Many of you know that I have taken a strong interest in FinTech over the last 2 years, and I am teaching classes in the subject with the help of many friends. From this I am seeing first hand how the Banking and Finance space is being forced to evolve and innovate, as well as the false attempts by incumbents to deflect the disruptors.

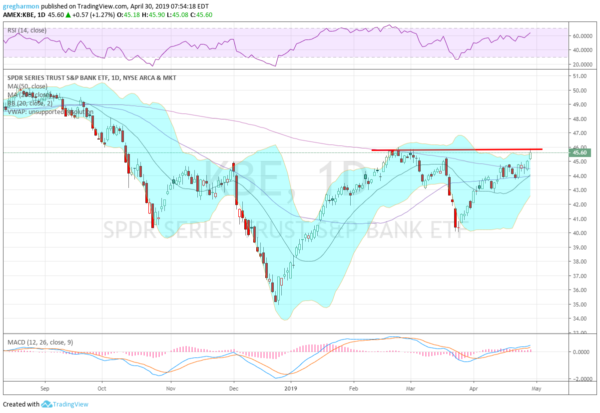

Despite this wave though, banks are still banks, making loans and providing the grease to the economy. And the chart of the SPDR S&P Banking ETF (NYSE:KBE), has been showing some life. Shown below it rose with the market off of a December bottom, but had stalled in February and pulled back. The pullback stopped at the October low, a reminder that an Inverse Head and Shoulders pattern could be setting up.

For now, the price touched the February high Monday. It is already over the 200-day SMA and is rising. Momentum is building and bullish on both the RSI and MACD. A push over 46 would not only give a new 6-month high, but signal a break out with a continuation target to 51. That would be a new all-time high.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.