Brent crude oil prices climbed above USD $74 per barrel following OPEC+'s announcement to delay its production increase originally scheduled for December. The decision marks the second postponement by OPEC+ amid persistent global economic challenges and aims to avoid potential market oversupply.

Demand prospects remain subdued with Europe's slow economic recovery and Asia's lacklustre performance, particularly in China despite recent stimulus efforts. Additionally, tensions in the Middle East, particularly Iran's continued threats against Israel, are providing strong support to oil prices, with potential escalations anticipated post-US presidential elections on 5 November.

Concerns that regional oil production facilities might be targeted in these attacks contribute to fears of disrupted supply, further buoying oil prices. Meanwhile, temporary weakness in the US dollar also increases oil prices.

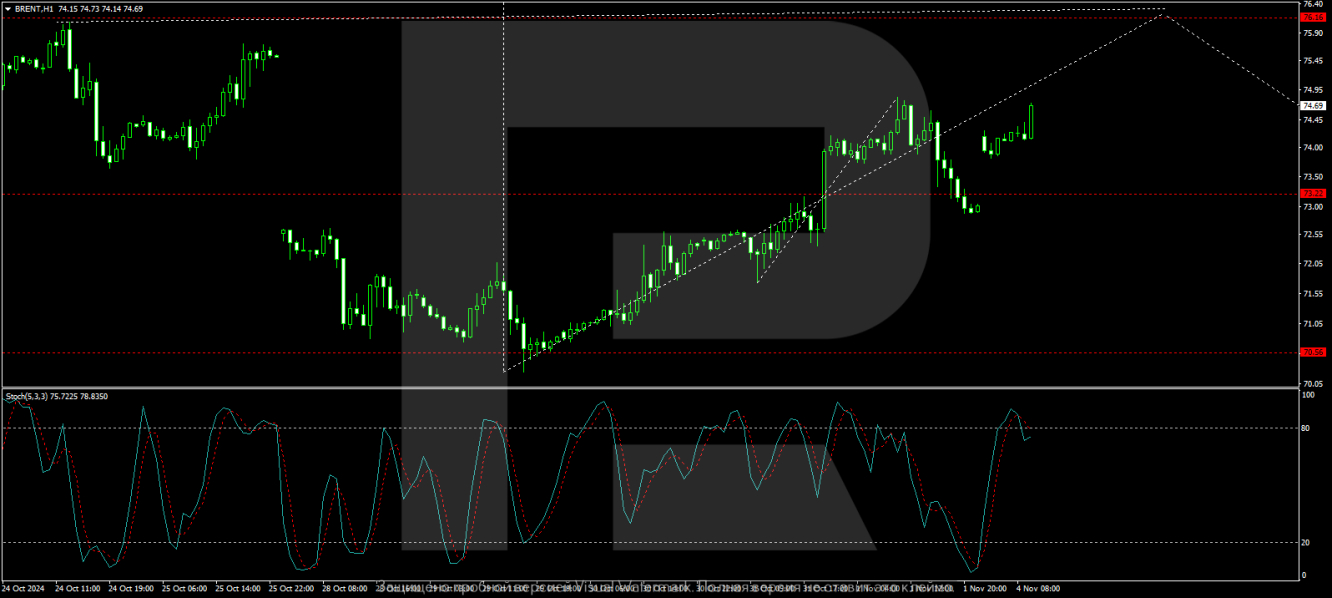

Technical analysis of Brent

Brent crude oil prices have rebounded from a recent low of USD $70.55 and are upward towards USD $76.16. The market is consolidating around USD $73.22, with a potential breakout that could lead to the USD $76.16 level. Once this target is achieved, a pullback to USD $73.22 could occur before further gains towards USD $79.20 are pursued. The bullish scenario is supported by MACD indicators suggesting upward momentum.

Following a correction to USD $73.22, Brent is poised to ascend to USD $74.90. A successful breach of this level could pave the way to 76.16. The stochastic oscillator's position above USD $50, pointing upwards towards USD $80, corroborates this potential upward movement.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.