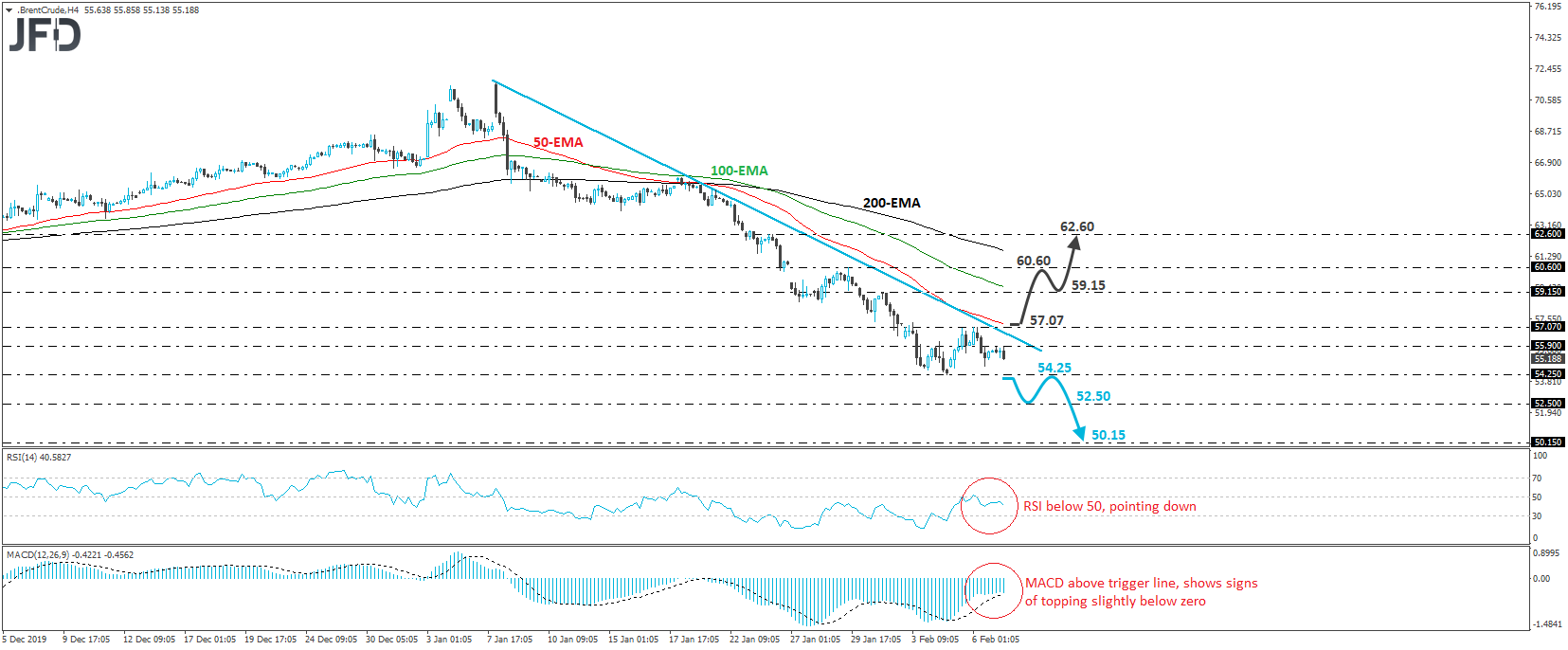

Brent crude oil traded slightly lower today, after hitting resistance near the 55.90 level. Overall, the black liquid has been trading below a downside resistance line drawn from the high of January 8th, and thus, we would consider the near-term outlook still to be negative.

That said, we would like to see a clear dip below 54.25, a support marked by Tuesday’s low, before we get confident on more bearish extensions. Such a dip would confirm a forthcoming lower low on both the 4-hour and daily charts and may encourage the bears to drive the battle towards the 52.50 hurdle, defined as a support by the low of January 2nd, 2019. If that level does not halt the slide, a dip lower may allow extensions towards the low of December 26th, 2018, at around 50.15.

Taking a look at our short-term momentum studies, we see that the RSI lies below 50 and points down, while the MACD, although above its trigger line, shows signs of topping slightly below zero. These indicators suggest that Brent may have started picking up downside speed again, which supports the case for further declines.

On the upside, we would like to see a decisive recovery above 57.07, marked by Wednesday’s and yesterday’s highs, before we abandon the bearish case. Such a move would also bring the price above the aforementioned downside line and may tempt the bulls to steal the bear’s weapons. If so, the recovery could continue towards the high of January 31st, at 59.15, the break of which may allow a test near the 60.60 zone, near the peak of January 29th. Another break, above 60.60, could set the stage for more advances, perhaps towards the high of January 24th, at around 62.60.