Forex News and Events

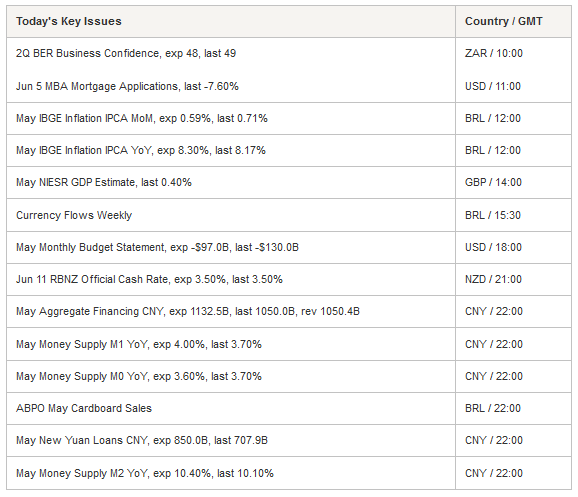

Yesterday, Dilma Rousseff announced an infrastructure investment plan of BRL198bn. The new concessions will be auctioned to private investors and are related to investments in seaports, airports, roads and railways. The main purpose of this package is to revitalise the Brazilian economy by building new infrastructures, but also by renovating outdated ones that weigh on productivity and efficiency of the world’s seventh biggest economy.

The government already unveiled a concession plan back in 2012, and it wasn’t a tremendous success, to say the least, as only 20% of the total BRL210bn had managed to attract private investors’ interest. However, Rousseff said that this time the concessions will guarantee fair returns to investors, as the Brazilian Development Bank is offering attractive financing conditions to auctions winners. Besides the evident desire of the government to create a more positive environment for private-public investments in an attempt to end the ongoing recession, the new concession plan is also aiming at balancing the recent negative headlines due to the fiscal adjustment measures that cut in labour and social expenditures. The investment package comes as a breath of fresh air, even if it will not improve immediate growth perspective, given that more than 65% of the investment auction will take place after 2018.

UK focuses on Brexit

Bank of England is meeting tonight. Governor Carney will deliver his annual speech at the Mansion House Dinner in London in a time of Brexit uncertainty.

Indeed, members of Parliament have voted for a referendum yesterday after the first debate on whether the UK should remain a member of the European Union. MPs voted largely in favour of this referendum. Therefore, it is very likely to be held by 2017. In addition, David Cameron wants to campaign for Britain to remain in the EU. Even more, his main concern is to discuss Brussels’ influence on important policies such as immigration. In our opinion, differences of treatment with other members would be a real negative signal and the EU could, ironically, weaken and enter into a political crisis. Also, Cameron has to face against his own party, as many conservatives will campaign to leave the European Union if Cameron fails to re-negotiate terms of membership.

However, exiting the Union would push UK investments downside, as it would deprive the country of all the EU’s support.

USD/JPY correction

USD/JPY fell to 122.65 from 124.55 on comments from BoJ's Kuroda. Traders have been anticipating the downward trend of inflation would accelerate pushing the BoJ into additional easing. However, Kuroda’s comments suggest that this is not a consideration currently. Kuroda stated that the BoJ wasn’t planning to continue QQE forever and was not considering excess reserve rate cut. But what really drove the strengthening of the JPY was the comment that the yen was “very weak” and may not weaken much further on real effective exchange rate basis. Elsewhere, Japanese April Core machinery orders rose 3.8% m/m (second straight month of solid growth) against expectation for a 2% contraction. May producer price index increased 0.3% m/m against 0.2% estimates. The Japanese economy has outperformed most analyst estimates, and our expectations for additional easing seems less probable. However, as the Fed shifts toward its first rate hike, short end US-JP yield spread should start widening, giving USD/JPY an additional boost. We see the current USD/JPY move as a correction rather than a reversal, and view the current pullback as an opportunity to reload longs.

EUR/USD - Approaching the resistance at 1.1459

The Risk Today

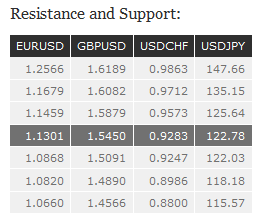

EUR/USD EUR/USD is now rising towards the resistance at 1.1459. Hourly resistance at 1.1346 (10/06/2015 high) has been broken. Hourly support can be found at 1.1214 (09/06/2015 low) ). A break of the support at 1.0868 (28/05/2015 low) will provide downside momentum to the pair. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD GBP/USD has broken the resistance at 1.5437 (27/05/2015 high) and has set a new hourly high at 1.5471 (intraday high). Key resistance lies at 1.5815 (14/05/2015 high). The technical structure suggests an upside momentum. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY USD/JPY is still trading slightly below its 13- year highest level at around 124.00. We are still targeting the resistance at 125.69 (12/06/2002 high), and we remain bullish for the pair as we stay largely above the 200-dma. However, the pair seems to gain bearish momentum on the short term. Hourly support is given at 122.78 (27/05/2015 low). Key resistance lies at 135.15 (14-year high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF USD/CHF has set a new hourly low at 0.9234 (intraday low). Hourly resistance can be found at 0.9333 (09/06/2015 high). Stronger resistance can be found at 0.9573 (29/05/2015 high) and stronger support lies at 0.9072 (07/05/2015 low). In the short-term, the pair is gaining downside momentum; therefore, we remain bearish over the next few weeks. In the long-term, there is no sign to suggest the end of the current downtrend after failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).