Brazil’s fiscal target

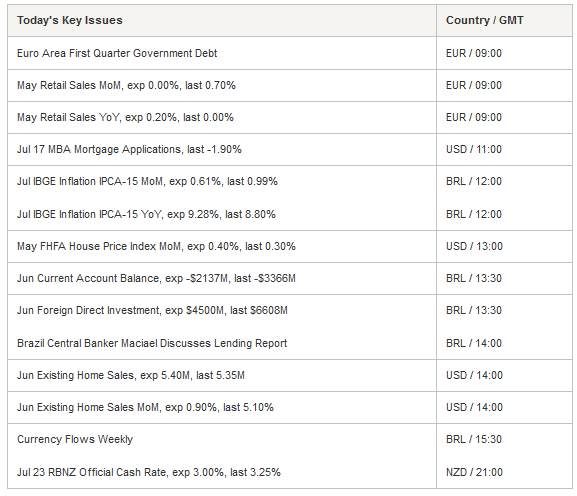

Today, Brazil’s mid-month IPCA inflation will be in focus. Inflation is expected to have accelerated since mid-June by 9.28%y/y versus 8.80% previous reading. Brazil’s central bank should therefore keep increase interest until inflation expectations for 2016 match the 2.5% target (according to the latest survey, inflation is expected at 5.40% by the end of 2016), the rate decision is scheduled for July 29 (next week).

The other hot topic of the day is the release of Brazil’s current account deficit that is expected to have improved to -$2,137mn from -$3,366mn a month earlier as the government struggles to deliver a primary surplus of 1.1% of GDP in 2015. In our opinion, fiscal performance will fall short of the primary surplus target of 1.1% of GDP in 2015. And therefore the government will be force, at some point, to face reality and to acknowledge this target is not reachable anymore. The new fiscal target will be officially announced today as the government has to disclose its bi-monthly budget program. We expect the government to lower the primary surplus target for 2015 between 0.4% and 0.6% of GDP as the country is being badly hit by exogenous factors such as a faltering growth in China, low commodity prices and an upcoming rates hike by the Federal Reserves.

Yesterday, USD/BRL moved significantly lower amid hawkish comments from Tony Volcon. Central bank director called for further rate hike from the BCB until the 4.5% inflation target is reached. The greenback lost 0.81% against the Brazilian real and stabilised at BRL3.1718 for $1.

RBNZ to lower its cash rate

Tonight the Reserve Bank of New Zealand will announce its cash rate decision. New Zealand’s rates are the highest amongst the G10 and weak inflation still gives Governor Wheeler room to support the Kiwi economy.

Last week Q2 inflation data came in lower than expected at 0.4% q/q below estimates at 0.5% but still better than prior Q1 data at -0.3%. Annualized inflation printed 0.3%. Inflation is still not on the Reserve Bank’s target band of 1 to 3% while aiming for near 2%. As long as inflation is outside of this range, we think that the official cash rate will be lowered. For the time being, we believe that the cash rate will be lowered at 3.25%. Furthermore, we anticipate that inflation target band will not be reached within next year as the recent collapse in commodity prices keeps on putting downside pressure on inflation. Rates are likely to decrease again before the end of the year.

Therefore we think that the RBNZ will be pushed to feed, against their will, the housing bubble, Auckland in particular. Or the country will have to face deflation which would slow growth. Also, economic data disappointed as the Q1 GDP was much lower than expected (02% q/q vs 0.6% q/q). Second quarter data are expected mid-September.

The Kiwi has been weakening against the dollar for one year from 1.1308 to 1.5386 mid-June. We remain bearish on the NZD.

USD/JPY - Lack of Follow-Through

The Risk Today

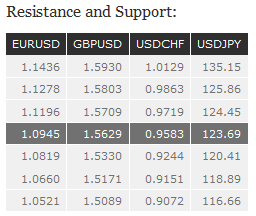

EUR/USD has increased. Hourly resistance lies at 1.1278 (29/06/2015 high). Stronger resistance lies at 1.1436 (18/06/2015 high). Support can be found at 1.0660 (21/04/2015 low).The pair is setting lower highs so we remain bearish. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD is consolidating. Hourly resistance is given at 1.5803 (24/06/2015 high). Hourly support is given at 1.5330 (08/07/2015 low). Nonetheless, we expect the pair to decrease again within the next few days. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY has broken resistance at 124.45 (17/06/2015 high) but has also failed to hold above it. Stronger resistance still lies at 135.15 (14-year high). Hourly support is given by the 38.2% Fibonacci retracement at 122.04. Stronger support is given at 120.41 (08/07/2015 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF has broken hourly resistance at 0.9543 (27/05/2015 high). Hourly support can be found at 0.9151 (18/06/2015 low). The road is now wide open for the pair to challenge stronger resistance at 0.9719 (23/04/2015 high). The pair is gaining momentum to challenge this resistance. In the long-term, there is no sign to suggest the end of the current downtrend. After failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).