Forex News and Events

The political unrest in Brazil kept on pushing the BRL toward fresh 12-year lows verses USD on the week to March 20th. The post-FOMC recovery remained limited at 3.1910 as dip-buyers were crowded at levels below 3.20 which becomes a bottom as the political pressures persist. Education minister Comes’ resignation adds to political pressures in the country, as the freshly re-elected President Rousseff and the government are under the spotlight for corruption scandal on Petroleo (NYSE:PBR). Proposal on anti-corruption will be presented today, while we see the angry crowds being hardly satisfied on any proposal and stand ready for renewed street protests over the weekend. Traders will certainly be reluctant to hold long-BRL positions over the week-end, hence we should see speculative BRL-longs closing before the weekend and sustain the current BRL weakness.

As the corruption scandal gains momentum on streets, the risk of a potential sovereign rate cut worries those who have money invested in BRL-denominated assets. The five-year credit default swaps rose to 6-year highs (306.340 bp). A downgrade on BRL rating would speed up the current capital outflow from Brazilian assets, increase selling pressures on the Real and therefore accelerate the uptrend in inflation. The IPCA-15 (extended national consumer price index collected in between 15th of each month) should print 1.25% increase on month to March 15th, thus pushing the annual inflation to 7.91%, levels last seen in 2005. As the government restriction on prices are being removed, the inflationary pressures in Brazil should remain tight despite globally lower oil prices (as the depreciation in Real offsets the fall in the oil market). The hiking consumer prices is expected to lead to additional Selic rate hike on April 29th policy meeting. This means that stronger inflation read will revive BCB-hawks and trigger short-term BRL correction on better carry appetite. Fundamentally however, the risk investors should prefer to reallocate funds to alternative risky assets that offer lower rate spread yet for better visibility. It is also important to remember that lower rating restrict the collateral value of BRL and BRL-denominated assets, therefore indirectly impacts a portfolio’s total return. This is why, higher return does not always justify increased allocation.

Data-full week ahead in Brazil: time to face the reality

The BRL will step into a data-full week: foreign direct investment, current account balance, unemployment and 4Q GDP will give direction to traders through the week ahead. Little improvement in current account deficit, foreign investors’ reluctance to boost activity amid Petrobras scandals and mounting anger against President Rousseff and the government, combined to fragile fiscal conditions, place the Brazilian economy at the edge of stagflation. Next week data will give a quantified summary of the economic situation and determine whether further BRL depreciation is justified.

The broad-based EUR weakness had little impact verse the BRL. EUR/BRL extends gains above 3.50 no matter how tight the EUR returns have become. The EUR/BRL is being overly purchased in our view: efforts to escape the political turmoil in Brazil do no longer justify the reverse carry flows towards the EUR, where the eco-political situation is hardly better.

The oversold BRL verse GBP, CHF and the negative positioning in speculative futures (-8550 contracts as of March 10th) signal there is potential for decent short-covering. However there is little probability of this happening over the next week.

EUR/USD remains weak

The Risk Today

Luc Luyet

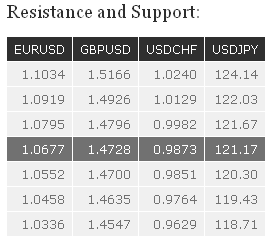

EUR/USD has moved back to price levels seen before the FOMC meeting, confirming persistent selling pressures. Hourly resistances can be found at 1.0795 (intraday high) and 1.0919 (19/03/2015 high). Hourly supports can now be found at 1.0552 (17/03/2015 low) and 1.0458. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. Strong resistances stand at 1.1114 (05/03/2015 low) and 1.1534 (03/02/2015 high). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD has erased most of the gains made on 18 March, indicating persistent selling pressures. A support stands at 1.4635. Hourly resistances can be found at 1.4796 (intraday low) and 1.4926 (intraday high). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). Another strong support stands at 1.3503 (23/01/2009 low). A key resistance can be found at 1.5552 (26/02/2015 high).

USD/JPY is bouncing sharply after having tested the low of its rising channel. Hourly resistances can be found at 121.10 (intraday high, see also the declining trendline) and 121.67 (12/03/2015 high). An hourly support lies at 120.30 (intraday high), while a key support stands at 119.30. A long-term bullish bias is favoured as long as the key support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF is fading near the hourly resistance at 0.9982 (12/03/2015 low). A period of consolidation is likely underway. Hourly support can be found at 0.9851 (intraday high) and 0.9764 (19/03/2015 low), while a key support lies at 0.9629. Another hourly resistance stands at 1.0070 (intraday high). In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. A key support can now be found at 0.9374 (20/02/2015 low, see also the 200-day moving average).