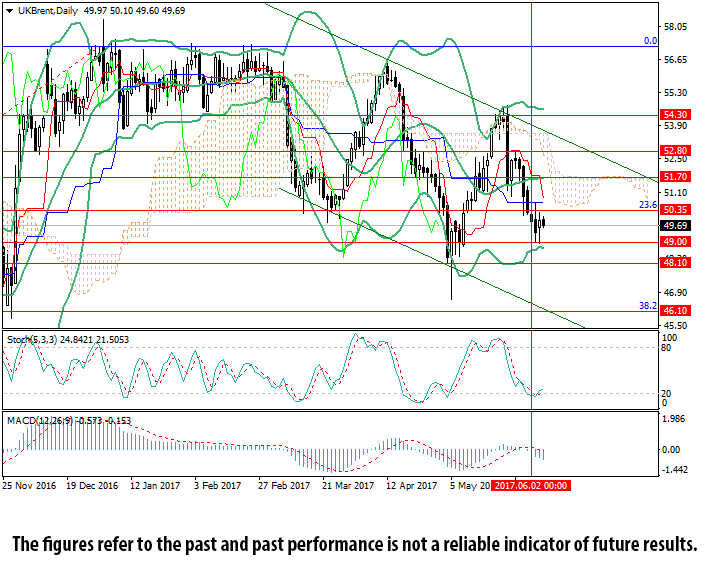

Technically the price is within the downward channel and is aiming at its lower border. However the mark 49.00 (lower line of Bollinger Bands) provides material support to the downward movement. It case it is broken though the price may continue to move to the lower border of the channel (46.10).

From the other side the growth of the price is limited by the level of 50.35 (Fibo correction 23.6%). The consolidation of the price above it may help the price return to the upper border of the channel (52.80) through the middle line of Bollinger Bands (51.70).

Support levels: 49.00, 48.10, 46.10.

Resistance levels: 50.35, 51.70, 52.80, 54.30.