Forex News and Events

Today, Brazil’s Q1 GDP release will be in focus ahead of a busy week as the Copom will announce monetary decision next Wednesday. On the data front, May’s Manufacturing PMI and Trade Balance are due Monday; April’s industrial production on Tuesday while May’s Services PMI will be released on Wednesday.

The world’s seventh biggest economy is expected to have contracted -1.8%y/y during the first three months of 2015 after having shrunk -0.2% in Q4 2014 (the last time we saw a positive figure was in Q1 2014) and we anticipate that it won’t be the last contraction of the year. Growth is expected to make its big comeback in the middle of 2016. At the moment, Brazil is therefore in a tough spot; however recent key austerity packages have been approved this week. The Senate approved measures that reduce pensions and labour benefits, which are expected to save about BRL 5bn a year. It will therefore help to balance budget while restoring confidence in President Dilma Rousseff’s government.

Initially we anticipated the BCB to increase the Selic rate by 25bps to 13.50% at the next policy meeting on June 2 and 3, as data indicate a slight deceleration in elevated inflation while downside surprises on the economic front point toward a more severe economic contraction. However, recent hawkish comments by central bank’s deputy-governor Luiz Awazu Pereira indicate that the BCB is committed to maintain the actual pace of tightening, by saying that the Copom will continue to remain “vigilant”. The wording therefore suggests that a rate hike of 50bps to 1.75% at the next meeting is more likely.

The BRL weakened against the USD and tested the resistance at 3.19/20 yesterday before stabilising around 3.16. During the next few days, political factors will keep pressuring the BRL and we therefore expect further weakness in the short term.

Concerns on New Zealand’s data (by Yann Quelenn)

Building permits came in last night at a disappointing -1.7% m/m with a prior figure of 11%. In the same time the ANZ activity outlook, a survey of business opinion, dropped to a two-year-low. Only 15.7% of respondents expect New Zealand economy to improve. It has to be compared with last month survey with 30.2% of positive opinion. Business confidence is slowing down as economy falls.

New Zealand inflation’s expectations for this year fell to 1.62%. 1.76% was the previous estimate. Though, inflation is still on the Reserve Bank’s target band of 1 to 3%. Outside of this range, the official cash rate at 3.5% is subject to be lowered. Furthermore, softer economic data would push the reserve bank to stimulate the economy. Nonetheless, there is still room for the reserve bank to act.

NZD has weakened against the greenback for the last six months and is now trading at around 1.4046. However, recent major moves are mainly due to the US. Yet, confirmation of New Zealand’s difficulties will push the pair higher.

Today's Key IssuesCountry / GMT May P CPI NIC incl. tobacco MoM, exp 0.10%, last 0.30%, rev 0.20% EUR / 09:00 May P CPI NIC incl. tobacco YoY, exp 0.00%, last 0.00%, rev -0.10% EUR / 09:00 May P CPI EU Harmonized MoM, exp 0.10%, last 0.50%, rev 0.40% EUR / 09:00 May P CPI EU Harmonized YoY, exp 0.10%, last -0.10% EUR / 09:00 Apr PPI MoM, last -0.10% EUR / 10:00 Apr PPI YoY, last -3.10% EUR / 10:00 Apr Fiscal Deficit INR Crore, last -100654 INR / 10:30 Apr South Africa Budget, exp -35.00B, last -1.23B ZAR / 12:00 Apr Trade Balance Rand, exp -4.9B, last 0.5B ZAR / 12:00 1Q GDP 4Qtrs Accumulated, exp -0.90%, last 0.10% BRL / 12:00 1Q GDP YoY, exp -1.80%, last -0.20% BRL / 12:00 1Q GDP QoQ, exp -0.50%, last 0.30% BRL / 12:00 1Q GVA YoY, exp 7.00%, last 7.50% INR / 12:00 1Q P GDP Annual Estimate YoY, exp 7.40%, last 7.40% INR / 12:00 1Q GDP YoY, exp 7.30%, last 7.50% INR / 12:00 Mar GDP MoM, exp 0.20%, last 0.00% CAD / 12:30 Mar GDP YoY, exp 2.10%, last 2.10% CAD / 12:30 1Q Quarterly GDP Annualized, exp 0.30%, last 2.40% CAD / 12:30 1Q S GDP Annualized QoQ, exp -0.90%, last 0.20% USD / 12:30 1Q S Personal Consumption, exp 2.00%, last 1.90% USD / 12:30 1Q S GDP Price Index, exp -0.10%, last -0.10% USD / 12:30 1Q S Core PCE QoQ, exp 0.90%, last 0.90% USD / 12:30 May ISM Milwaukee, exp 50, last 48.08 USD / 13:00 Apr Net Debt % GDP, exp 33.40%, last 33.10% BRL / 13:30 Apr Nominal Budget Balance, exp 5.0B, last -69.2B BRL / 13:30 Apr Primary Budget Balance, exp 12.5B, last 0.2B BRL / 13:30 May Chicago Purchasing Manager, exp 53, last 52.3 USD / 13:45 May F U. of Mich. Sentiment, exp 89.5, last 88.6 USD / 14:00 May F U. of Mich. Current Conditions, last 99.8 USD / 14:00 May F U. of Mich. Expectations, last 81.5 USD / 14:00 May F U. of Mich. 1 Yr Inflation, last 2.90% USD / 14:00 May F U. of Mich. 5-10 Yr Inflation, last 2.80% USD / 14:00 Apr Eight Infrastructure Industries, last -0.10% INR / 22:00 G-7 Finance Ministers and Central Bank Chiefs Meet in Dresden EUR / 22:00 The Risk Today

Yann Quelenn

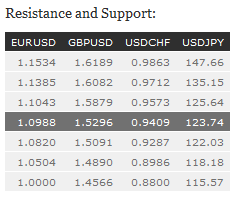

EUR/USD has bounced on the short-term rising trend-line and is now trading between the hourly resistance at 1.0940 (intraday high). Support lies at 1.0868 (28/05/2015 low). Stronger support can be found at 1.0820 (27/04/2015 low) while upper resistance is given at 1.1217 (19/05/2015 high). In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD is declining through a short-term trend-line. Lower lows suggest a downside momentum. Hourly resistance can be found at 1.5437 (27/05/2015 high) and supports is given at 1.5261 (28/05/2015 low). In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY

After its sharp increase over the last few days, USD/JPY is now consolidating at around 124.00. We target the resistance at 125.69 (12/06/2002 high). The pair is still bullish as we stay largely above the 200-dma. Hourly support is given at 121.45 (25/05/2015 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF has erased the mid-term declining channel at 0.9498 and stays below this level. We target the supports at 0.9287 (22/05/2015 low). Resistance can be given at 0.9573 (29/05/2015 high) and stronger support is at 0.9072 (07/05/2015 low). In the long-term, there is no sign to suggest the end of the current downtrend. After failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).