Continuing with the emerging markets underperformoance theme, Brazil's stock market hit new post-recession lows on Wednesday. We haven't seen the Bovespa index this low since the spring of 2009.

The Brazilian Real (BRL) fell to 2.23 per dollar. As with equities, we haven't seen USD/BRL at these levels since the first half of 2009.

There are three key reasons for these violent market "adjustments".

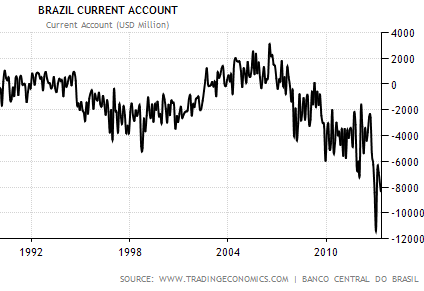

1. Brazil's economy has been weakened by slowing global demand, particularly from China and the eurozone. The nation's current account has been in the red for awhile and is deteriorating.

The Economist: Failing to meet low expectations is becoming a habit for Brazil’s economy. Figures published on May 29th showed that in the first quarter of this year it grew by just 0.6% (2.4% annualised), well short of the recovery analysts had expected. For the first time in years the country is running a trade deficit. Its primary fiscal surplus (ie, before interest payments) is shrinking and government debt is growing.

2. Over the past decade Brazil experienced tremendous growth, which ended up masking a number of structural and social issues. Now these issues are coming to the surface and spooking many investors.

Reuters: After more than a week, the biggest series of protests to sweep Brazil in more than two decades continued in major capitals and moved into smaller cities. Focused at first in cities like Sao Paulo, Rio de Janeiro and the capital, Brasilia, demonstrations in more than 70 smaller cities were expected across the country on Thursday.

3. The Fed is now looking to slow the pace of massive amounts of stimulus being added to the system in the U.S. each month.

Bernanke: “If the incoming data are broadly consistent with this forecast, the committee currently anticipates that it would be appropriate to moderate the pace of purchases later this year,... We will continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year.”

As a result, rising rates have generated a broad "risk-off" market sentiment, with active investors dumping anything that feels risky. Brazil is high on that list.

When markets open across Asia and Europe tomorrow, expect to see some major adjustments among emerging markets in those areas as well. But Brazil, being squeezed from all sides, probably takes the cake for the worst financial markets turbulence among major emerging market economies - for now.

The Brazilian Real (BRL) fell to 2.23 per dollar. As with equities, we haven't seen USD/BRL at these levels since the first half of 2009.

There are three key reasons for these violent market "adjustments".

1. Brazil's economy has been weakened by slowing global demand, particularly from China and the eurozone. The nation's current account has been in the red for awhile and is deteriorating.

The Economist: Failing to meet low expectations is becoming a habit for Brazil’s economy. Figures published on May 29th showed that in the first quarter of this year it grew by just 0.6% (2.4% annualised), well short of the recovery analysts had expected. For the first time in years the country is running a trade deficit. Its primary fiscal surplus (ie, before interest payments) is shrinking and government debt is growing.

2. Over the past decade Brazil experienced tremendous growth, which ended up masking a number of structural and social issues. Now these issues are coming to the surface and spooking many investors.

Reuters: After more than a week, the biggest series of protests to sweep Brazil in more than two decades continued in major capitals and moved into smaller cities. Focused at first in cities like Sao Paulo, Rio de Janeiro and the capital, Brasilia, demonstrations in more than 70 smaller cities were expected across the country on Thursday.

3. The Fed is now looking to slow the pace of massive amounts of stimulus being added to the system in the U.S. each month.

Bernanke: “If the incoming data are broadly consistent with this forecast, the committee currently anticipates that it would be appropriate to moderate the pace of purchases later this year,... We will continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year.”

As a result, rising rates have generated a broad "risk-off" market sentiment, with active investors dumping anything that feels risky. Brazil is high on that list.

When markets open across Asia and Europe tomorrow, expect to see some major adjustments among emerging markets in those areas as well. But Brazil, being squeezed from all sides, probably takes the cake for the worst financial markets turbulence among major emerging market economies - for now.