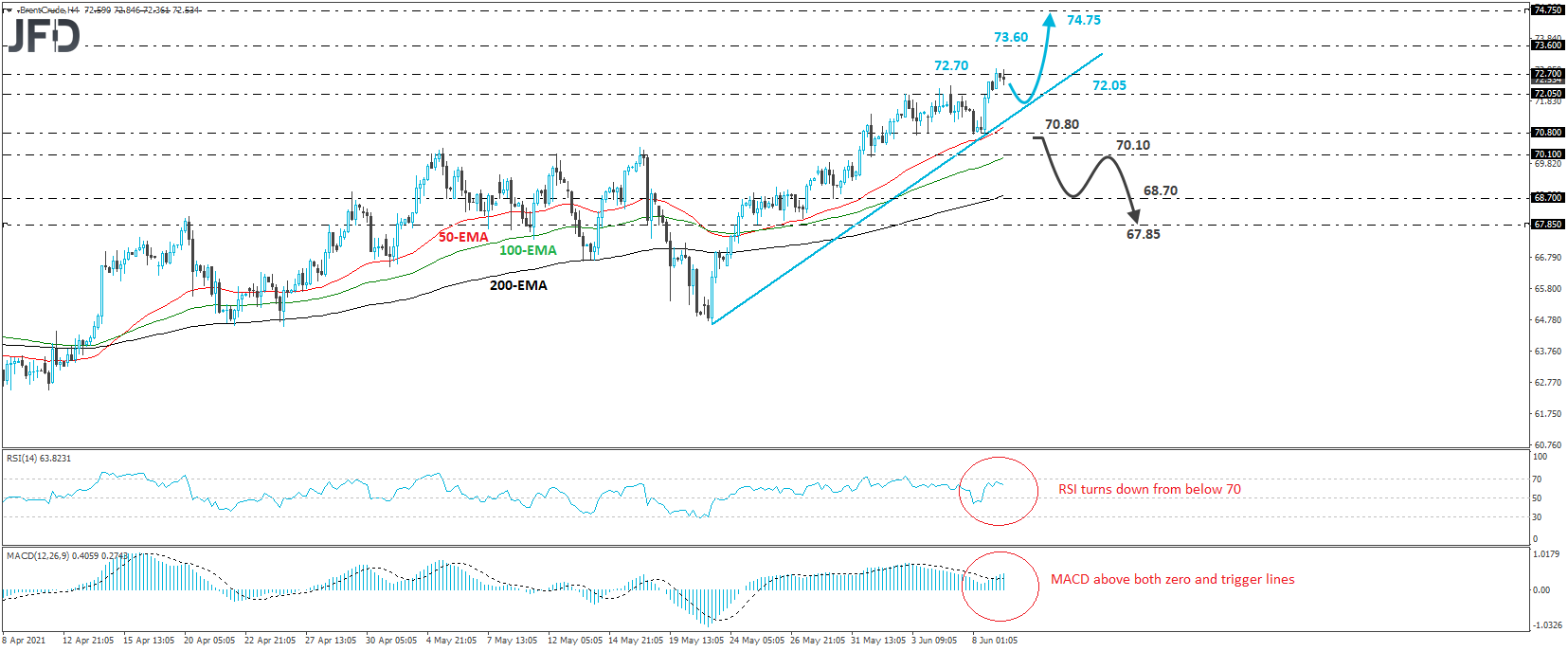

Brent crude oil traded higher on Tuesday, after hitting support near the 70.80 zone. The rebound took the black liquid above the 72.05 barrier, which provided resistance between June 3 and 7, thereby confirming a forthcoming higher high. With that in mind, and also that the price is trading above the tentative upside support line drawn from the low of May 21, we would consider the near-term outlook to be positive.

At the time of writing, the price is hovering fractionally below the 72.70 barrier, marked by the highs of May 16 and 20, 2019, where a break could open the path towards the peak of Apr. 26, 2019, at around 73.60. If the bulls are not willing to stop there, then their next challenge may be the 74.75 territory, defined as a resistance by the high of the day before.

Taking a look at our short-term oscillators, we see that the RSI turned down from near its 70 line, while the MACD, although above both its zero and trigger lines, shows signs of slowing down as well. Both indicators suggest that the strong upside speed may have started to ease somewhat, which makes us cautious over a potential pullback before the next leg north, perhaps for Brent to test the aforementioned upside line.

That said, in order to start examining whether the bears have stolen all of the bulls’ weapons, we would like to see a dip below 70.80. This will take the price below the upside line and also confirm a forthcoming lower low. We could then see a test near the 70.10 barrier, the break of which could set the stage for declines towards the 60.70 zone, marked by the low of May 28, or the 67.85 area, defined as a support by the low of May 25.