“Brazilian analysts say the tariffs announced by U.S. President Donald Trump against Canada, Mexico and China could cause a currency-related inflation surge in Latin America's largest economy, clouding the central bank's outlook for interest rates.”

The article written in Reuters goes on to say that Brazil is facing inflationary pressures, which is why they raised their interest rates by 100-basis points.

The article then goes on to quote central bankers who say that tariffs could in turn, present “downside risk for price pressures in the event of a less inflationary scenario for emerging economies arising from shocks on international trade or global financial conditions."

This is exactly what I have been trying to relay to traders and investors.

It could spark inflation.

It could spark disinflation and a global slowdown, but it might not.

PRICE rules.

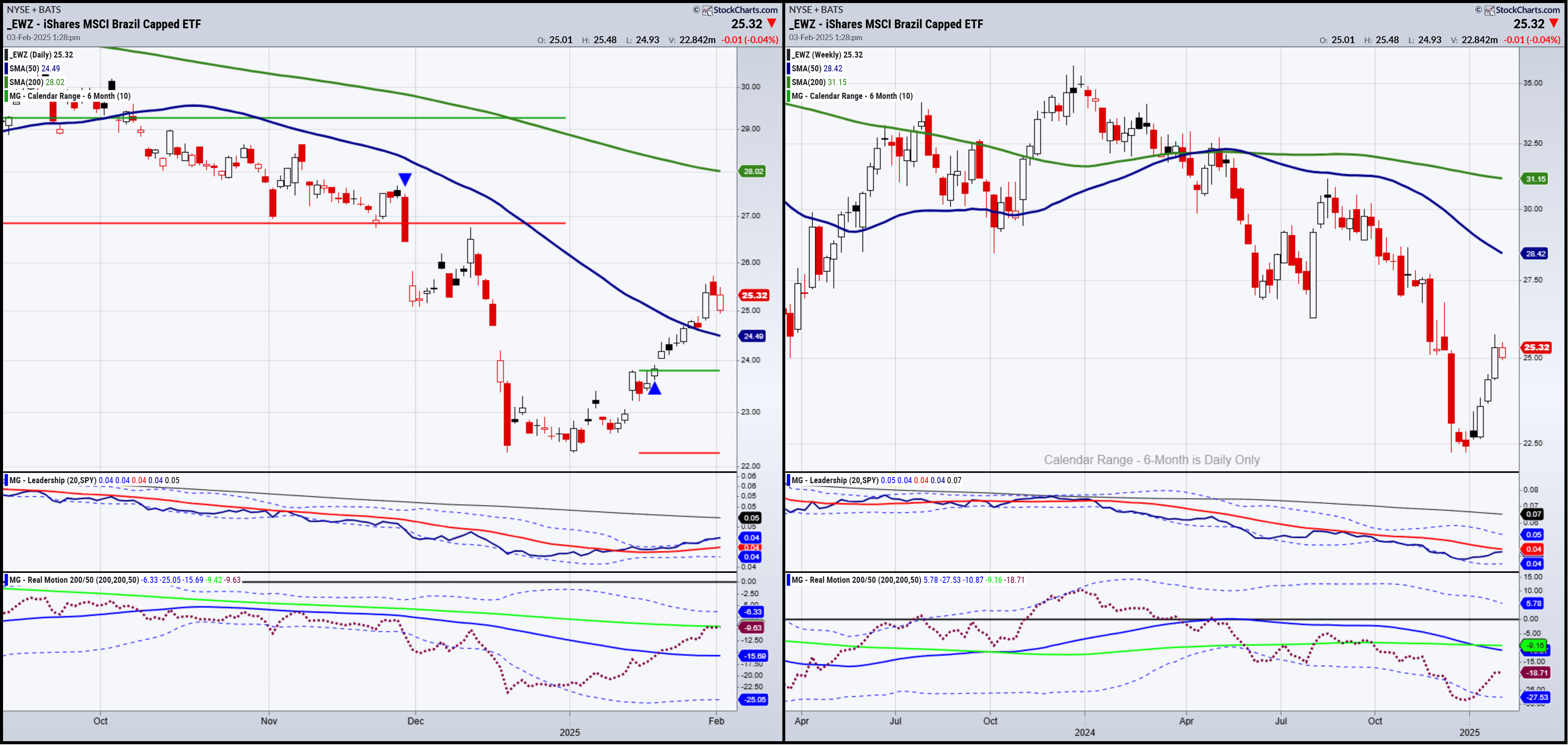

Let’s look at the charts of EWZ, the iShares MSCI Brazil ETF (NYSE:EWZ).

On the Daily chart, EWZ cleared the 50-DMA and entered a recovery or recuperation phase.

Last Friday’s price lines up perfectly with what you don’t see on the weekly chart, a favored exponential moving average.

So, we can safely say a close over Friday’s high will correspond with a significant weekly breakout.

EWZ is outperforming the benchmark on the Daily chart and on par with it on the weekly chart.

Real Motion or momentum looks better on the Daily chart than on the weekly chart.

But again, it is most likely safe to say that a breakout over Friday’s high will most likely improve momentum.

The monthly chart has its own narrative.

A favorite indicator on the monthly chart is the Bollinger Bands. You can see the one that is red.

I like it when the price sits below the BB and then rises above it.

Plus, EWZ is gaining relative strength after looking oversold.

While there is a lot of overhead resistance, this ETF is now on our radar.

I hope that like so many amazing setups I have shared with you (Gold, gold miners, corn, IBM, Stratasys (NASDAQ:SSYS), and so on) all of which went on to give us huge gains, you keep this ETF on your radar now too.

Price rules, fundamentals drool.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) Spectacular turnaround from open until close-580-600 current range

- Russell 2000 (IWM) 225-227 is now the area to get back above

- Dow (DIA) 452 now the resistance to clear

- Nasdaq (QQQ) 511 area key support

- Regional banks (KRE) 64 to clear and 62 to hold

- Semiconductors (SMH) 237 support needs to clear and hold over 242

- Transportation (IYT) Its all about 68 support now

- Biotechnology (IBB) Held where it needed to

- Retail (XRT) 77 key support resistance to clear 81

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 79 support