Friends, colleagues and even the Guardian newspaper told me that I sounded ‘weary’ when detailing the prospects of the latest Eurogroup summit and how close we were to a deal on the Greek debt problem. The collapse of talks last night has steeled me from my somnambulance as the fears over a Greek exit from the euro are starting to reach the levels that we saw back in 2012.

Greece’s rejection of the EU’s insistence that they should continue and finish the current bailout plan saw finance ministers walk away from the table, once again without even putting out a joint statement. “There was a very strong opinion across the whole Eurogroup that the next step has to come from the Greek authorities,” said Jeroen Dijsselbloem, Chairman of the Eurogroup. The ball has been batted back into the Greek court by the wider EU but that ball is now starting to look a lot more like a hand grenade.

According to Greek Finance Minister Varoufakis he had been ready to sign an agreement that Pierre Moscovici, the European Commission’s economic chief, had presented to him but that it was amended to reflect the continuation of the current plan. Market moves in the coming days will be largely governed by just how quickly we can get back to the negotiating table.

A fair few analysts are upgrading the chances that we will see an eventual Greek exit from the single currency given the current impasse. A deal can still be done of course, as Eurozone officials were at pains to emphasise last night.

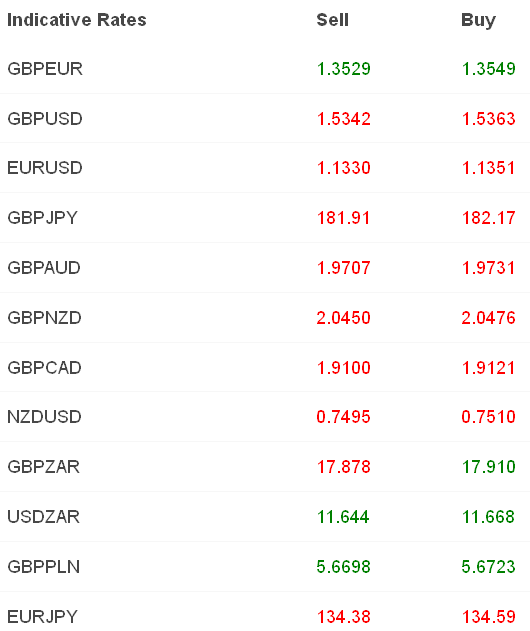

The European single currency came sharply lower as the meeting broke up and one has to think that euro volatility will only increase as the deadline comes increasingly into view. A report yesterday from JP Morgan suggested that the Greek banking system could last 14 weeks given its current outflows of around EUR2bn a week although we would have to caveat that number by saying an acceleration of those outflows is almost guaranteed if we reach March with no deal in place.

GBP/EUR is lingering around its seven year highs this morning ahead of the UK’s latest check on inflation. Decelerating CPI will once again be a story of weak energy prices, driving the overall basket to outright deflation. According to the Bank of England on Wednesday, the movements in oil prices are expected to drive inflation around 0.8% lower through to Q2 2015 while we can also see that price cuts from utility companies for domestic energy supply will also start to impact the inflationary basket moving into the middle of the year.

Cutting a long story short the inflation picture is expected to remain a drag on the pound through the year, obviously limiting the Bank of England’s policy response. Last month’s 0.5% inflation reading looks done for with markets looking for prices to have only gained 0.4% since this time last year, with the low expectation at 0.1%. As we have seen with other inflation announcements in recent weeks it is not so much about the headline index but more the ‘core’ reading. The deleterious effects of falling commodity and energy prices are obvious but should an economy’s ‘core’ prices, that do not include these volatile measures, remain strong then that is cause for optimism and will eliminate near-term fears of outright deflation.

CPI is due at 09.30 GMT.

Overnight, AUD has been the largest gainer as the latest minutes from the Reserve Bank of Australia limited the expectation of additional interest rate cuts. According to the document, the 0.25% cut in rates seen at the beginning of the month could have been made this month or next suggesting that only one cut was envisaged. They continued that the exchange rate remained the key area of uncertainty and remains above their own measures of fair value. Those looking for a lower AUD will have to shy away from RBA action it seems.