Silver prices have stayed range bound for some time although QE3 helped push prices for Comex December silver to $35 levels in September, while India silver prices climbed August-September on weakness in rupee value.

For most of 2012, Silver did not find much favour with investors and latest US CFTC Commitment of Traders (COT) data (for week ended October 30) shows net long positions held by managed funds have fallen by 914 to 34328 while short positions have risen by 1592 to 5218. The market seems to remain in a bearish grip although Comex December charts (at bottom of the article) show an indication of breakout happening at $31.5/Oz levels which could push prices higher to $33-34 levels thanks to Obama effect. But chart breakout signals are not strong and we may have to wait a few more days for a clear picture to emerge.

On the positive side, recent update by ETF Securities Ltd shows assets in silver exchange traded funds witnessed the second largest increase after gold in Q3, 2012 but we have to factor in the Q3 effect into this. Silver is more volatile than gold and allegations of price manipulation is much higher in the white metal than other precious metals.

Coming to the Indian scenario, a few factors are hampering silver’s upward movement- One is the government decision to hike import duty to 6%, weak rupee and South West Monsoon (June to September) that was not so rainy enough to help rural demand for silver to climb up. India imports around 2500-3000 tons of silver annually but this year imports may fall due to the factors mentioned above.

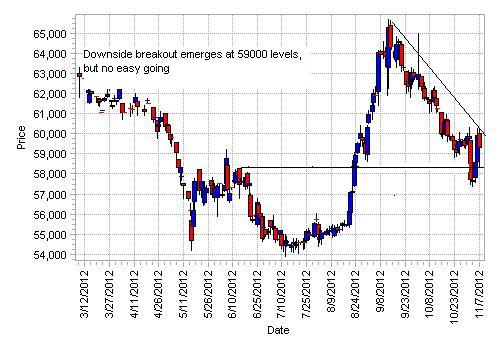

In MCX Silver December Charts (see below), the descending triangle is much sharper than Comex Silver December futures but is exhibiting chances of a similar breakout emerging at Indian Rupee (INR) 58,500 per kg levels but again the signals aren’t that strong. Diwali effect may help create a strong breakout as November is traditionally a good month for precious metals. But again, investors need to keep a close watch to establish the possibility of a bullish trend.

Silver behaves a bit differently from Gold as it doubles up as a major industrial commodity also along with platinum and palladium. On the industrial front, things aren't so rosy due to eurozone debt crisis, slowdown in emerging markets and strength of US dollar.

By Sreekumar Raghavan

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Breakout Emerging In US Silver, India Silver Futures

Published 11/11/2012, 01:20 AM

Breakout Emerging In US Silver, India Silver Futures

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.