The US consumer foods and products business looks like it's expecting growth - at least, if some of the industry's leading corporations' job postings can be trusted as an indicator.

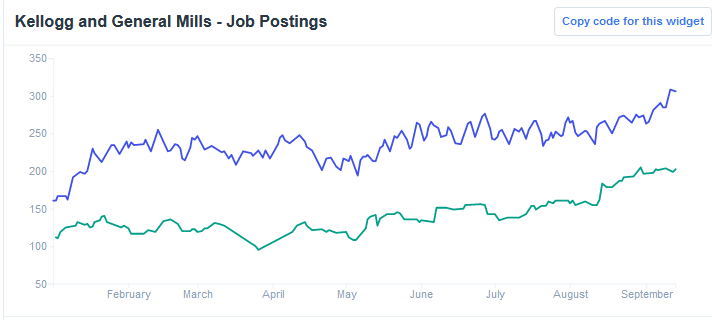

Analysts tracked by Zacks Investment Research are looking for EPS of $0.77 when General Mills reports earnings on Thursday, September 19 and judging by job postings optimism is in fact warranted - the company has already seen shares rise more than 40% in 2019. Along the same timeframe, job postings are up about 80%.

General Mills isn't alone on this - which is what makes it a compelling trend. Kellogg (NYSE:K), one of its biggest competitors, has seen shares grow in value more than 13% so far this year - but its pace of job posting growth is matching that of General Mills (NYSE:GIS). Job postings from Kellogg grew 90% so far this year.

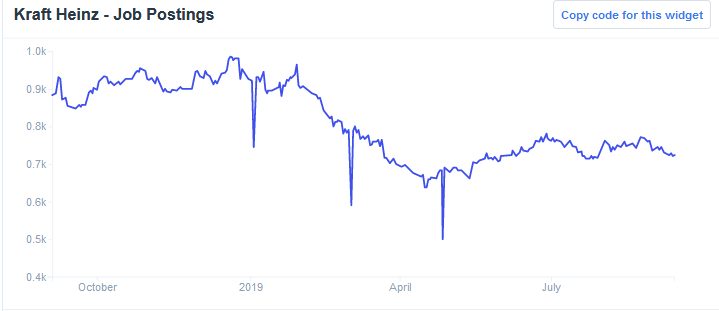

For our final chart - the picture of a company bucking the trend, and for all the wrong reasons. So far this year Kraft Heinz (NASDAQ:KHC) shares have looked a little more Heinz than Kraft (that's an NFL joke, folks), as it were. Job postings have dipped more than 20%, as the stock slid by more than 34% this year.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.