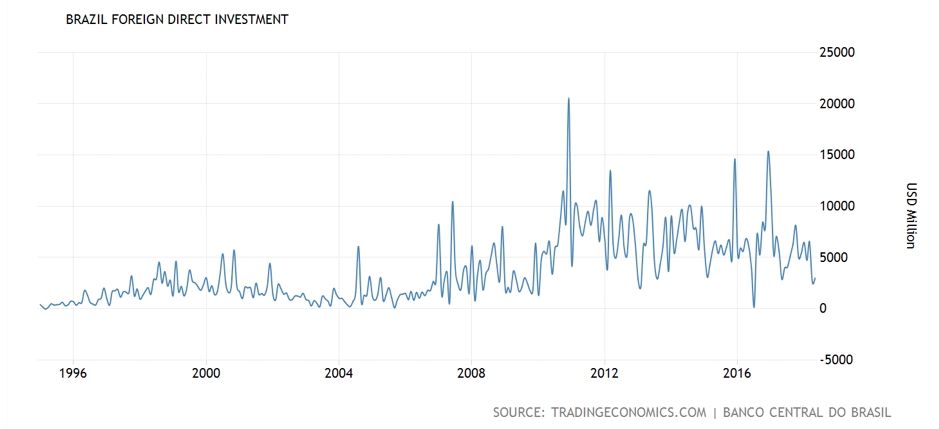

Brazil has been one of the hardest hit countries since the natural resources boom ended. This resulted in Brazil falling into a very deep recession and foreign direct investment dropping by more than 75% from its peak. But the rules of the game changed in June, setting the stage to dramatically change investor outlook in its mining sector for a number of years ahead. This is after little changes in Brazil’s mining sector going back to 1967.

But before putting money to work in Brazil, most investors and speculators can think about a number of issues the country has faced since the commodities boom ended. For instance:

Foreign Direct Investment is down by more than 50% since the peak in 2011

Mining Disaster in 2015

Mining Bankruptcy: Luna Gold

Currency Heavily Depreciated

Increased Political Challenges over the past few years

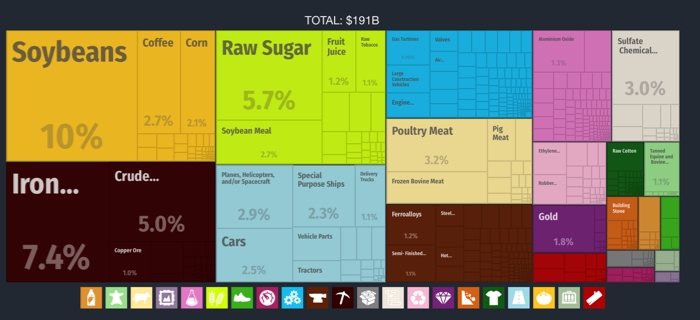

These are all the hallmarks of wanting to shy away as an investor. In the short-term, we see these as only temporary, and more issues may continue to unfold because Brazil is primarily a natural resources country. Just like Canada, and Australia that are heavily influenced by the prices of oil, iron ore, and other natural resources. Brazil is no different, with iron ore, crude oil, soybeans, sugar and gold accounting for almost 30% of the country’s exports in 2016.

Source: MIT

What Happened? The BIGGEST Change in Brazil’s Mining Sector in 50 Years

Brazil updated its mining code that has changed little since 1967, that will positively impact investors looking to invest in the sector.

“…allow for mining titles to be used as guarantees for financing, aimed at stimulating investment in the sector and to allow miners to continue exploring for minerals while production license applications are pending,” the Mines and Energy Ministry said.(Reuters)

Legal classifications for mining resources, which still use terms from a 1967 mining code, will come into line with global standards, and filings for permits will be more focused on economic feasibility, the two sources said. (Reuters)

President Temer signed the decrees on Tuesday, saying the economy needed a competitive, innovative and sustainable mining industry. "The mining code has been modernised and reflects the best international practices, as well as improving legal certainty," he said in a translated tweet, "which helps to attract more investments and jobs for our country." Mining Journal

What Does the New Rule Changes Open Up For Investors?

The decree would open up roughly 20,000 exploration areas where permit applications have stalled or been abandoned, one source said. Those blocks, which account for about a tenth of areas in Brazil with permits pending, would be subject to new auctions. (Reuters)

"Brazil is opening up its markets and there are many opportunities," Andre Clark, head of Siemens in Brazil. (DW.com)

Why Do the Policy Change?

"The objective of the measure is to attract new investments, generating wealth for the country and employment and income for society, always based on the precepts of sustainability, "the Brazil ministry said in a statement.

“With this (decree), we will ensure our attractiveness to foreign capital,” the second source said. “There will be the legal security necessary for people to invest in Brazil.”(Reuters)

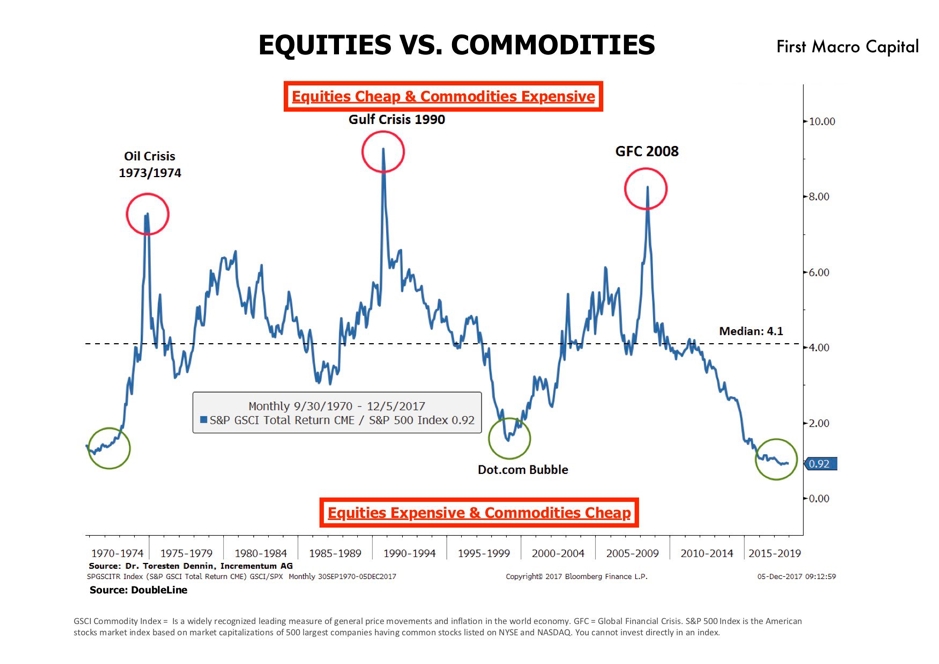

The Timing of The Policy Change

If we take into account a rotation from equities to commodities, then this is a huge positive policy change at the start of the commodities cycle. Brazil has the potential in the coming natural resource boom to be a big winner again for investors because it is setting policies in place to help the country grow again and attract investment. There are plenty of different commodities for investors to invest in Brazil. These new mining policies have a high probability of improving investor sentiment of Brazil. Government policies can pull or push away investment, and these new changes will pull in investment into Brazil, particularly as the commodity cycle unfolds. In turn, new job opportunities will open up in Brazil’s mining sector.

Bloomberg Interview with Mark Mobius – July 11, 2018

Host: “Do we know enough who the winners might be in your view?”

Mobius: “In our view, in terms of the emerging markets, some of the most interesting now because of their tremendous decline in the currencies and markets, would be Brazil.

Host: “Do you think we bottomed across emerging markets, just generally speaking from a sentiment play?”

Mobius: “I can’t say they bottomed. Emerging markets as you know are down about 20 something percent in general. Some markets are down more than that. I expect probably another 10%. As you know about a year ago, I said probably a 30% decline/correction. I think we will still achieve that. But now of course, now is the time to begin looking and locating those companies in emerging markets. The opportunities are going to get better. The currencies look very cheap as you know. The markets are down in many cases substantially. Places like Brazil, Argentina, these are really bombed out markets.”

Host: “Bombed out presents the opportunity of being greedy when others are fearful.”

Mobius: “That’s always been the case. The problem of course is putting money to work when markets are down substantially. One of the reasons of course, is that investors hold back. And therefore, we don’t have the cash to put money to in these markets. People are learning, there are a lot of investors that are willing to go into these bombed out markets.”

Wealthy Group and Strategic Investors that Added to Their Investments in Brazil in 2018:

In recent months there has been an increased activity of successful mining investors deploying capital into Brazil while gold price remains down. These are investors with a proven track record of creating wealth with a longer-term focus than just 3-6 months.

1. Ross Beatty via Equinox

2. Sprott and Lundin family in joint investment via Americano Mining

3. Mitsui investing in Vale

· Asked whether Mitsui could buy all of the shareholders’ stake if it were offered as a parcel, Takebe said: “I wouldn’t rule out possibility, but it’s unlikely that we would buy all the shares on sale.” Source: Reuters

4. Anglo American (LON:AAL)

· Anglo has confirmed to Reuters it had obtained permits covering almost 1.9 million hectares to explore in the Mato Grosso and Para states but said it was too soon to make claims about the project's viability.

· Brazil's national mining agency director general Victor Bicca told the wire service it could be a "mega deposit" with similar mineral content to Chile. Source: Mining Journal

5. Royal Gold (NASDAQ:RGLD) investment to obtain royalty of Amarillo Gold (V:AGC). Source: Amarillo Gold

There are a number of companies already invested in Brazil, and this new rule could entice them to further invest in the country with these new rule changes. They’ll be able to utilize their first mover advantage versus everyone else. Already registered companies, established teams, relationships, etc.

1. Vale

2. BHP Billiton (LON:BLT) Limited

3. AngloGold Ashanti Ltd ADR (NYSE:AU).

4. Kinross Gold Corporation (NYSE:KGC)

5. Alcoa (NYSE:AA) Inversiones España

6. Norsk Hydro ASA ADR (OTC:NHYDY)

7. ArcelorMittal SA ADR (NYSE:MT)

8. Anglo American

9. Yamana Gold Inc (NYSE:AUY).

10. Novelis

11. ThyssenKrupp CSA

12. Sao Bento Mineracao

13. Technip (PA:FTI)

14. GoldMining Inc (TO:GOLD)

15. Equinox Gold Corp (V:EQX)

16. Americano Mining

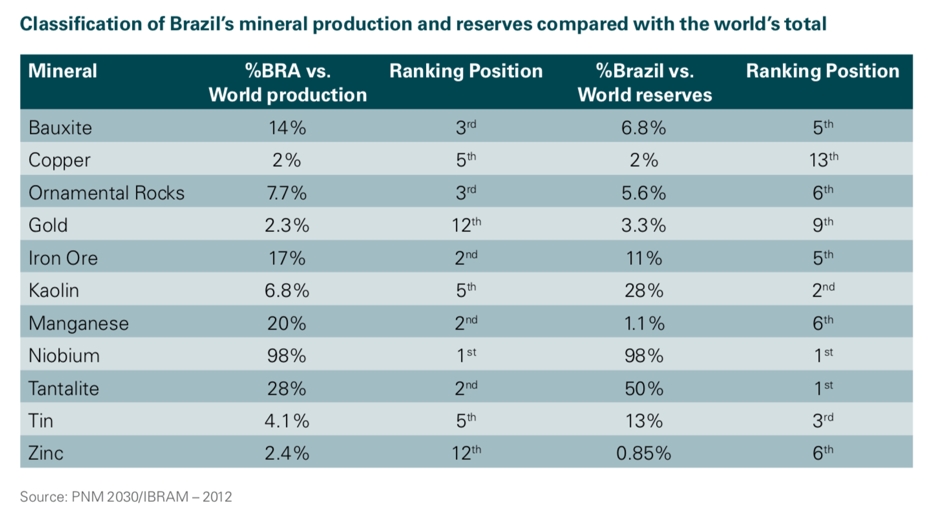

Brazil is the #1 producer in niobium, 2nd largest producer of iron ore and manganese, as part of the almost 80 mineral commodities that Brazil produces. The big winners will be on gold and copper investment because there is more certainty with customers, and investors are more familiar with these commodities. Electric vehicles will create a new source of demand for copper, that no one truly knows the demand side.

Policy changes can dramatically positively or negatively impact investor sentiment. We think in Brazil’s case; these new mining updates positively improve investor sentiment over the coming years ahead. Will the currency and other issues probably come up in the meantime as the natural resources boom has yet to take hold? We think there’s a high probability chance. Smart money is already deploying capital in the country, and those investors that are willing to take a multi-year view on Brazil; mining in Brazil has the potential to eclipse what it did in the last cycle because of these new policy changes. Copper and gold projects will be some of the big winners, particularly as electric vehicle demand grows. Being greedy when others are fearful, puts Brazil near the top to consider for natural resource investors and investors looking for deep value opportunities.

Disclosure: Paul Farrugia, BCom. Paul is the President & CEO of First Macro Capital.