- Brent crude oil prices dropped below $70 a barrel, the lowest since December 2021.

- OPEC+ downgraded 2024 oil demand growth forecasts, primarily due to weakness and concern around China.

- Technical analysis suggests potential further decline in oil prices. Is there more room to the downside?

Oil prices fell off sharply today to trade below $70 a barrel for the first time since December 2021. OPEC + did release its monthly oil report earlier in the day but the selloff was not down to the OPEC + downgrades alone. As it stands it does not appear to be any single catalyst which facilitated the selloff but rather growing bearish pressure on oil prices.

Earlier in the day, market participants likely had an eye on Chinese imports and export data. The belief that weaker exports or a slowdown in demand leading to weaker imports as well could be a sign that the global economy is slowing.

Chinese exports soared however at the fastest pace since March 2023, up 8.7% YoY for the month of August. It was the fifth straight month of growth in shipments, amid robust foreign sales and despite growing trade tensions with the West. Among trading partners, exports rose to South Korea (3.4%), Taiwan (6.8%), the EU (13.4%), the US (4.9%), Japan (0.5%), and the ASEAN countries (8.8%).

Chinese imports did however show signs of a slowdown but not enough to justify the selloff in oil prices. Imports increased by 0.5% year-on-year, reaching USD 217.63 billion. This growth fell short of market expectations of a 2.0% rise and significantly slowed from the 7.2% surge observed in the previous month, reflecting a fragile recovery in domestic demand.

OPEC Downgrades Forecasts, First Time Since July 2023

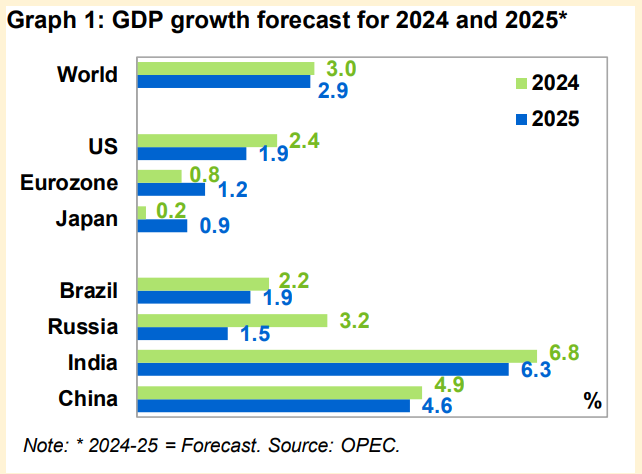

The bigger news directly relating to oil came from the OPEC monthly report. The key takeaways saw another downgrade by the oil cartel which cut oil demand growth for 2024 and also trimmed its expectations for 2025. The 2024 figure was adjusted down from 2.11 million bpd to 2.03 million bpd, which was the first change by the cartel since July 2023.

Source: OPEC

This comes after OPEC + announced last week that it would halt its plan to increase production from October. The downgrades were mostly down to China, with demand from the world’s second-largest economy trimmed to 650k bpd from a previous 700k for 2024.

Given the massive gap between IEA and OPEC forecasts, the market will no doubt be focused on IEA figures due for release on Thursday. Later in the day we have API data which could have an impact on prices as well.

Technical Analysis

From a technical perspective, oil has been in free fall since a rejection of the psychological $80 a barrel mark on August 30. Since then the selloff has been pretty aggressive with OPEC cancelling output increases and still failing to support oil prices.

The downgrades by OPEC today did not help matters coupled with the slowdown in Chinese imports adding to demand concerns. Trading at levels last seen in December 2021 there is support around current price.

The concern is the bigger picture as oil prices have broken out of a multi-year consolidation range and could be in for further losses. There might be a pullback in the short-term but selling pressure is likely to remain strong on any attempted rallies to the upside.

Brent has just broken through a key support level of 69.50 with the next area of support resting at 68.17.

Conversely, a move higher first faces resistance at 69.50 before the psychological 70.00 handle comes back into focus.

Brent Crude Oil Daily Chart, September 10, 2024

Source: TradingView

Support

- 68.17

- 67.21

- 66.42

Resistance

- 69.50

- 70.00

- 71.69

Most Read: GBP/USD Rises on Robust Labor Data – Challenges Ahead for the BoE