Brazil Real Non-Commercial Speculator Positions:

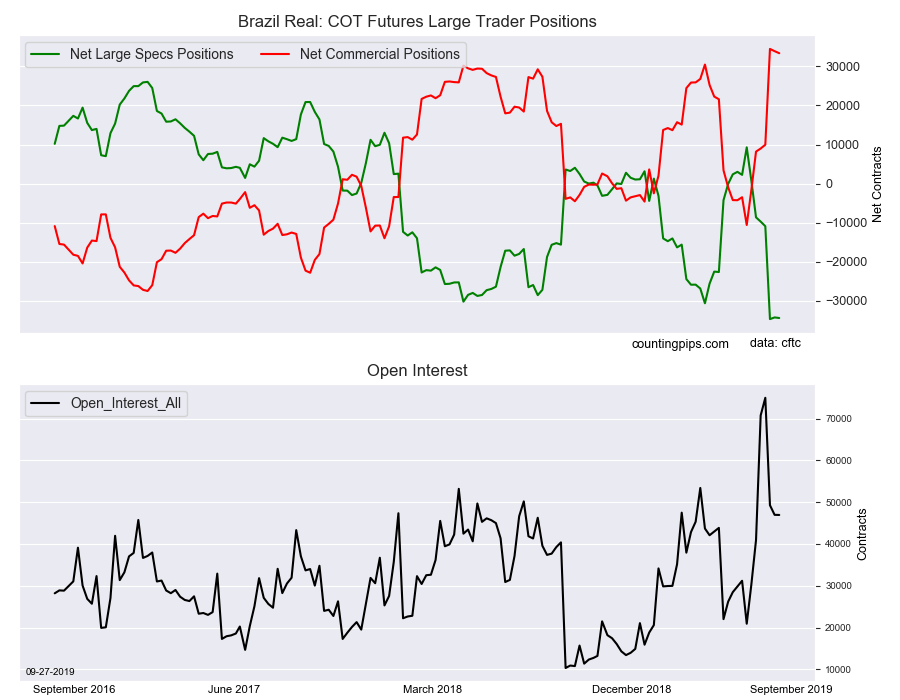

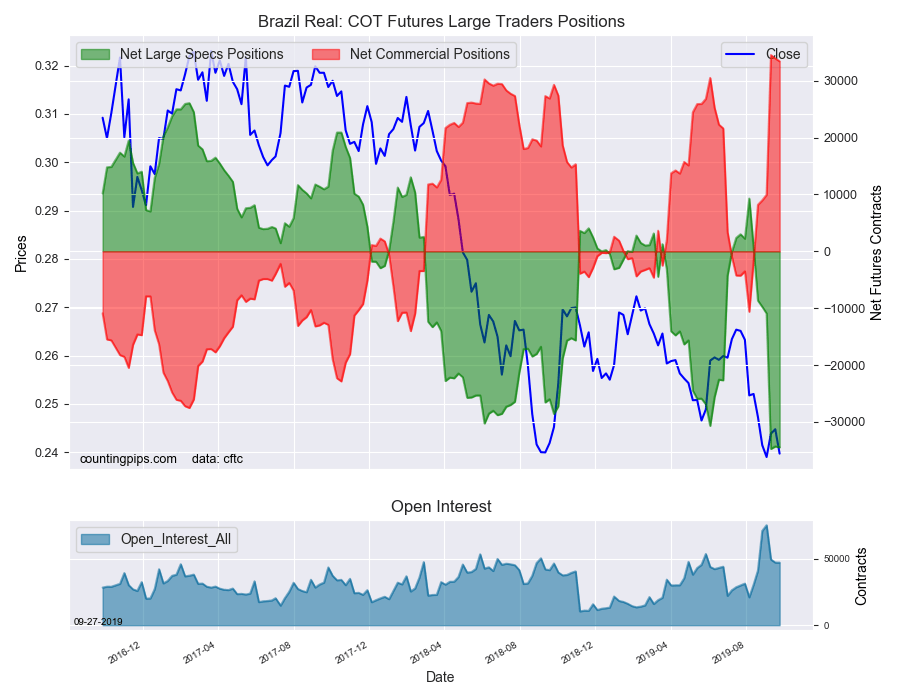

Large currency speculators continued to raise their bearish net positions in the Brazil Real futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Brazil Real futures, traded by large speculators and hedge funds, totaled a net position of -34,451 contracts in the data reported through Tuesday September 24th. This was a weekly change of -148 net contracts from the previous week which had a total of -34,303 net contracts.

The week’s net position was the result of the gross bullish position (longs) advancing by 157 contracts (to a weekly total of 8,995 contracts) while the gross bearish position (shorts) rose by a slightly larger amount of 305 contracts for the week (to a total of 43,446 contracts).

Brazilian real speculators continued to increase their bearish bets last week as positions have gone more bearish in six out of the past seven weeks. The bearish position has risen by a total of -43,720 contracts in just these past seven weeks while the overall net position standing is now above the -30,000 contract level for a third straight week.

Speculator sentiment had been slightly bullish from the middle of July into the middle of August before turning bearish on August 20th.

Brazil Real Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 33,394 contracts on the week. This was a weekly decrease of -523 contracts from the total net of 33,917 contracts reported the previous week.

Brazil Real Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Brazil Real Futures (Front Month) closed at approximately $0.2397 which was a loss of $-0.0055 from the previous close of $0.2447, according to unofficial market data.