West Texas Intermediate and Brent Oil crudes climbed after Russia completed annexing Crimea, escalating the worst standoff with the West since the Cold War.

WTI rose 0.6 percent and Brent 0.4 percent. Russian President Vladimir Putin signed legislation needed to absorb the Black Sea peninsula, and its port of Sevastopol from Ukraine. Futures retreated from the day’s highs after the Standard & Poor’s 500 Index slipped from a record.

“Crude is up on concern that Putin may decide over the weekend that areas of eastern Ukraine might also prefer to be part of Russia,” said Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, which oversees $1.4 billion.

WTI for May delivery advanced 56 cents to settle at $99.46 a barrel on the New York Mercantile Exchange. The April contract expired yesterday after dropping 0.9 percent to $99.43. The volume of all futures traded was 16 percent below the 100-day average at 2:30 p.m.

Brent for May settlement rose 47 cents to end the session at $106.92 a barrel on the London-based ICE Futures Europe exchange. Trading was 15 percent below the 100-day average.

Brent, the benchmark for more than half the world’s oil, closed at a $7.46 premium to WTI.

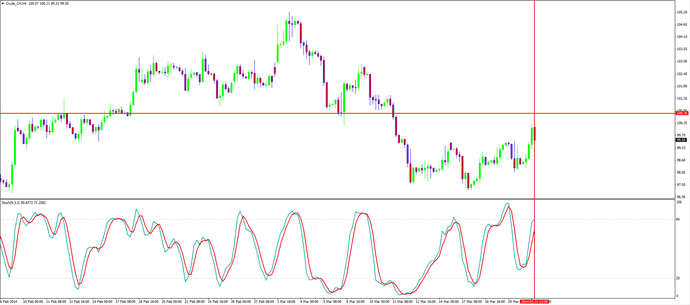

Technically, Crude oil after the break of the support of 100.70 level price is retesting the new resistance level of 100.70 zone. After the retest we can see crude oil is showing a bearish momentum and on close crude is trading at 99.50 level. Crude is at a minor support level of 99.30 but further we still anticipate more downward pressure to the next major support of 97.50 level.